Data shows the Bitcoin diamond hands have continued to sit tight recently as almost a third of the supply hasn’t been moved in five years.

Bitcoin Has A Notable Part Of Its Supply Dormant Since Over Five Years

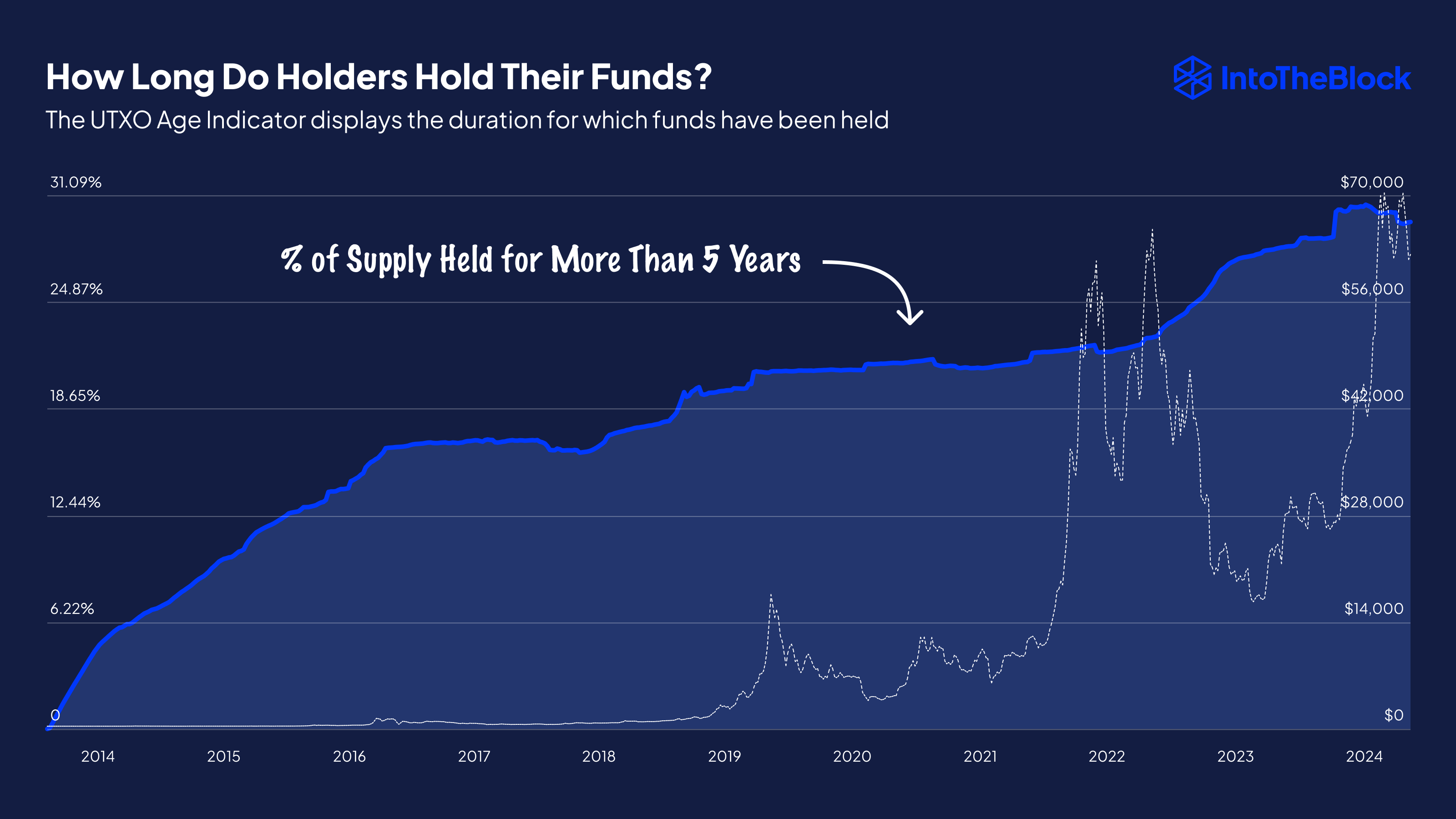

In a new post on X, the market intelligence platform IntoTheBlock has discussed about how the most dormant BTC supply has been looking like recently. The supply in question is the one made up of the Unspent Transaction Outputs (UTXOs) that have aged past the five-year mark.

In other words, this supply includes the coins of the investors who have been holding onto them since more than five years ago, without having sold or moved them from their wallets.

The investors who have coins aged more than 155 days are popularly known as the “long-term holders” (LTHs), so this five-year old supply would represent the holdings of the especially aged LTHs.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell said coins at any point. As such, the LTHs are considered to be the resolute side of the market. The LTHs dormant since more than five years ago would then, of course, be the diamond hands among diamond hands.

Something to note, though, is the fact that not all of this supply would actually be an indication of HODLing. The reason behind this is simple: the older the tokens become, the more likely they get to have become lost, whether by simply having their existence forgotten or by having their keys become inaccessible.

Thus, as the supply in question is over 5+ years old, a part of it is probable to in fact never make it back into circulation. That said, the rest of it would have attained the age through sheer conviction.

Below is a chart that shows the trend in the percentage of the Bitcoin supply that’s in this age bracket over the history of the cryptocurrency.

Looks like the value of the metric has been going down in recent days | Source: IntoTheBlock on X

As is visible in the above graph, the Bitcoin 5+ year LTH supply registered a decrease earlier in the year as some old investors woke up to collect their rally profits, but this decline was only slight, and since then, the indicator has been moving sideways.

At present, the metric’s value stands at 30.7%, which means almost a third of the cryptocurrency’s entire supply in circulation hasn’t been moved in more than five years.

For perspective, the five-year cutoff puts the earliest possible buying point for these coins back in August 2019. Thus, these investors have survived at least the COVID-19 crash, the 2021 bull market, the 2022 bear market, and now, the rally that first began in 2023.

Given this resilience, it’s unlikely most of these investors would sell their Bitcoin under anything, but very special circumstances.

BTC Price

Bitcoin has seen a plunge of almost 4% over the last 24 hours, which has taken its price to $58,100.

The price of the coin appears to have plunged recently | Source: BTCUSD on TradingView