On-chain data shows the Bitcoin Mining Hashrate has recently shown some sudden rapid growth, breaking the previous trend of consolidation.

Bitcoin Mining Hashrate Has Shown A Sharp Surge Recently

The “Mining Hashrate” refers to a metric that keeps track of the total amount of computing power that the miners as a whole have connected to the Bitcoin network. Its value is measured in hashes per second (H/s), or the larger and more practical terahashes per second (TH/s).

When the value of this indicator rises, it means new miners are joining the blockchain and/or old ones are expanding their farms. Such a trend implies the network is looking like an attractive venture to these chain validators.

On the other hand, the metric going down suggests some of the miners have disconnected their rigs from the network, potentially because they aren’t finding mining profitable anymore.

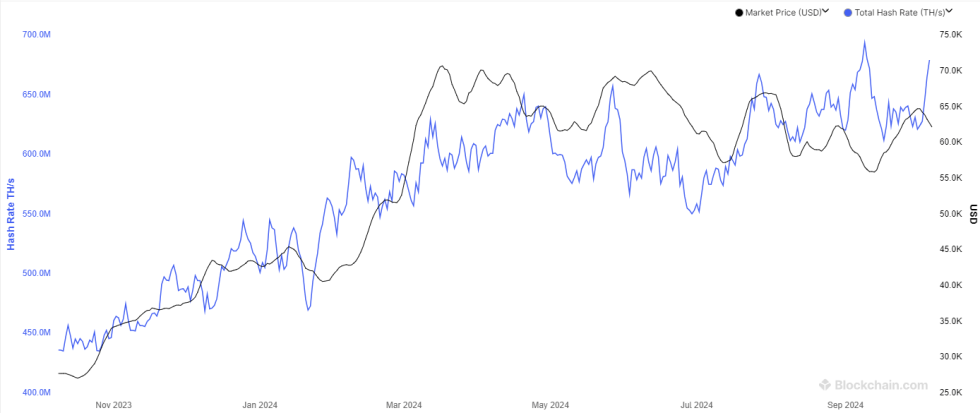

Now, here is a chart from Blockchain.com that shows the trend in the 7-day average Bitcoin Mining Hashrate over the past year:

The 7-day value of the metric appears to have been sharply going up in recent days | Source: Blockchain.com

As displayed in the above graph, the 7-day average Bitcoin Mining Hashrate registered a sharp plunge in mid-September right after setting a new all-time high (ATH). This crash forced the indicator into a phase of sideways movement around the lows, which finally ended with the start of this month.

In the week since the month has started, the metric has shown a big jump from the 621 TH/s mark to 679 TH/s. This surge means that power is now not too far from being at the 693 TH/s ATH set last month.

Bitcoin miners make the major part of their income through the block subsidy, which they receive for solving blocks on the network. This reward is given out at a fixed BTC and time-interval rate, so the only variable related to it is the USD price of the cryptocurrency.

As a consequence of this relationship, the miners’ behavior tends to follow the asset’s value. Last month, when the Hashrate had set its new ATH, the metric had shown an interesting divergence with the BTC price.

The miners may have been anticipating the rally to return, so they had invested into their facilities. Once it had become clear that this wasn’t the direction BTC was heading in, the miners had rolled back, thus causing the indicator’s value to plunge.

The latest Hashrate increase has also come while the Bitcoin price has seen a net decline, potentially suggesting that the miners may be betting on a future rise again.

It only remains to be seen, however, if things would work out for the miners this time around or if failure is waiting for them, just like last month.

BTC Price

Bitcoin had plunged to $60,000 last week, but the asset appears to have made some recovery during the last few days as its price is now back at $62,900.

Looks like the price of the coin has seen a setback in its recovery recently | Source: BTCUSDT on TradingView