Data shows the Bitcoin mining hashrate has remained at high levels recently, despite the hashprice observing a deep plunge.

Bitcoin Hashrate Has Continued To Be Near All-Time Highs Recently

The “mining hashrate” refers to the total computing power currently connected to the Bitcoin blockchain. The metric is measured in terms of hashes per second, where “hashes” refer to calculations that miners have to make.

When this indicator’s value goes up, the miners are connecting more mining rigs to the network. Such a trend can indicate that these chain validators are now finding the coin attractive to mine.

On the other hand, the metric’s value decreasing suggests some miners disconnect from the blockchain, possibly because they aren’t making any profits.

Now, here is a chart that shows how the 7-day average Bitcoin mining hashrate has changed during the past year:

The 7-day average value of the metric seems to have been going up in recent days | Source: Blockchain.com

As the above graph shows, the 7-day average Bitcoin mining hashrate has registered some growth recently and has set a new all-time high (ATH). Since the crash, the metric has dropped slightly, but its value remains near ATH levels.

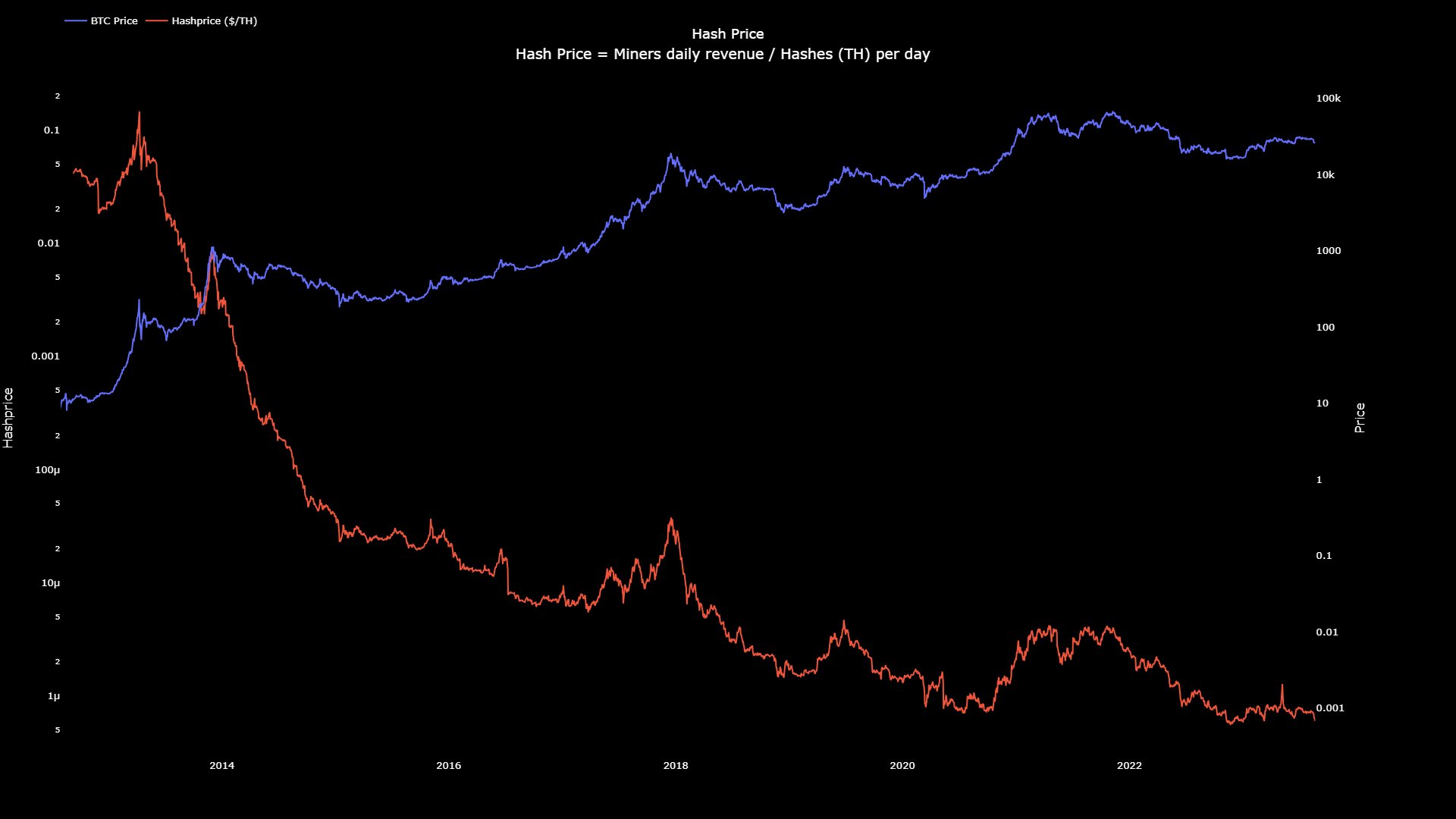

Interestingly, the indicator has stayed at these high values even though the hashprice has taken a hit recently, as the CryptoQuant Netherlands community manager Maartunn has pointed out on X.

Looks like the metric has been heading down recently | Source: @JA_Maartun on X

The “hashprice” here refers to the amount of daily revenue the miners make corresponding to every hash they handle. From the graph, it’s apparent that the indicator’s value has been on a perpetual downtrend throughout the asset’s history, a consequence of the hashrate trending up during this same period.

Block rewards (that is, the compensation that the miners receive for solving blocks) on the network remain nearly constant, so regardless of the amount of hashrate connected to the network, the miners’ total revenues won’t budge, but rather their shares would be affected.

Therefore, as more hashrate has been coming online due to the increasing competition in the space, the hashprice has constantly decreased. The metric does show local deviations from time to time, though, and these usually correspond to rallies and crashes.

The metric is measured in dollars, so it makes sense that the BTC price going up or down would also affect the indicator’s value. Recently, as Bitcoin has crashed, so has the hashprice, and the metric’s value is now around an all-time low.

Despite miners making historically low revenues per hash now, they haven’t yet significantly disconnected power from the network. It’s uncertain whether this will remain the same in the coming days, but if it does, it could be a sign that the miners are hopeful about the long-term outcome of the cryptocurrency, so they don’t see much reason to disconnect just yet.

BTC Price

At the time of writing, Bitcoin is trading at around $26,100, up 1% in the last week.

BTC has stagnated since the crash | Source: BTCUSD on TradingView