On-chain data shows the Bitcoin mining hashrate has seen a strong rebound off its recent lows and has just set a new all-time high (ATH).

Bitcoin 7-Day Average Mining Hashrate Has Shot Up To A New ATH

The “mining hashrate” refers to a metric that keeps track of the total amount of computing power connected to the Bitcoin blockchain by the miners.

When the value of this indicator goes up, it means that new miners are joining the network, and old ones are expanding their facilities. Such a trend implies that interest in blockchain mining is currently high.

On the other hand, the metric heading down implies some miners have decided to disconnect from the chain, potentially because they aren’t finding it profitable to mine anymore.

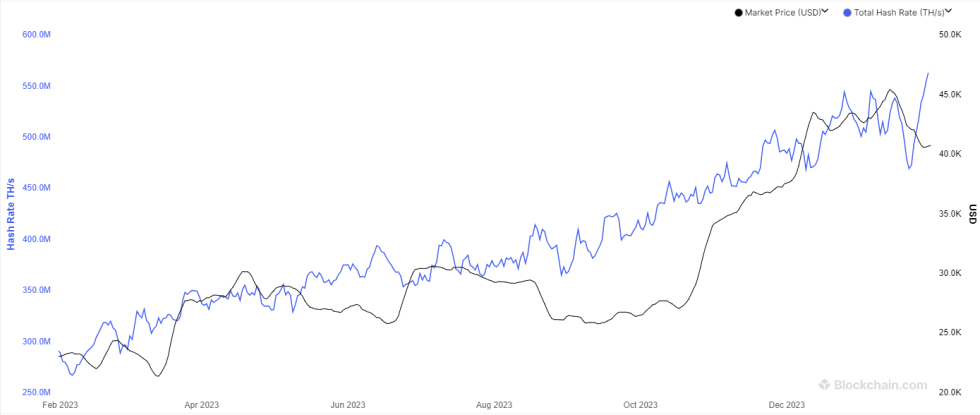

Now, here is a chart that shows the trend in the 7-day average Bitcoin mining hashrate over the past year:

The 7-day average value of the metric seems to have been sharply going up in recent days | Source: Blockchain.com

As the above graph shows, the 7-day average Bitcoin mining hashrate had observed a notable drawdown just earlier, taking it to the lowest levels in over two months.

Since this low, however, the indicator has rebounded strongly, as it has not only made a full recovery from the drawdown but has flown well past the previous high, setting a new record.

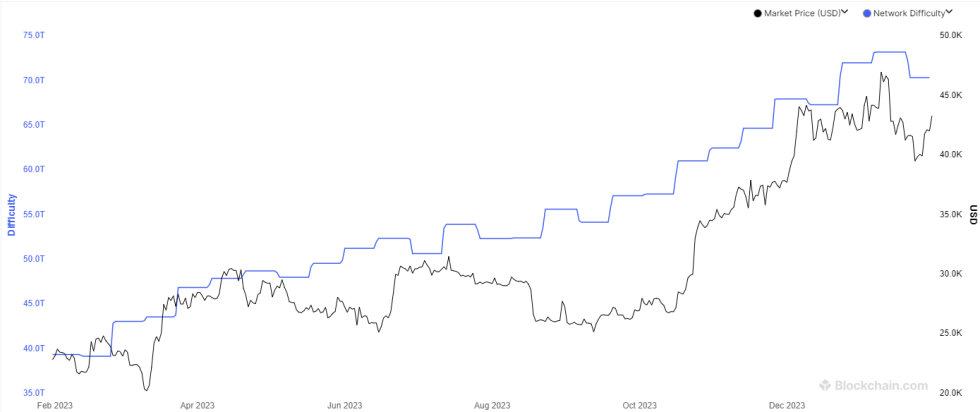

The impetus behind this increase could lie in the recent mining difficulty trend. The “mining difficulty” is a feature on the Bitcoin blockchain that decides how hard the miners find it to mine blocks on the network.

The reason that this metric exists is to help control the inflation of the cryptocurrency. The block rewards that miners receive serve as the only way to produce more of the asset, so if the miners’ pace can be controlled (by making it harder or easier), so can this production rate.

Looks like the value of the metric has taken a plunge recently | Source: Blockchain.com

The Bitcoin network aims to keep it so that a block is mined every ten minutes. When the miners increase their hash rate, they naturally become faster at mining (thanks to the extra power) and can produce blocks faster than this standard rate.

Once this happens, the blockchain ups the difficulty in the next-scheduled adjustment (adjustments automatically occur approximately every two weeks), making it just hard enough for the miners that they are slowed back down to the intended pace.

The chart shows that the difficulty took a plunge in the latest adjustment, a natural consequence of the hashrate’s drawdown. Interestingly, the 7-day average hashrate bottom coincided with this difficulty decrease.

It would appear that the miners have latched onto the opportunity provided by the decreased difficulty and have connected a large amount of computing power to the network to mine blocks faster.

The blockchain would again increase the difficulty, potentially causing this extra hash rate to pull out once more (if the new hash rate has only been put online to leverage this dip). But until that happens, the miners can continue to enjoy faster rewards.

BTC Price

At the time of writing, Bitcoin is trading at around $43,500, up 11% in the past week.

The asset appears to have made some sharp recovery over the last few days | Source: BTCUSD on TradingView