Data shows that Bitcoin investors have been showing signs of fearful sentiment as the price of the cryptocurrency has plunged below $27,000.

Bitcoin Social Dominance Spike Suggests Fear In Market

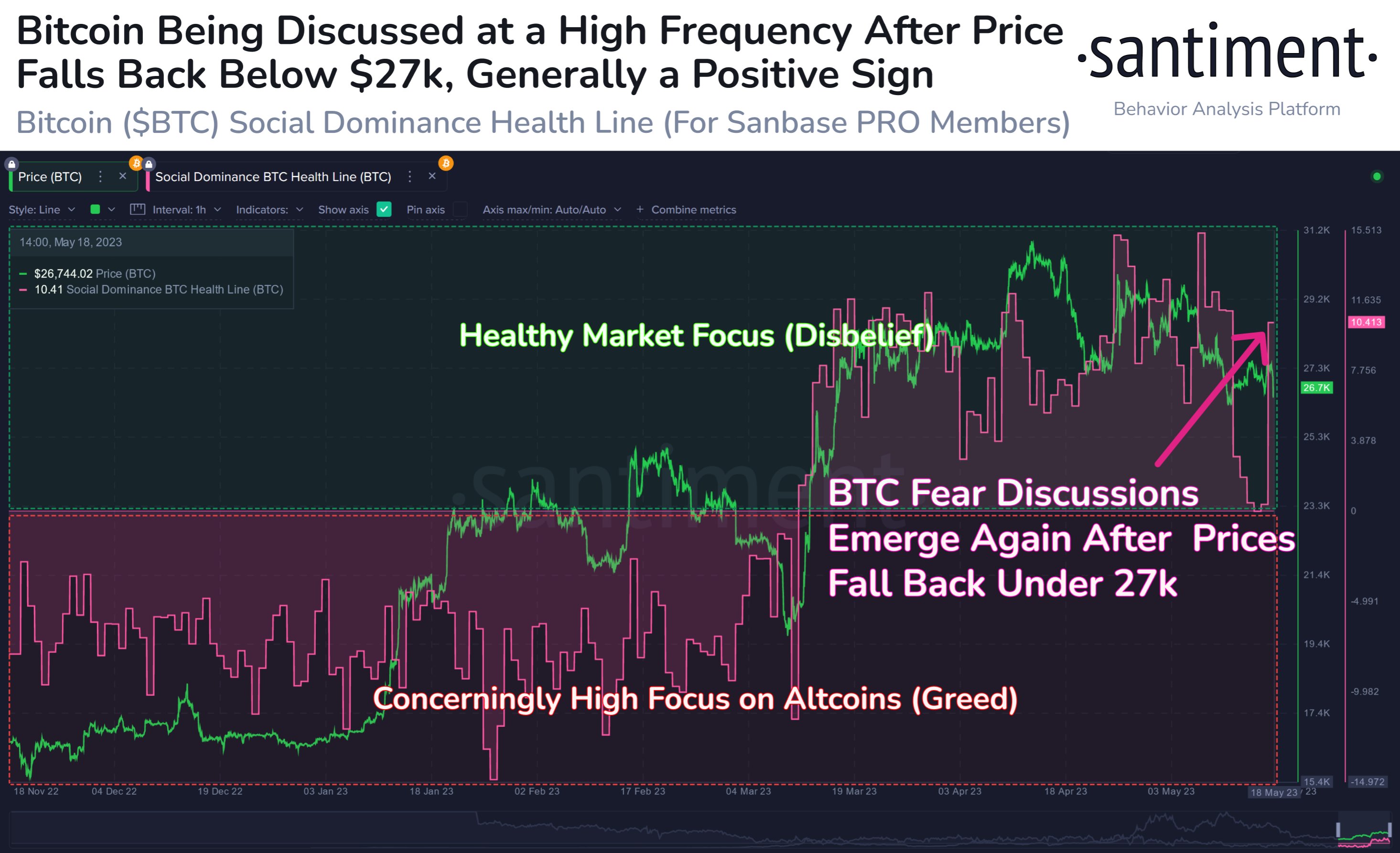

According to data from the on-chain analytics firm Santiment, BTC’s social dominance has seen an uplift recently. The “Bitcoin social dominance” is an indicator that measures the percentage of the total discussions involving the top 100 assets by market cap that mention BTC.

What this metric tells us is how the current interest in BTC among investors compares with that of the altcoins. Historically, high interest in altcoins (meaning that the social dominance of BTC is low) has been a sign of greed in the market.

Usually, markets gain a higher probability of moving opposite to the wider market sentiment the more the sentiment leans into one particular direction. So, during times of greed, corrections in the prices can become likelier.

When the social dominance of BTC is high, however, it’s a sign that the interest in BTC is high at the moment. Such market conditions may be linked with the presence of fear, and so, rebounds naturally become more probable to take place.

Now, here is a chart that shows the trend in Bitcoin’s social dominance over the last few months:

The value of the metric seems to have been high in recent days | Source: Santiment on Twitter

In the above graph, Santiment has switched around the social dominance scale and has made the 20% mark the “0” level. According to the analytics firm, this 20% mark serves as a sort of “health line” for the cryptocurrency, meaning that it’s the threshold below which altcoins get dangerous levels of focus.

From the chart, it’s visible that the social dominance had been negative (that is, below this 20% health line level) during the first couple of months of the rally, which had then culminated in the price observing a plunge below the $20,000 level.

After the price rebounded from those lows, however, the social dominance of Bitcoin shot up into positive territory. Since then, the metric has stayed inside this zone.

Recently, the indicator was quite close to falling back inside the greed zone, as can be seen in the graph. Discussions related to BTC have once again surged, though, as the cryptocurrency’s price has found further struggle and has plunged under the $27,000 level.

The timing of this spike likely means that the current high discussions are taking place because of fear brewing among the investors. It’s unclear right now how the market may proceed from here, but the emergence of fear at least implies that there is a higher probability of a local bottom being discovered soon, following which a rebound could take place.

BTC Price

At the time of writing, Bitcoin is trading around $26,900, up 2% in the last week.

Looks like the value of BTC has gone below the $27,000 level | Source: BTCUSD on TradingView