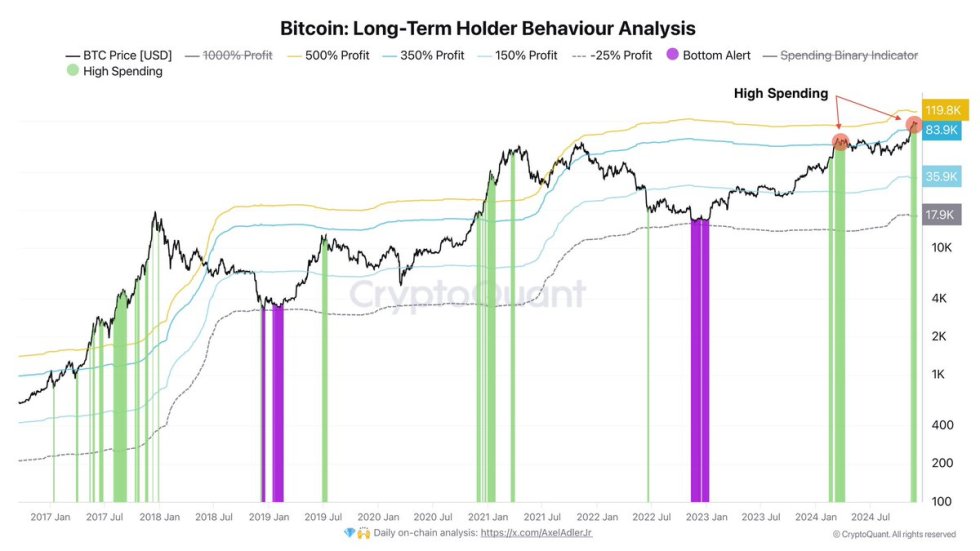

Bitcoin has experienced a couple of “quiet” weeks following its recent all-time highs at $99,800. After weeks of aggressive upward momentum, the market has slowed down, and the recent price action shows signs of active selling pressure. Key data from CryptoQuant reveals that long-term holders are increasingly selling their positions, which could be contributing to the price stagnation.

This selling activity suggests that the rally may face more resistance in the short term, especially as BTC struggles to break above the $100K mark. The ongoing supply from long-term holders and a lack of fresh demand are holding Bitcoin’s price down. As the market tries to push toward new highs, the selling pressure from holders could prevent any immediate breakouts.

The market sentiment remains positive, but this dynamic could keep Bitcoin range-bound for longer. Traders and investors are closely watching for signs of fresh demand that could overcome the current resistance from sellers. Until then, Bitcoin’s ability to break above $100K will be challenged, and further consolidation or even a pullback might be in store if selling pressure persists.

Bitcoin Data Suggests Smart Money Is Selling

Bitcoin experienced a massive rally in recent weeks, surging almost 50% in less than a month. This aggressive price movement has drawn attention from investors, but with impressive gains come active profit-taking. As Bitcoin climbs, many investors are starting to lock in profits, especially those who have held since earlier in the cycle.

Data from CryptoQuant analyst Axel Adler reveals that Long-Term Holders (LTH) are actively selling at current levels. At the $84K price point, the average LTH is sitting on a 350% profit. This substantial gain creates a natural incentive to sell, as these holders may look to cash out or reallocate their assets. As a result, the market is facing an increase in selling pressure from seasoned investors, which could create resistance to further price increases.

Demand must increase to absorb the selling pressure for Bitcoin to continue its ascent. If new buyers or fresh capital enter the market, this could help push prices higher. However, as BTC continues to rise, smart money will likely distribute coins to “weak hands”—new investors or those less experienced—once the cycle reaches its peak. This distribution pattern is typical at the top of bullish cycles, as whales and long-term holders offload their assets to less informed participants.

In summary, while Bitcoin’s recent rally is impressive, the market faces challenges. For continued growth, strong demand must outweigh the selling pressure, and investors must watch for signs that the rally is sustainable beyond profit-taking.

Can BTC Break Above $100K?

Bitcoin has experienced a period of consolidation after reaching a high of $99,800 twelve days ago. While the price remains strong, the market is showing signs of a slowdown compared to the euphoric rally seen in early November. The inability to break above the $100,000 mark has left many analysts questioning whether Bitcoin can maintain its momentum and reach new all-time highs.

The key price level to watch in the coming days is the $95,000 mark. If Bitcoin holds above this level, it could signal the strength to challenge the $100,000 resistance. A sustained period above $95,000 would increase the likelihood of a breakout attempt to test the $100,000 level. However, if Bitcoin fails to hold $95,000, the price could drop toward lower demand levels, potentially testing the $90,000 or $85,000 areas for support.

As market participants wait for a clear direction, Bitcoin’s ability to break through the $100,000 mark remains a critical factor in determining the next phase of its price action. A failure to do so could lead to more consolidation or even a deeper correction, while a successful break could trigger a fresh rally.

Featured image from Dall-E, chart from TradingView