Since last week, Bitcoin has dropped a net total of approximately $10 (3.5%). This drop came after a brief surge to the high $290s; the Bitcoin price flirted with $300 but ultimately failed to break through the resistance. Furthermore, news of Mark Karpeles’ arrest seems to have indirectly affected the price.

Also Read: Last Week’s Market Wrap Up

Just a few days ago, Mark Karpeles — the ex CEO of the now-defunct Mt Gox exchange — made headlines once again by being arrested on suspicions of fraudulent system manipulation. Japanese police estimated that Mark has profited around $1 million from alleged illicit activities.

“If found guilty of suspicions, Karpeles could face up to 5 years in prison or a fine of up to $4,000. While these charges might seem relatively minor, police could find more wrongdoing and press additional charges after conducting their investigation.”

Mt. Gox shut down in early 2014 after losing over 850,000 Bitcoins. Since the exchange’s demise, the Bitcoin community has been calling for Karpeles’ arrest, accusing him of defrauding his customers. Over a year and one bankruptcy filing later, customers have still have not been able to withdraw Bitcoins they lost during the Gox collapse. The Gox debacle created one of the biggest drops in Bitcoin value, from which the Bitcoin price has never fully recovered.

Volume peaked at $32 million earlier this week, with typical volumes hovering around either under $20 million or just above that mark. Volume reflected the price; peak volume was around the same time as peak price occurred and vice versa.

Altcoin Market Analysis

The altcoin market is looking pretty grim also, reflecting similar net changes albeit more defined. Most of the bigger positive (and negative) changes were in the altcoins with smaller markets. CryptoCircuits, for example, came in at number 82 with an approximately 113% gain this week and Auroracoin at number 101 with a 36% drop in price.

When it comes to the top 10, however, only two coins made positive movements this week: Ripple with a 1% gain and Bytecoin with 20%. The other 8 suffered losses ranging anywhere from 3% to 16%.

![]()

Litecoin’s market value hasn’t been doing the best either, which was unexpected given that almost 50% of the total LTC supply has been mined, plus an upcoming block halving in less than a month. The decline in supply should in theory raise price, as it is harder to accumulate LTC, but so far results haven’t proved to be compliant with that train of thought. Price has declined 12% this week, and price has struggled to hold itself above $4.

![]()

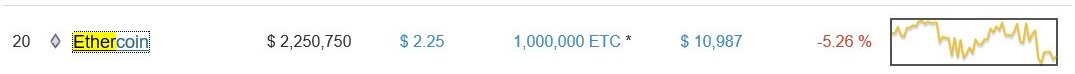

Ether also made big news this week, with users now being able to GPU mine Ether alongside the Frontier, the first release of Ethereum. Do note Ether is only available for mining, and network will not be at 100% functionality until after “the thaw.” The market dip we are seeing in Ethercoin (which is redeemable for Ether on a 1:1 basis), however, seems more like an attempt at mass accumulation, as many exchanges planning on launching ETH/BTC markets once network has been thawed. Once the exchanges open up, expect Ethers price to jump, if only temporarily.

A clear leader in the altcoin market this week has to be Vanillacoin, at number 36. While most either had a little change and had a high market cap or high change and low market cap, Vanillacoin managed to attain both with over a $1 million market capitalization and nearly 100% gain this week.

Vanillacoin is a cryptocurrency quickly gaining popularity as an altcoin with targeting the privacy-centered niche. This coin brings several new, one of which is ZeroTime, which is described as “an approach to decentralized autonomous zero confirmation cryptographic-currency transactions.” ZeroTime allows the resending of ZeroTime coins after 8 seconds without the need of Masternodes or any similar implementation.

All in all, there are a lot to look forward for in the upcoming week. How is Ether’s price after a week of going live? Will Litecoin’s price recover? And the big one every week, where will Bitcoin’s price be next week? Let us know in the comments below!

Photo Sources: CMC