Bitcoin continued to decline from the $240s earlier this week, hitting a floor at around $220. The price is currently retesting new levels between $220 and $230, but that seems to be a losing battle with the price still trending downwards.

Also read: Bitcoin Market Wrap Up: 4/5-4/15: BTC, LTC, and Dash Down, Crave Cut Short

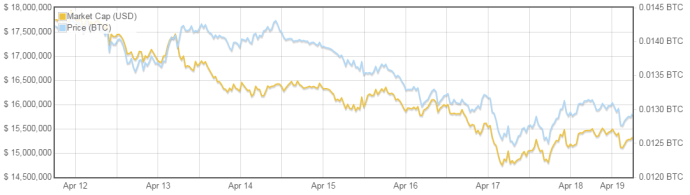

Volume has also been quite low this week, reaching slightly over $15 million for today’s 24 hour trading volume. This is a continuation of last week’s trading patterns. Devaluation was only slight this week, with only a 5.7% decrease in price over the last seven days.

If current patterns continue with sideways movement followed by decreasing price, we may see Bitcoin below $220, even below $200. As is typical, Bitcoin has had its fair share of bad and good news this week. However, one particular headline, may have influenced the price. I am referring to WizSec’s new update on the missing Mt. Gox Bitcoins.

In this update, WizSec suggests that Mt. Gox may have lost the bitcoins weeks or even months before the public found out that the exchange was insolvent. The blog captures the essence of the much more detailed article in their executive summary:

“Most or all of the missing bitcoins were stolen straight out of the MtGox hot wallet over time, beginning in late 2011. As a result, MtGox operated at fractional reserve for years (knowingly or not), and was practically depleted of bitcoins by 2013. A significant number of stolen bitcoins were deposited onto various exchanges, including MtGox itself, and probably sold for cash (which at the Bitcoin prices of the day would have been substantially less than the hundreds of millions of dollars they were worth at the time of MtGox’s collapse).”

While the collapse happened back in 2013, fear and other negative feelings may have resurfaced due to this new report, but the feelings may have been exaggerated due to FUD spreading. Whatever the reason may be, Bitcoin seems to be still decreasing in price even if it is ever so slightly.

Altcoin Market Analysis

DASH took a harder hit than Bitcoin this passed week. With the price declining by 14%, DASH has fallen below the average $3 price that persisted before the rebranding –showing no signs of stopping.

Craved has picked up the slack, however, rising by 32% this week. Bytecoin also saw some significant upward movement, increasing by 46.5% this week. While DASH remains the undisputed king of privacy-centric coins, other coins may start to give DASH a run for its money.![]()

Litecoin has dipped to a current price of $1.38, almost 6% lower than the value of Litecoin at the beginning of the week. Like Bitcoin, Litecoin is still tumbling downwards in price.

What are your predictions for next week? Do you see Bitcoin below $200? Let us know in the comments below!

Photo Sources: CMC