On-chain data shows the Bitcoin network has hit a new milestone as the total number of holders now exceeds the population of Spain.

Bitcoin Holders Now Count At More Than 48.5 Million

As pointed out by an analyst in a post on X, BTC investors now count at a higher number than the entire population of Spain. The Bitcoin holders here are counted through the total number of addresses on the blockchain carrying a non-zero balance.

This means that if some addresses were active at some point but no longer carry any coins because they have been emptied, they wouldn’t be counted here.

Since this count would include all types of BTC investors, whether the shrimps, the sharks, or the whales, the trend in its value may provide us with information about the overall adoption that the cryptocurrency is observing.

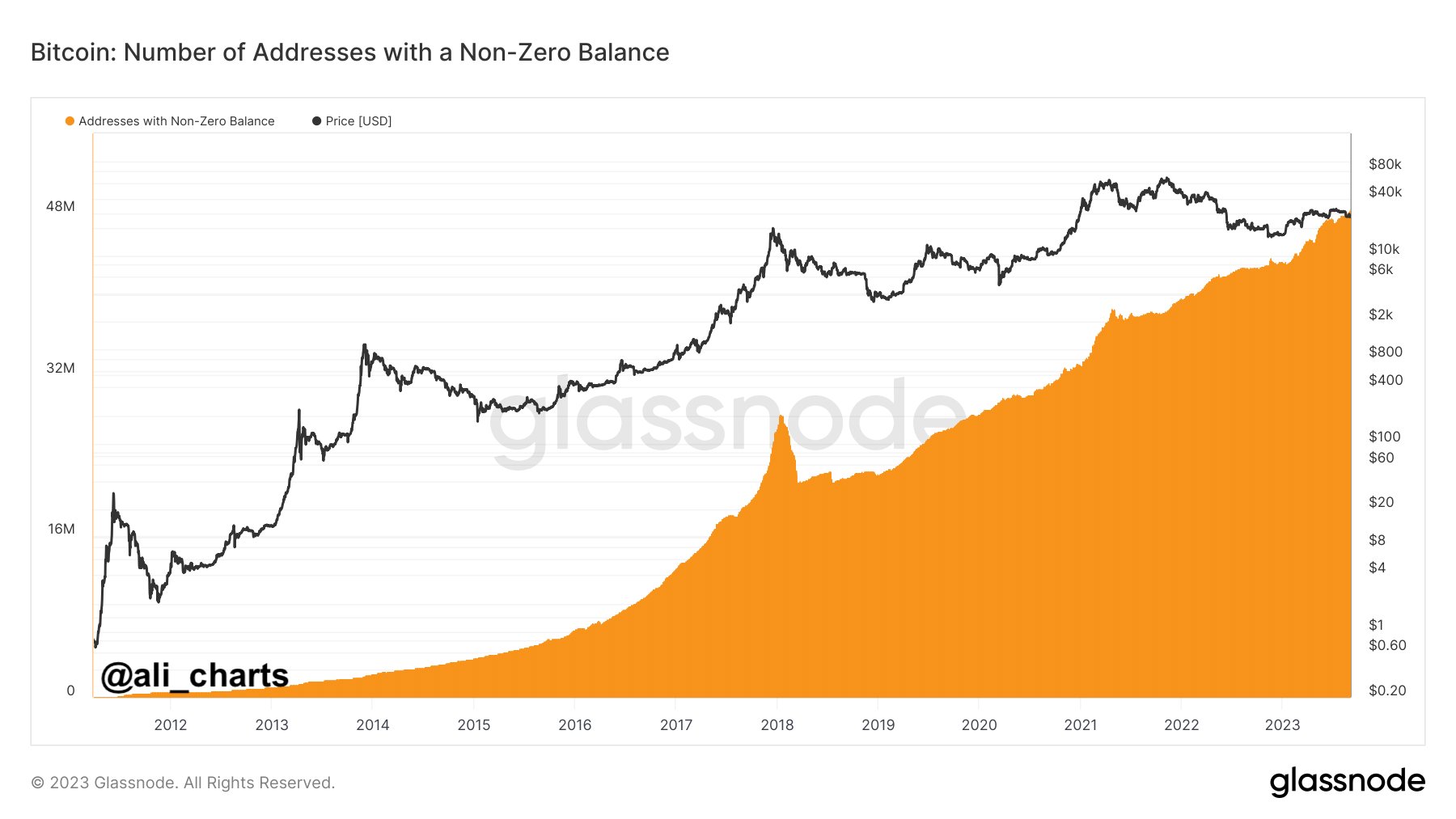

The chart below shows how the number of addresses with a non-zero balance has changed throughout the coin’s history.

The value of the metric has been going up in recent days | Source: @ali_charts on X

As displayed in the above graph, the total number of Bitcoin addresses carrying some balance has steadily increased over the years as the asset has continued to be more adopted.

There have only been a few instances in the asset’s history where the indicator observed significant pullbacks. These occurrences coincided with the 2017 and 2021 bull run tops.

It would appear possible that the investors who bought near the top might have wholly emptied their wallets and exited the asset when they saw the bull run coming to a halt, hence resulting in the metric’s drop.

With the latest increase, the indicator has hit a new milestone, now exceeding the 48.5 million mark. According to Worldometer, Spain has a population of about 47.5 million, meaning there are now more BTC holders than people in the European nation.

The current count of Bitcoin holders is also ahead of the population of countries such as Argentina, Algeria, and Iraq. The number of the asset’s non-zero balance addresses is also more than any American state, including California (about 39 million people).

More adoption is generally a constructive sign for the cryptocurrency, as a larger user base usually results in better groundwork for larger price rallies in the future.

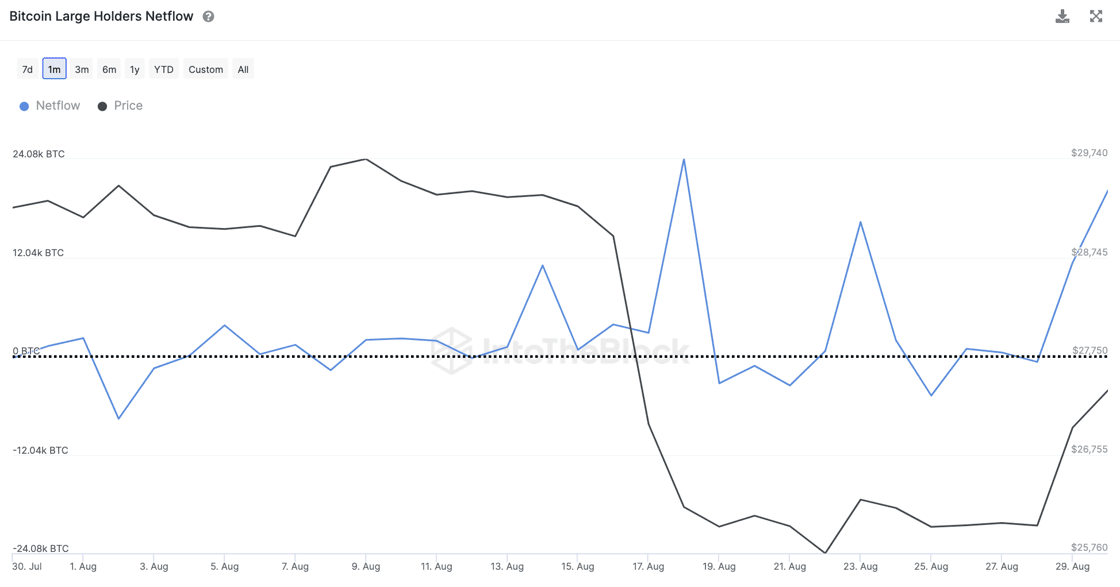

Speaking of adoption, the market intelligence platform IntoTheBlock shared some data a couple of days back that suggests the largest of the Bitcoin holders, the whales (or more precisely, the investors carrying a balance equal to or exceeding 0.1% of the total circulating supply) have added another $1.5 billion to their holdings recently.

Looks like the whales have been accumulating recently | Source: IntoTheBlock on X

Whales accumulating at the latest lows is a positive sign for the asset, as it shows that these humongous holders believe these prices could be profitable buying points.

BTC Price

Bitcoin has registered losses of 1% over the past week as the coin has now declined to the $25,800 level.

BTC has been frozen solid in the last few days | Source: BTCUSD on TradingView