Even if the intricate realm of cryptocurrencies remains a mystery, the name Bitcoin (BTC), the pioneering cryptocurrency with the highest market capitalization, likely rings familiar.

Despite its decentralized nature, lurking within the expansive crypto landscape are formidable whales—entities, whether individuals or organizations, holding substantial stakes in this vast sea of digital assets.

The enigma surrounding the identity of these significant holders persists, fueled by the limited circulating supply of the alpha crypto, intensifying the curiosity of investors eager to unveil the faces behind the sizable Bitcoin holdings.

Bitcoin’s Skyrocketing Riches: 237% Surge In Million-Dollar Wallets

In a testament to Bitcoin’s soaring prominence, the number of wallets holding over $1 million in Bitcoin has surged by an astounding 237% this year, data from BitInfoCharts shows. Notably, this surge is not just driven by individual investors; financial institutions are making a significant mark in this neck of the woods.

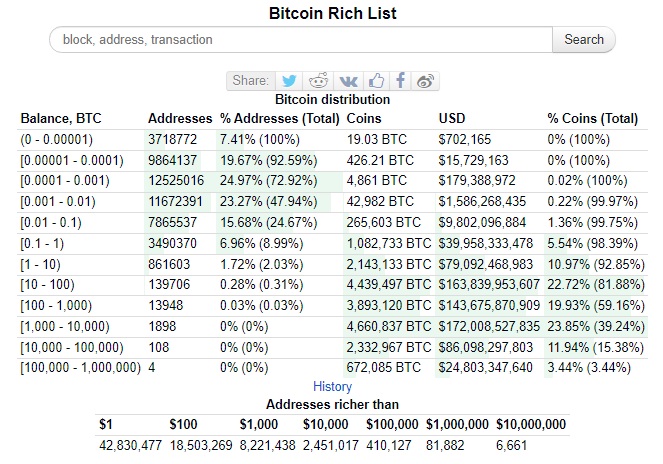

Source: BitInfoCharts

The once skeptical traditional finance sector is now embracing Bitcoin as both a store of value and a lucrative investment. This metamorphosis signals a broader shift, ushering in a new era where institutions confidently navigate the million-dollar echelons of the Bitcoin ecosystem, illuminating a landscape teeming with wealth and potential.

Glassnode’s comparison data indicates that the number of Bitcoin addresses with values greater than $1 million peaked in November 2021, during the height of the previous bull market. In particular, a startling 112,573 addresses were registered on November 9, 2021—the day before Bitcoin hit its all-time high of $69,000 on November 10 of the same year.

The increase in affluent Bitcoin holders is matched by a consistent rise in the count of so-called “wholecoiners,” referring to individuals or entities possessing a minimum of one unit of Bitcoin.

Bitcoin slides back into the $36K territory today. Chart: TradingView.com

According to the data provided by Glassnode, there has been a 4% increase in the number of wholecoiners, rising from 978,197 individuals at the beginning of 2023 to a total of 1,018,015. The observed rise indicates a consistent pattern of accumulation, despite the occurrence of multiple downturns in the bitcoin market.

Amidst an atmosphere charged with excitement, Bitcoin’s trading price see-sawed from $36,800 to $37,050 over the weekend, showcasing a nearly 40% surge in the past month. The rally is not merely a coincidence but a result of the optimistic projections surrounding the awaited spot exchange-traded fund (ETF) for Bitcoin.

Since the start of the year, the quantity of "millionaire" Bitcoin wallets has increased by more than 237%. Source: Glassnode

Bloomberg’s ETF analysts boldly declared a 90% likelihood of approval by January 10th, setting the stage for widespread anticipation and fostering expectations of an impending price rally. Adding fuel to this bullish fire are luminaries like Michael Saylor, prophesying a tenfold surge in Bitcoin demand within the upcoming year.

Satoshi’s Reign: Unveiling The Enigmatic Overlord Of Bitcoin

Meanwhile, ever wondered who reigns supreme as the top BTC holders? Well, as of 2023, the crown sits atop the enigmatic head of Satoshi Nakamoto, the elusive creator of Bitcoin. Revealed by the Bitcoin research and analysis firm, River Intelligence, Nakamoto commands a staggering 1.1 million BTC tokens spread across a labyrinth of 22,000 different addresses.

Venture a bit further, and you’ll find BitInfoCharts diligently keeping tabs on the Bitcoin elite. Their findings unveil a compelling narrative, with the majority of the top 10 wallet addresses intertwined with the realms of Binance and Bitfinex crypto exchanges.

Curious to know who else claims a spot in this exclusive club? Here’s a glimpse into the cryptic world of the top 10 Bitcoin wallets:

34xp4vRoCGJym3xR7yCVPFHoCNxv4Twseo

Balance – 248,597 BTC

bc1qgdjqv0av3q56jvd82tkdjpy7gdp9ut8tlqmgrpmv24sq90ecnvqqjwvw97

Balance – 178,010 BTC

bc1ql49ydapnjafl5t2cp9zqpjwe6pdgmxy98859v2,

Balance – 118,300 BTC

39884E3j6KZj82FK4vcCrkUvWYL5MQaS3v

Balance – 115,177 BTC

bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt

Balance – 94,643 BTC

37XuVSEpWW4trkfmvWzegTHQt7BdktSKUs

Balance – 94,505 BTC

1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF

Balance – 79,957 BTC

bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6

Balance – 69,370 BTC

3LYJfcfHPXYJreMsASk2jkn69LWEYKzexb

Balance – 68,200 BTC

bc1qd4ysezhmypwty5dnw7c8nqy5h5nxg0xqsvaefd0qn5kq32vwnwqqgv4rzr

Balance – 59,300 BTC

Some Names In The Bitcoin Whale Top Rank Include:

Brian Armstrong

Coinbase CEO

Michael Saylor

Entrepreneur/CEO of MicroStrategy

Changpeng “CZ” Zhao

Binance CEO

Tim Draper

Tech billionaire

The Winklevoss Twins

The significance of these Bitcoin whales and their colossal holdings goes beyond mere curiosity. They are architects of market sentiment, influencing the trajectory of the crypto landscape.

As financial institutions join the ranks, the narrative of Bitcoin evolves, transcending skepticism to become a cornerstone of investment portfolios. In this ever-evolving saga, the identities of these Bitcoin titans not only matter—they shape the future of finance itself.

Featured image from Icons8_team/Pixabay