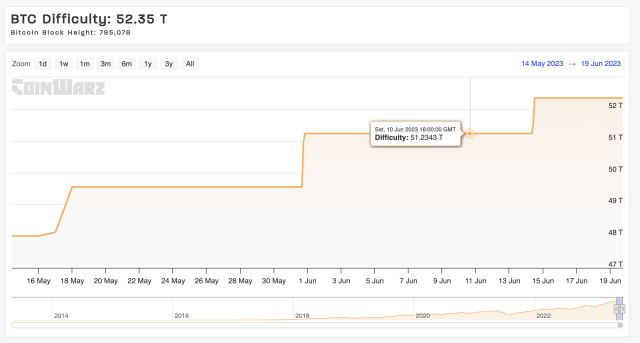

As additional miners join the Bitcoin network and existing miners continue to deploy new mining rigs, the difficulty of mining BTC is expected to reach a new all-time high within the month. According to data from Coinwarz, a Bitcoin mining monitoring platform, it looks like there’s likely to be another surge in mining difficulty in the coming weeks.

Bitcoin Mining Difficulty Increase: What Does It Mean?

The process of mining Bitcoin becomes increasingly harder as more miners join the network. The Bitcoin algorithm automatically adjusts to ensure that one block is mined every 10 minutes. When there are more miners competing, the difficulty goes up to make it harder to find a block.

The higher the difficulty, the more hash power miners need to solve blocks and earn BTC. As difficulty continues marching upwards over time, mining profitability declines. Miners can be severely impacted by this, as they will need to raise the amount of energy and money spent mining in order to maintain the same payout rate.

Mining difficulty rises to 52.35T | Source: CoinWarz

Right now, data from the Bitcoin difficulty chart shows that the difficulty is at its record high at 52.35 trillion hashes. However, this metric is poised to jump to 53.33 trillion hashes later this month around June 28, indicating a 1.78% increase. This increase will mark the third jump this month only, as the price of Bitcoin continues to range and trend above the $26,000 range.

How Mining Difficulty Impacts The Price Of Bitcoin

The difficulty of Bitcoin mining only directly impacts profits as a miner. However, some investors will like to correlate an increase in difficulty with an increase in the market price of BTC.

Mining difficulty is most efficient on the price of BTC when there is a Bitcoin halving. With a higher mining difficulty and fewer block rewards, fewer BTC is being introduced into circulation.

BTC price retests $27,000 resistance | Source: BTCUSD on TradingView.com

The increasing difficulty and reduced block reward signal lower future supply growth, which investors see as a bullish sign that frequently sparks buying interest in the market. According to the BTC halving schedule, the block reward is cut in half roughly every 4 years.

Of course, the price of Bitcoin is quite volatile and influenced by many factors, so there is no guarantee of a price increase following a jump in mining difficulty. For miners and investors alike, increasing mining difficulty means gearing up for the next stage of Bitcoin’s growth cycle. It shows the entire network is growing and more secure.

As mining difficulty rises, the security of the blockchain also gets stronger as more miners are securing the network. The decrease in incoming supply coupled with the increased security signals to investors that it is a good time to buy BTC, which leads to a surge in price. For this reason, a rise in mining difficulty and the upcoming halving can be a very bullish event for the cryptocurrency.