The price of Bitcoin has been on a tear in the past few days, returning to the lofty levels it once occupied at the beginning of the year. Interestingly, not only has BTC’s price been on the rise, but the coin’s open interest has also witnessed significant growth in the past few days.

The Bitcoin open interest, depending on its movement, can often signal the trajectory of the BTC price in the near future.

Bitcoin Open Interest Soars To $12 Billion

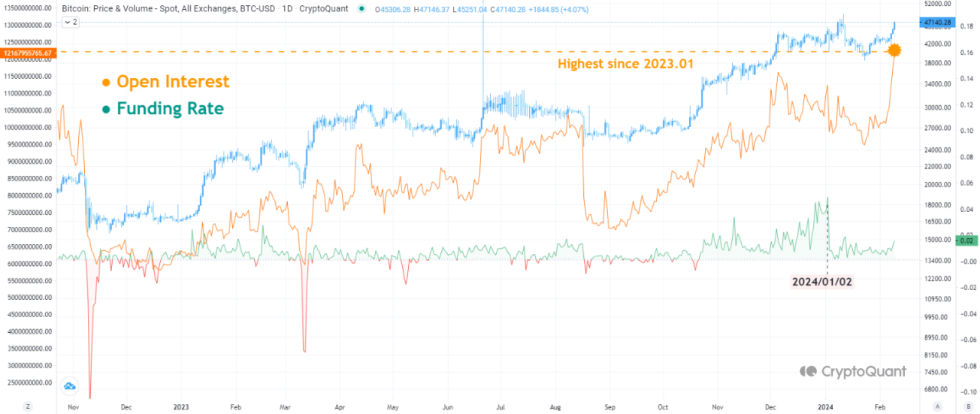

According to the latest on-chain data, Bitcoin’s open interest has been increasing rapidly across various exchanges, corresponding with the recent rise in price. This metric tracks the amount of money poured into BTC derivatives at any given time.

Data from CryptoQuant shows that the coin’s open interest is over $11.68 billion as of Friday, 9th of February. What’s more interesting is that this figure represents the metric’s highest value since May 2022, coinciding with the infamous collapse of the Terra Luna ecosystem.

A pseudonymous analyst, in a CryptoQuant Quicktake post, offered insight into the recent surge in open interest and how it could impact the price of BTC. While highlighting that the recent rise in Bitcoin open interest might “suggest a short-term overheated level,” the analyst noted that the current funding rate somewhat dispels this argument.

A chart showing BTC's open interest and funding rate | Source: CryptoQuant

For context, the funding rate is a periodic payment between long or short traders to ensure a perpetual contract price stays close to the spot price of the underlying asset (Bitcoin, in this scenario). Positive funding rates indicate that the long traders are paying the shorts, while negative funding rates suggest the opposite.

According to the author of the Quicktake post, the funding rate is positive but does not signal significant overheating. The analyst added:

This indicates that the ratio between long and short-position investors is not abnormally skewed, resembling the steady rally seen in October-November 2023.

The CryptoQuant analyst, however, warned that a sudden spike in the Bitcoin funding rate to as high as 0.05 could result in a long squeeze. A long squeeze typically occurs when long traders are forced to sell their positions to cover losses, resulting in an abrupt decline in the asset’s price.

Ultimately, rising open interest is a positive development for the price of Bitcoin, especially as historical patterns show that BTC’s value tends to move in the same direction as its open interest.

BTC Price

As of this writing, the price of Bitcoin stands just above $47,200, reflecting a 4% increase in the past day.

Bitcoin price holds steady above $47,000 on the daily timeframe | Source: BTCUSDT chart on TradingView