The crypto market is witnessing a notable downturn, with Bitcoin’s price plummeting below the $39,000 threshold. Bitfinex’s latest Alpha Report paints a bearish picture, suggesting that the prevailing market sentiment is inclined toward further downturns.

This perspective is based on analyzing critical price levels that could support BTC’s falling value.

Further Plunge Ahead?

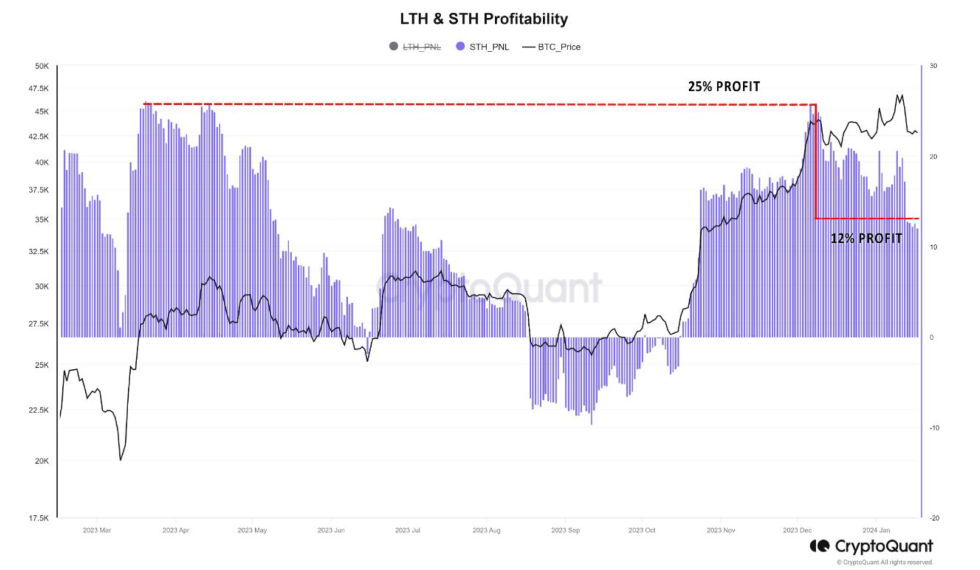

The ongoing decline in Bitcoin’s value, as highlighted by Bitfinex, has caused a significant reduction in short-term holder profits and raised concerns about increased selling pressure from this group of investors.

Analysts from Bitfinex emphasize that this trend could potentially lead to “further substantial price correction,” in the Bitcoin market. Short-term holders, known for their sensitivity to market movements, could trigger further price dips, with critical support levels identified at “$38,000 and $36,000.”

According to the report, this range closely aligns with the realized price of BTC for short-term holders, currently at $38,307. The analysis also revealed that over half of the profits accumulated by short-term BTC holders have been erased, leading many, especially recent buyers, to exit the market at a loss.

Speaking of loss, in just 24 hours, BTC’s price has sharply fallen, dropping from above $41,000 to approximately $38,908 at the time of writing, losing over $2000 in value.

This decline of 4.6% in a day affected the asset’s value and led to substantial liquidations in the crypto market. Data from Coinglass indicates that over 123,000 traders have been liquidated in the past 24 hours, with cumulative liquidations amounting to $325 million.

BTC long traders bore the brunt of these liquidations, incurring losses of around $80.35 million. Ethereum traders have also felt the ripple effects, with significant liquidations experienced among long and short traders. Long traders faced liquidations totaling $63.46 million, while short traders saw $6.48 million in liquidations.

Reasons Behind Bitcoin Market Downturn

The BTC market downturn has been attributed to various factors, including the continuous outflows from the Grayscale Bitcoin Trust (GBTC). Bloomberg analyst James Seyffart commented on the gravity of the situation, noting that GBTC experienced its largest outflow yet, totaling $640 million in a single day.

Woof. BAD day for #Bitcoin ETFs overall in the Cointucky Derby. $GBTC saw over $640 million flow out today. Outflows aren’t slowing — they’re picking up. This is the largest outflow yet for GBTC. Total out so far is $3.45 Billion. (Don’t have BlackRock data yet) pic.twitter.com/jNOyiTADVq

— James Seyffart (@JSeyff) January 23, 2024

Another critical factor influencing Bitcoin’s dip below $39,000 is the reduced activity in futures and options markets. Notably, the open interest in CME Bitcoin futures significantly declined, indicating a decrease in market leverage and speculative interest.

CME #Bitcoin futures open interest has dropped by over $1.64 billion following the spot BTC ETF approvals pic.twitter.com/3DBv4p3ezq

— Satoshi Stacker (@StackerSatoshi) January 21, 2024

Crypto analyst Skew provided insight into the dynamics between Bitcoin’s perpetual futures and spot markets. Skew observed a dominance of short positions in the perpetual futures market, suggesting a bearish sentiment.

The analyst also noted the lack of volatility and urgency in the current market, attributing it to decreased open interest and a focus on spot market flows.

$BTC Binance / Bybit Open Interest & Delta

Nothing too conclusive yet in perps market other than shorts becoming the dominant position in the market currentlyPerp premiums often occurring during periods of spot limit selling into price

Spot premiums notably when perps push… pic.twitter.com/PdZtfIQK5U

— Skew Δ (@52kskew) January 22, 2024

Featured image from Unsplash, Chart from TradingView