According to a new analysis by Daniel Batten, managing partner at CH4 Capital and a renowned Bitcoin ESG researcher, the BTC network has achieved three remarkable new all-time highs. However, these milestones are not related to its price, which has yet to surpass the previous peak of $69,000.

Batten’s insights were detailed in the latest issue of “The Bitcoin ESG Forecast,” where he elucidates on how BTC is gradually gaining traction among institutional investors, particularly within the $23 trillion ESG funds sector.

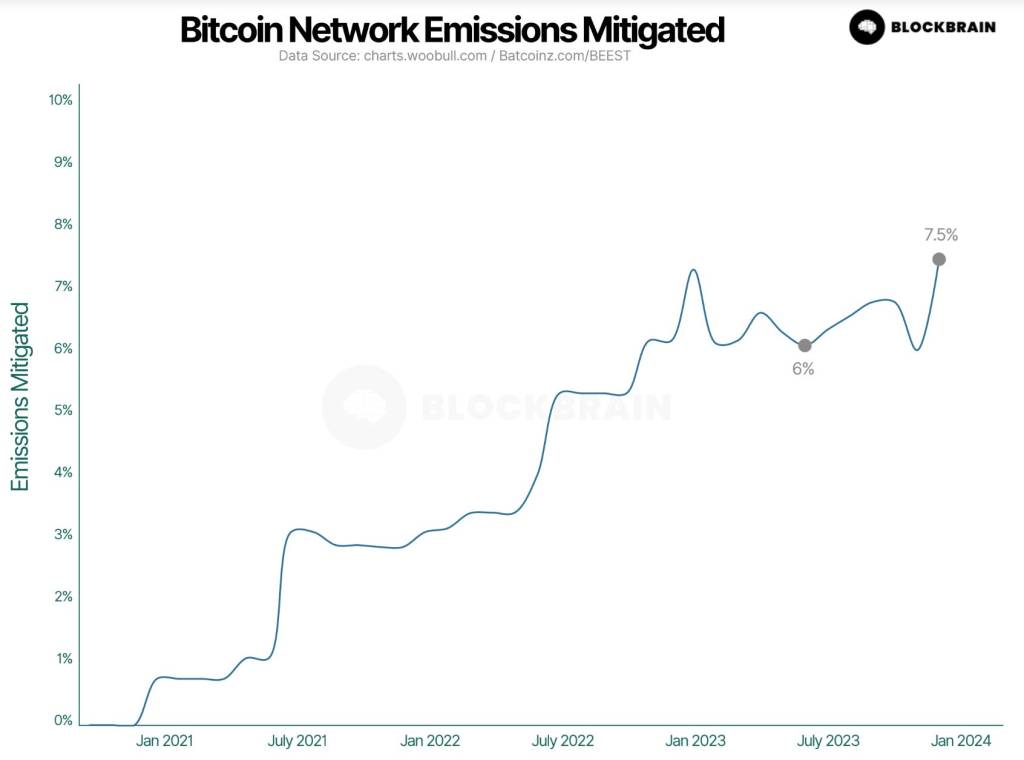

New All-Time High #1: Methane Mitigation

Batten highlights the critical achievement in methane mitigation, where the Bitcoin network is making significant strides. “In four years, without subsidies or purchasing offsets, Bitcoin mining now offsets one in every 13 tonne of emissions through methane mitigation,” Batten notes.

This milestone is particularly significant in light of the focus on methane at the recent COP28, with companies like Vespene leading the way in utilizing landfill gas for BTC mining.

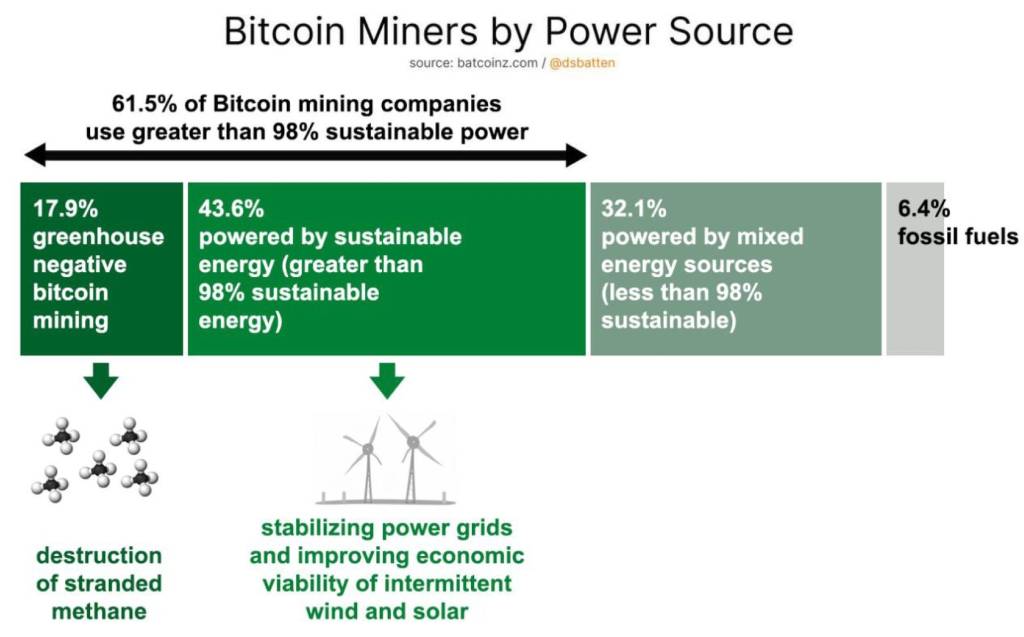

New All-Time High #2: Sustainable-Energy Based Bitcoin Mining

An impressive 61.5% of all known miners are now using sustainable energy. “To our knowledge, there is no other industry where such a high percentage of operators use almost exclusively sustainable energy,” Batten states, emphasizing the shift away from the narrative that mining is predominantly fossil-fuel based.

This statistic includes nearly 18% of all miners who use stranded methane, highlighting the industry’s commitment to combating climate change.

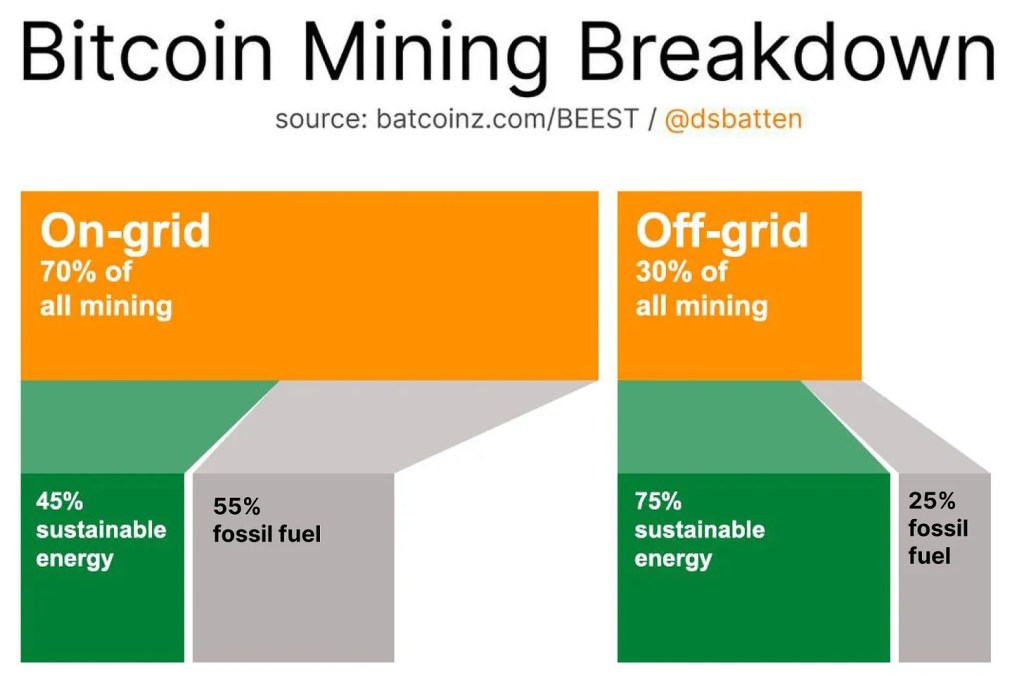

New All-Time High #3: Off-Grid Mining

The expansion of off-grid BTC mining to 29.8% underscores the sector’s innovative approach to energy use. “Cheap power, usually sustainable energy, drives miners off-grid,” explains Batten. He further elaborates that the cost of sustainable energy has decreased significantly, making it a lucrative option for miners who are driven by profit yet are finding a convergence with ecological imperatives.

Batten critiques existing models, like Cambridge’s, for not accounting for off-grid mining, which he believes has historically understated the scale of sustainable-energy based Bitcoin mining. He argues that the industry stands as a prime example of how “economic incentive and ecological imperative are increasingly overlapping.”

Science Community Backs Bitcoin

Furthermore, Batten addresses the shift in narrative surrounding Bitcoin mining’s environmental impact. He cites recent peer-reviewed scientific literature that endorses the net-positive environmental potential of Bitcoin mining. This includes studies from Cornell University and findings published in MDPI and Sciencedirect, which collectively support Bitcoin mining’s role in renewable energy development, grid decarbonization, and methane mitigation.

1/6

Many people don't realise how much peer reviewed scientific literature came out in the last 18 mths endorsing Bitcoin mining's net-positive environmental potential

Here's 5 of the most recent publications with

♻️source

♻️headline

♻️TL;DR summary🧵

— Daniel Batten (@DSBatten) February 12, 2024

“These publications reveal a transformative potential in the BTC mining sector, especially regarding demand response, grid flexibility, and methane mitigation,” Batten highlights, challenging the mainstream media’s often critical perspective of Bitcoin’s environmental impact.

With this comprehensive analysis, Batten not only sheds light on BTC’s pivotal role in environmental sustainability but also underlines its growing appeal among global investors, particularly within the ESG-focused funds. As Bitcoin continues to achieve new records in sustainability and innovation, it reinforces its position at the forefront of aligning economic incentives with environmental goals, paving the way for broader institutional acceptance.

At press time, BTC traded at $50,116.