The recent surge in Bitcoin’s prices to a new all-time high is being faced with growing pessimism as short sellers are rising significantly in the market. Given the constant increase in short sellers, the flagship asset could be poised for a notable price correction toward key support levels in the upcoming days.

Short Sellers Bet Against Bitcoin’s Upward Strength

Advanced investment and on-chain data platform Alphractal, in a newly-published research, has reported a worrying shift in sentiment among Bitcoin investors on the X (formerly Twitter) platform.

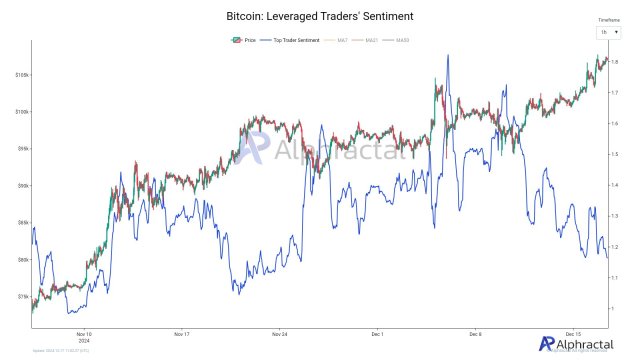

Bitcoin has demonstrated remarkable price performances in the last few days, sparkling excitement within the crypto community. However, a substantial spike in leveraged short positions has followed the robust rally to a new all-time high. “After an increase in short positions by traders, Bitcoin defied expectations and broke through the $107,000 barrier, catching the market off guard,” the platform stated.

Alphractal revealed the development after examining the data from the Leveraged Traders’ Sentiment metric. According to the platform, this indicator is quite potent since it warns of movements that deviate from the majority’s expectations. Also, this metric serves as a gauge for possible mass liquidations and trading behavior.

This rise in leveraged short positions indicates increasing bearish sentiment and trader speculation. It also implies that a lot of investors seem to be placing bets on a price correction even though the bullish trend has driven the crypto asset to record highs.

While this development has historically led to a pullback, Alphractal highlighted that the market has moved in the opposite direction. The platform claimed that the move, triggering liquidations, has also driven BTC’s price even further.

Furthermore, this movement demonstrates how Bitcoin defies expectations and emphasizes how crucial it is to monitor sophisticated metrics like this. With a clear detailed analysis of key metrics, one can navigate the crypto market successfully and prevent rash decisions.

Thus far, the platform has warned investors and traders to closely watch out for excessive optimistic or pessimistic sentiment in the market. As prices draw closer to resistance levels, the rise in leverage short sellers might fuel volatility in the near term.

BTC’s Bullish Momentum Fading?

Several metrics lately have turned bearish amidst Bitcoin’s recent rally to new levels. On-chain data platform CryptoQuant has revealed a negative trend between the Coinbase Premium Index and BTC’s price, raising questions about the rally’s sustainability.

Over the past week, the Coinbase Premium has decreased sharply despite BTC surging from $94,000 to $106,000. CryptoQuant also noted that a notable divergence has emerged between the index and BTC’s price. If demand from the US investors has not kept pace with this price increase, it may suggest a sign of underlying weakness in the medium-term rising momentum.