Here’s how much Bitcoin the whales have added to their combined holdings since the start of the year 2024, according to on-chain data.

Bitcoin Whales Have Accumulated This Much BTC In 2024

In a post on X, the on-chain analytics firm Santiment has discussed the changes that have taken place in the holdings of the Bitcoin sharks and whales this year.

The metric of interest here is the “Supply Distribution,” which tells us about the total amount of Bitcoin the different wallet groups on the network are holding right now. Addresses are divided into these wallet groups based on the number of coins they are currently carrying in their balance.

In the context of the current topic, two groups in particular are of relevance: “sharks” and “whales.” The sharks are typically defined as the BTC investors holding between 100 and 1,000 BTC, while the whales are those with 1,000 to 10,000 BTC.

As both of these cohorts have large holdings, they can carry some influence in the market. Naturally, the whales are the more powerful of the two groups since their holdings are simply the more massive ones.

Generally, individual moves by members of these groups don’t have much visible effects on the market, but when these investors move as a group, the scale can become large enough to send shockwaves through the cryptocurrency.

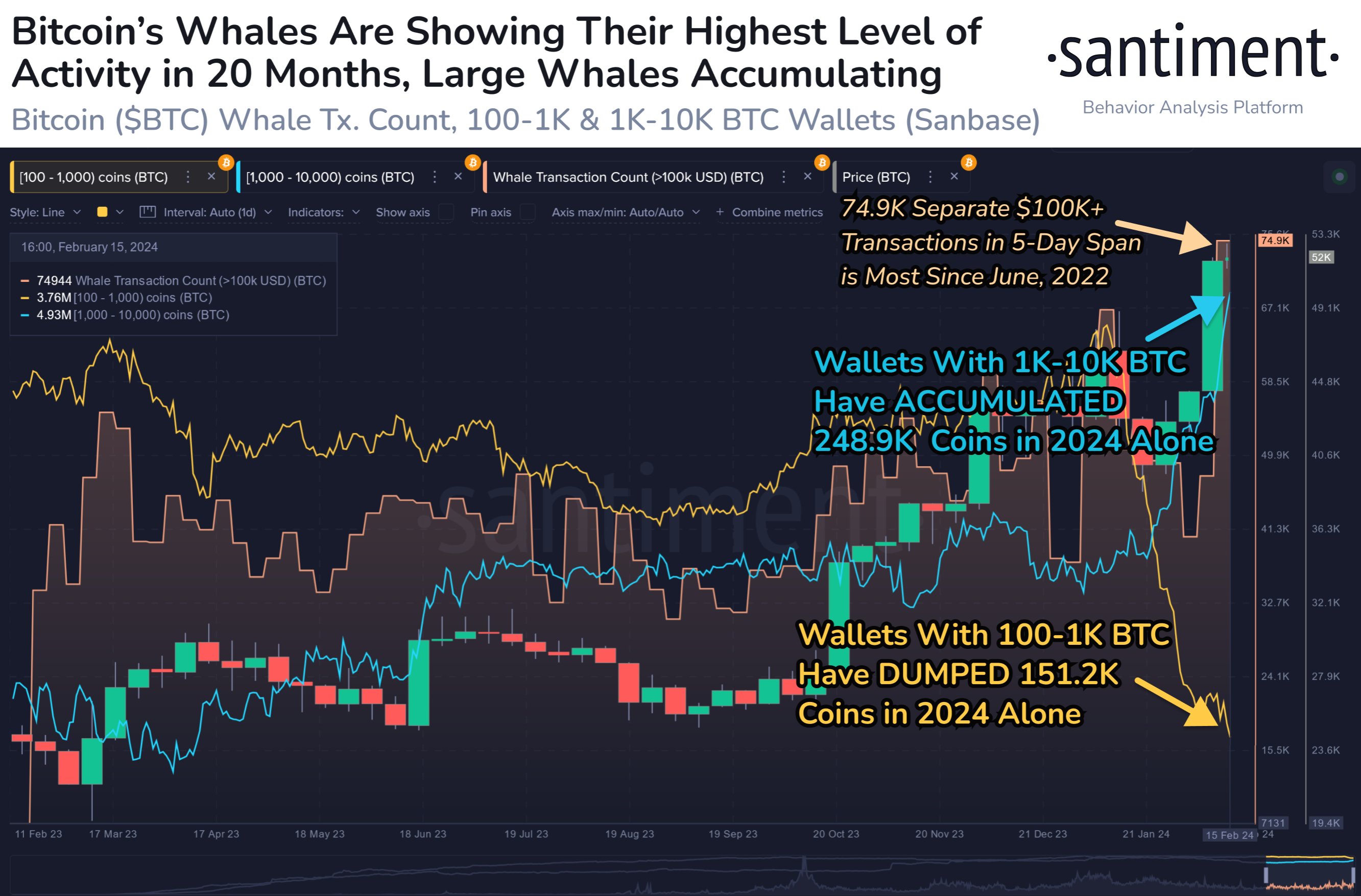

Now, here is a chart that shows the trend in the Bitcoin Supply Distribution for each of these two groups over the past year:

Looks like the metric has gone opposite ways for these groups | Source: Santiment on X

As displayed in the above graph, the Bitcoin supply held by the whales has been sharply going up since the start of the year. The supply of the sharks, on the other hand, has seen a notable drawdown during the same period.

In total, the 1,000 to 10,000 BTC wallet group has added 248,900 BTC, while the 100 to 1,000 BTC cohort has sold 151,200 BTC. At the current price of the asset, these amounts are worth about $13 billion and $8 billion, respectively.

Clearly, while the sharks have participated in some selling, the buying from the more influential whales has more than made up for it. In net, the market has seen accumulation worth $5 billion from these large holders.

Some of the apparent selloff from the sharks may, in fact, simply be a result of some members of the cohort buying enough to cross the 1,000 BTC threshold, thus becoming part of the whale cohort instead.

Either way, the strong accumulation from the whales is naturally a positive sign for the cryptocurrency, as it suggests that these humongous holders have backed the coin through its recent run of bullish momentum.

In the chart, Santiment has also attached data for another metric: the number of transactions being made by the whales. This indicator recently reached its highest value across a 5-day span since June 2022, showing how these large investors have ramped up their activity.

BTC Price

Bitcoin has followed an overall sideways trajectory recently as its price continues to trade around $52,300.

The price of the coin seems to have gone through a temporary drop over the weekend | Source: BTCUSD on TradingView