- Chainlink has beaten bitcoin while emerging as one of the most profitable assets in the cryptocurrency, as well as the traditional market, in 2020.

- Demand for Chainlink’s LINK token has gone up after a US-based venture capital firm has backed its use to offer collateral to dwindling stablecoin DAI.

- LINK has broken above crucial resistance areas and is looking to extend its uptrend. However, there are some risks.

Chainlink’s native cryptocurrency LINK has rebounded by more than 180 percent from its mid-March lows, beating top assets including Bitcoin and Ethereum.

The LINK-to-dollar exchange rate topped at $3.84 on Saturday as ParaFi Capital, one of the venture firms backing popular DeFi platform MakerDAO, proposed to collateralize its stablecoin DAI using the LINK cryptocurrency.

The firm noted that LINK brings an attractive “market cap, liquidity profile, and appetite for speculation,” which could assist DAI in maintaining its US dollar-peg.

“For context, lending protocol Aave has seen close to $20MM in LINK 2 supplied as collateral since launching in mid-January,” wrote ParaFi. “LINK is valued at over $1 billion and is also one of the most liquid ERC-20 tokens available. The token is relatively decentralized with no known “kill-switch” or blacklisting capabilities.”

The speculation helped to bring more users to the Chainlink network. The number of LINK wallets last week surged at an average of 1,400 per day, leading analysts to predict an uptrend in the LINK prices.

Congrats to all the #Chainlink holders & #LINK Marines who had strong hands and accumulated more after the crash. We are recovering quickly! Demand is sky high!

🔥 $LINK's Performance is Legendary 😎

— Kevin Svenson (@KevinSvenson_) April 18, 2020

LINK Up 100% YTD

The Chainlink predictions are coming to be accurate, at least in the near-term. The LINK-to-dollar exchange rate on Monday jumped 6.26 percent to $3.79, signaling traders’ willingness to keep the prices afloat above crucial support levels. The move uphill brought the pair up by more than 100 percent on a year-to-date timeframe.

In comparison, bitcoin was down 0.21 percent within the same period.

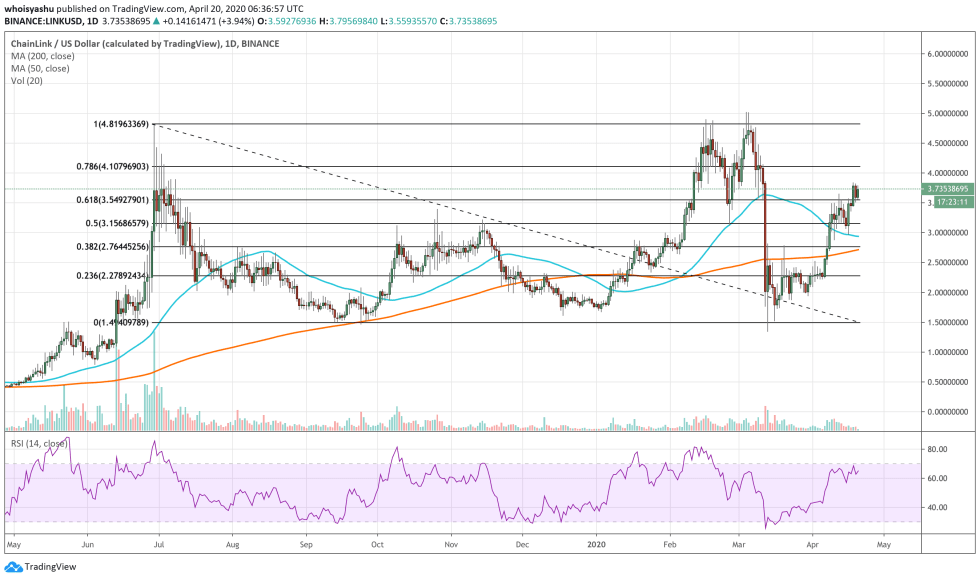

Chainlink’s gains also led the prices above its long-term moving average, the 200-daily MA. The blue wave in the chart above is now likely to behave like psychological support – a place of LINK token accumulation. That increases the possibility of the cryptocurrency to retest $4.10. An extended move above the said level could push LINK’s upside target towards $4.81.

Nice upwards move, but didn't clear resistance.

Yes, we've cleared a high, but the crucial area should be the red zone between $3.72-3.85 to break here.

If can't break, I'm assuming we're going to test lower levels and possibly $3 again.

Breaking -> $4.80. pic.twitter.com/GMLdLP4fyA

— Michaël van de Poppe (@CryptoMichNL) April 18, 2020

Chainlink Downside Risks

Notably, the Chainlink price is rising but remains at the risk of profit-taking. Once the MakerDAO hype fades, traders could start offloading their LINK positions to move into either Bitcoin or fiat. Part of the reason is the fast-spreading Coronavirus pandemic that has raised the demand for the US dollar among institutional and retail investors.

Another reason for a medium-term downside move could be low volume. The price of the cryptocurrency is rising but on meager trade volumes, which shows that a lesser number of traders are participating in the ongoing bull run.

That said, maintaining stop-loss orders on bullish positions is necessary to minimize risks should there by any surprising trend reversal.

Cover Image via Unsplash