On-chain data shows the Chainlink supply on exchanges has dropped to the lowest level in around four years, a sign that could be bullish for LINK.

Chainlink Supply On Exchanges Has Seen A Plunge Recently

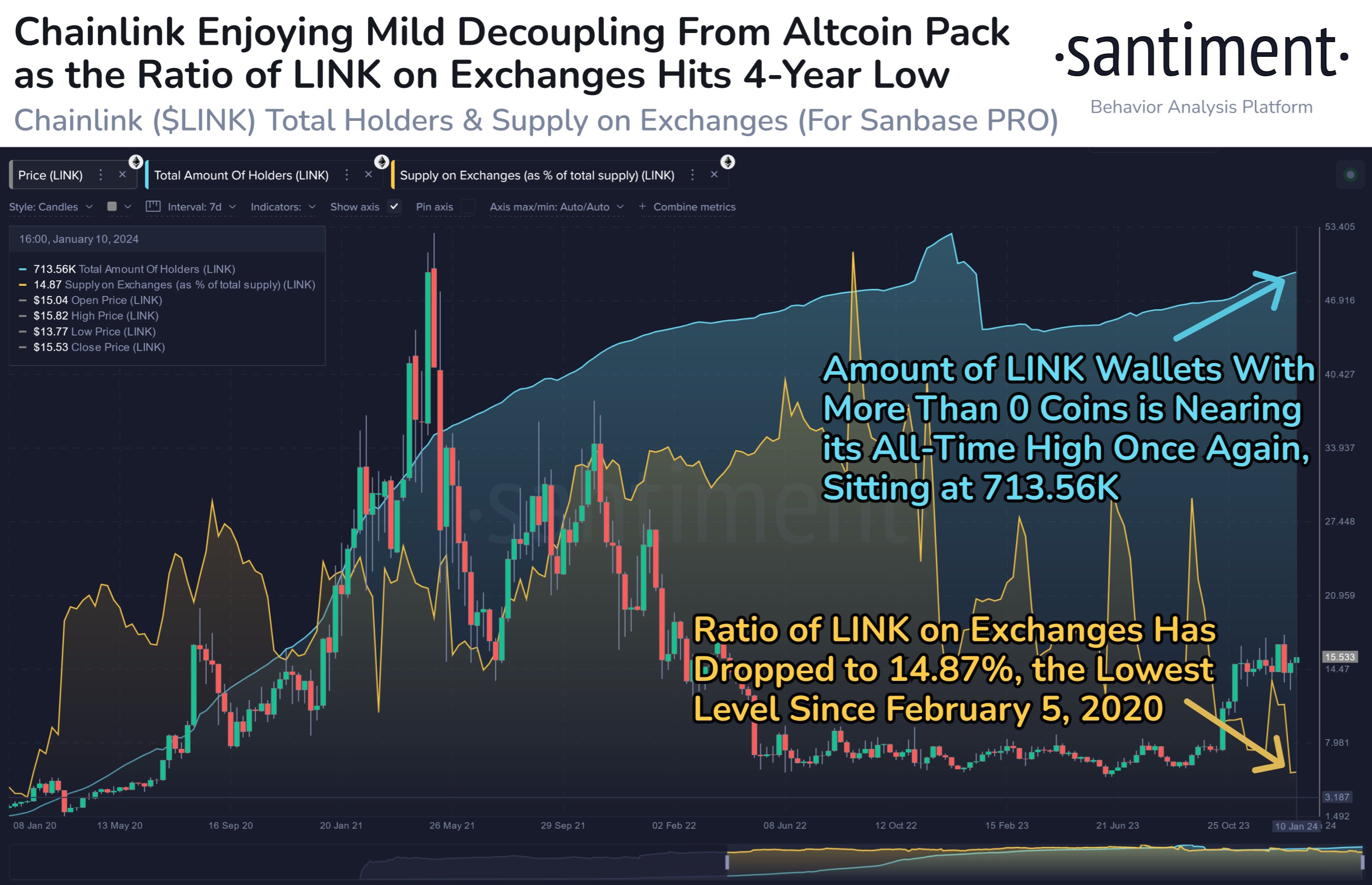

According to data from the on-chain analytics firm Santiment, LINK’s latest upward surge has come as the cryptocurrency’s supply on exchanges has dropped to lows.

The “supply on exchanges” refers to the percentage of the total circulating Chainlink supply currently being stored in the wallets of all centralized exchanges.

When this metric’s value goes up, the investors are depositing a net number of coins to these platforms right now. As one of the main reasons the holders would transfer their LINK to exchanges is for selling purposes, such a trend could be bearish for the asset’s price.

On the other hand, the indicator observing a drop implies a net amount of the cryptocurrency is currently leaving the exchanges. This kind of trend could be a sign that the investors are accumulating, which can naturally be bullish for the price in the long term.

Now, here is a chart that shows the trend in the Bitcoin supply on exchanges over the last few years:

Looks like the value of the metric has been going down in recent weeks | Source: Santiment on X

As displayed in the above graph, the Chainlink supply on exchanges has seen a sharp decline recently. This would suggest that net asset withdrawals have occurred on the exchanges.

Following this drop, the indicator’s value has hit just 14.87%. This is the lowest metric since 5th February 2020, almost 4 years ago.

As the supply on exchanges has hit these lows, the price of LINK has registered some rebound as it has recovered from its crash below the $13 level. It’s possible the outflows had something to do with the recent price action, but it’s hard to say for sure.

Either way, the indicator dropping to such low levels is certainly an optimistic development for Chainlink. And it’s not just because it means that many LINK investors are possibly interested in HODLing the coin currently; there is also another implication here.

It’s the fact that the portion of the supply in the custody of the exchanges has been reduced. A push towards self-custody is always ideal for any cryptocurrency, as these central entities will affect the market to a lesser degree.

In 2022, the sector saw cases like the FTX collapse, which ended up destabilizing the entire market. If investors continue to put their coins inside wallets the keys they own, then scenarios like those would potentially not repeat.

LINK Price

At the time of writing, Chainlink is trading at around $15.3, up 13% in the past week.

LINK has seen some surge during the last few days | Source: LINKUSD on TradingView