The crypto industry has been rocked yet again with another scandal. And this time, the name of the entity in the spotlight is CoinDeal.

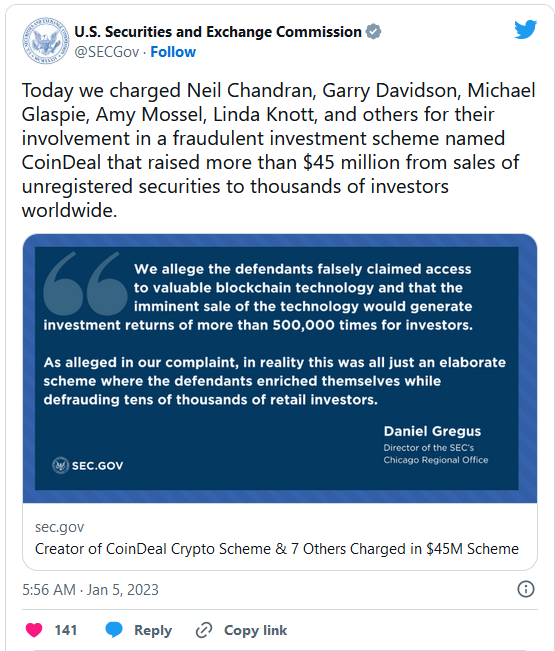

The U.S. Securities and Exchange Commission released a report detailing the charges brought against eight individuals and business entities involved in the mess.

Neil Chandran, Garry Davidson, Michael Glaspie, Amy Mossel, Linda Knott, AEO Publishing Inc, Banner Co-Op, Inc, and BannersGo, LLC all allegedly used the investment scheme CoinDeal to defraud investors.

The defendants are accused of breaking the provisions of the Securities Act and the Exchange Act that prohibit fraudulent activity and require registration.

CoinDeal: Case In A Nutshell

According to the report, the accused falsely claimed that investors of CoinDeal could make extravagant returns in the underlying blockchain technology.

In the period between 2019-2022, the scheme amassed $45 million in investor funds.

The CoinDeal funds were then used by the accused for personal use with Chandran even using them to buy real estate, cars, and a boat.

Daniel Gregus, Director of the SEC’s Chicago Regional Office, said:

“We allege the defendants falsely claimed access to valuable blockchain technology and that the imminent sale of the technology would generate investment returns of more than 500,000 times for investors.”

The SEC is demanding all defendants pay back the money they stole, plus pre-judgment interest, fines, and permanent injunctions.

The press release also segregated the accused with their respective charges, which are as follows:

- Chandran, Davidson, Glaspie, Knott, Banners Co-Op and BannersGo are charged with violating the anti-fraud and registration provisions of Securities Act and Exchange Act

- Davidson, Glaspie, Knott, Banners Co-Op and BannersGo are charged with violating the anti-fraud provisions of the Securities Act as they helped Chandran with the scheme

- Mossel and AEO Publishing are charged with violating the anti-fraud provision of the Securities Act as well as providing assistance to Glaspie with the scheme

Overall, the CoinDeal case is still hot from the oven so we should expect updates in the coming days or months.

Meanwhile, Chandran is currently incarcerated for trial in a separate investment fraud case brought by the United States Department of Justice.

If found guilty by the DOJ, Chandran could spend 20 years in federal prison.

Crypto total market cap at $777 billion on the daily chart | Chart: TradingView.com

What This Means For The Crypto Industry

As we may know, the world of crypto, DeFi, and Web3 is in its infancy. But throughout its lifetime it has already achieved a lot and have had its fair share of highly scandalous events akin to that of the 2008 financial crisis.

With the collapse of FTX, regulation might be one of the ways to prevent large-scale frauds like this from happening.

This is not new, however, with developed and emerging economies even passing legislation regarding the use of cryptocurrencies as a means for payment and to protect investors as well.

That said, the crypto industry must be ready to face a new wave of regulations to rid the crypto industry of bad actors. The extent of the future regulation, however, remains to be seen.

-Featured Image: WBRE