Crypto theft and exploits took center stage in April, leaving investors reeling from the staggering $103.7 million in funds lost to cybercriminals, according to the latest report from CertiK.

The month was marked by a wave of security breaches and fraudulent activities, culminating in a total year-to-date loss of $430 million.

As the crypto industry continues to grapple with mounting security risks, experts warn that vigilance and caution are more crucial than ever before.

Crypto Theft, Flash Loan Attacks Continue To Plague Industry In April

Despite efforts to enhance security measures, the crypto industry faced a challenging month of April, with a surge in flash loan attacks, exit scams, and other forms of crypto theft. According to CertiK, the total amount lost to these security breaches reached $75 million, comprising almost half of the $145 million lost in the first four months of 2021.

Combining all the incidents in April we’ve confirmed ~$103.6M lost to exploits, hacks, and scams.

Exit scams were ~$9.3M.

Flash loans were ~$19.8M.

See the details below 👇 pic.twitter.com/jflvMPiJGQ

— CertiK Alert (@CertiKAlert) April 30, 2023

One of the most significant incidents involved Yearn Finance, which suffered a $20 million loss due to a hacker exploiting an outdated smart contract on April 13. Meanwhile, the month also witnessed several high-profile exploits, such as the $25.4 million loss resulting from the compromise of multiple MEV trading bots on April 3.

Crypto total market cap barely unchanged at $1.25 trillion on the daily chart at TradingView.com

In addition, Bitrue exchange fell victim to a $22 million hot wallet exploit, while South Korean GDAC exchange lost $13 million in a hack.

The latest victim to fall prey to a flash loan attack was the Ovix protocol, based on the Polygon blockchain, which suffered a loss of $2 million on April 28 due to the exploit.

Source: Shutterstock

The Implications Of Crypto Exploits: What Can Be Done To Prevent Them?

The recent spate of crypto exploits and hacks is a stark reminder of the risks that come with investing in digital assets. These security breaches not only result in significant financial losses for investors and companies but also damage the reputation and credibility of the crypto industry as a whole.

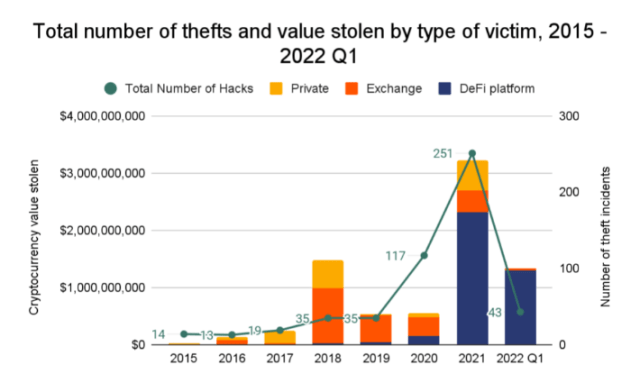

According to Chinalysis, one of the most effective ways to prevent crypto exploits and hacks is through regular security audits and risk assessments. By conducting these evaluations, companies can identify and address potential vulnerabilities before they can be exploited.

Source: Chainalysis

Another approach is to promote greater transparency and accountability within the crypto industry. By sharing information and collaborating on security best practices, companies can improve their collective defenses against malicious attacks.

Moreover, the involvement of regulatory bodies can ensure that companies adhere to strict security standards and prevent bad actors from taking advantage of regulatory loopholes.

While the risks of investing in cryptocurrencies cannot be completely eliminated, taking proactive steps to enhance security can significantly reduce the likelihood of falling victim to crypto theft.

-Featured image from Entrackr