The struggles of cryptocurrency hedge funds in 2018 seem to have no end in sight. With half of the year almost gone, these crypto-focused hedge funds continue to perform poorly.

Declining Revenues Amid Price Dip

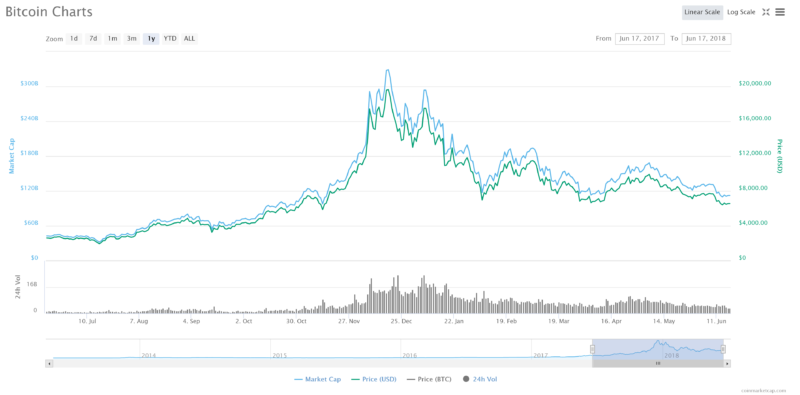

According to the Financial Times, cryptocurrency hedge funds are down by 35 percent so far in 2018. This decline is in stark contrast to 2017 when revenues grew by 2,700 percent. Such was the success of the market that a total of 167 firms were established in 2017 alone.

The digital currency market has had a rough 2018. Market prices have declined steadily with any hint of a rally quickly smothered by a sharp dip. Commenting on the situation, PwC cryptocurrency lead, Henri Arslanian said:

I expect the crypto markets to remain volatile for the foreseeable future. While retail investors may see volatility in the crypto markets as a downside, many crypto funds see it as an opportunity.

The Bitcoin price downturn epitomizes the current market situation. The number one cryptocurrency is currently trading at a third of its value during its ATH is mid-December 2017. Cryptocurrency hedge funds have lost their luster in the wake of the prolonged bear run of 2018. As of April 2018, nine firms had closed down while only 8 percent of the top 25 crypto hedge funds recorded any profits.

Hope on the Horizon for Cryptocurrency Hedge Funds?

Despite the decline, there are still positive signs for cryptocurrency hedge funds. News from the SEC regarding the regulatory status of Bitcoin and Ether in the United States has ushered in something of a reprieve in a dour market downturn. With these top two digital currencies exempt from the jurisdiction of SEC regulators, institutional investors might be incentivized to put more into the market.

Lack of regulatory clarity and delays in the emergence of critical market apparatus like custodial tools are some of the factors that have contributed to the recent price downturn. Arslanian also noted that an influx of big-time investors into the industry will have a profound effect on the market that is far more critical than any temporary price fluctuation.

Concerning institutional investors, firms like Coinbase and Goldman Sachs have launched products targeted at big investors. With the emergence of clear regulations and trustworthy custodial tools, the cryptocurrency market revival can likely begin. If that happens, then the good times could come rolling again for cryptocurrency hedge funds.

Will cryptocurrency hedge funds be able to survive the difficulties experienced so far in 2018? Let us know in the comment section below.

Image courtesy of CoinMarketCap, Wikimedia Commons