A dubious survey on NFT adoption among Americans, apparently from Piplsay Research, claims 18% of Americans own these collectibles.

Dubious Survey Floats Around The Web, Says 18% Of Americans Own NFTs?

According to Bitcoin.com, global consumer research platform Piplsay Research conducted a survey on NFTs between 3-5 September.

However, the original poll is nowhere to be found as Piplsay seems to have already deleted the study. It’s hard to say what went wrong with the survey, but its claims were frankly absurd, and thus mocked around the community.

Related Reading | Bitcoin Adoption In El Salvador Is The “Start Of A New World,” deVere CEO

Apparently, over 30k Americans and around 9k British respondents participated in the survey. The aim of the poll was to find the general consensus regarding NFTs in this booming market.

The boldest claim in the survey, also the source of all the mocking, is that 18% of Americans have personally invested into these digital collectibles.

18% is an astonishingly high figure. For perspective, 18% of the US population is around 60 million people! Over the past month, OpenSea, the largest NFT marketplace, only saw around 233k unique active addresses. Assuming there are 2 million total addresses in all marketplaces (and that’s on the higher side of the estimate), where are the rest of the people getting their collectibles from?

Here are some of the reactions from the community below the tweet from Zero Hedge regarding the survey:

You misplaced your decimal. I'll fix it for you:

.18% of Americans have personally invested in #nfts, while .22% know someone who has made a purchase.

— RentARocker (@RentARocker) September 7, 2021

I would be surprised if 18% of Americans knew what an NFT is. https://t.co/ANpR4IMU30

— Alejandro Arrieche R (@AArriecheR) September 7, 2021

I don’t even think 18% of NFT twitter has personally invested in NFTs https://t.co/wgg29AlOPV

— Dan Knight (@DipDeity) September 7, 2021

State Of The Non-Fungible Token Market

The recent NFT craze has slowed down a little this month, but the market activity is nowhere near dead. Rather, it’s still thriving.

Back in May, the collectible token market had an almost 90% crash, after which some people thought it would never recover, and that the “fad was over.”

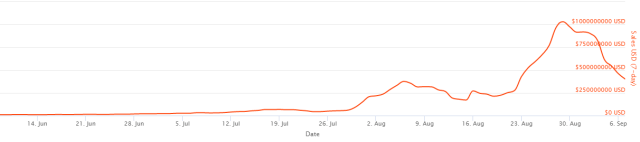

Fast forward to late July, and the market made a big comeback as NFT trading volume broke its last all-time-high (ATH).

The NFT trading volume over the last three months | Source: nonfungible.com

August saw further movement upwards as the 7-day trading volume managed to set an ATH of a whopping $1 billion in transactions.

Related Reading | NFTs In A Nutshell: A Weekly Review

Since then, the market has certainly slowed down a little, but trading volume is still about $400 million today. For reference, the value of the same indicator was about $176 million during the May boom.

Bitcoin Price

Incidentally, around the May NFT crash previously mentioned, BTC also had an almost 50% crash (and so did the rest of the crypto industry).

At the time of writing, Bitcoin’s price floats around $46k, down 4% in the last 7 days. Over the past month, the crypto has gained 0.5% in value.

Yesterday, BTC;s volatility shot up as the coin plunged down 20% to $43k, then recovering to $47k within 15 minutes or so. Here is a chart that shows this crazy behavior observed yesterday:

Bitcoin price goes wild | Source: BTCUSD on TradingView