Once a successful cryptocurrency exchange with a staggering $32 billion valuation, FTX is now sinking in legal troubles amid a sea of scandal. Sam Bankman-Fried, better known as SBF, the exchange’s former CEO, is at the heart of the storm after the company filed for bankruptcy protection in November, allegedly due to fraud committed by SBF.

Recent developments include SBF’s legal team accepting a gag order and actively seeking to have it expanded to cover all trial participants and witnesses.

Legal Battle Tactics From SBF’s Defense Team

A gag order is a strong instrument that the court might employ in a legal setting to prevent the public from learning details of a particular case. It is usually imposed to stop witnesses, defendants, lawyers, and other parties from speaking out in public or revealing specific information that would jeopardize the trial’s outcome or proceedings’ impartiality. A gag order’s main goal is to preserve the fairness of the legal system and guarantee a fair trial by preventing biased publicity.

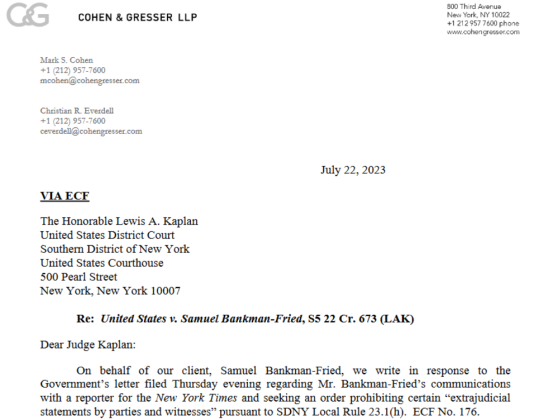

Source: Courtlistener

Mark Cohen, SBF’s attorney, revealed that his client had given the New York Times private documents, including those of a former coworker named Caroline Ellison who was cooperating with the US authorities. Cohen, though, maintains that there were no “infractions of protection orders” or bail terms.

Cohen said in a letter:

“Bankman-Fried did not violate the protective order in this case, nor did he violate his bail conditions, nor did he violate any law or rule governing his conduct.”

Surprisingly, SBF and his legal team have agreed to a gag order that forbids him from discussing the topic with anyone outside of the courtroom. The purpose of this measure is to forestall any possibly bias-inducing utterances that could damage public opinion or impede justice.

Former FTX founder Sam Bankman-Fried. Source: Reuters/Mike Segar/File Photo

But SBF’s legal team is not satisfied with that. They have asked the judge to impose the same rules on everyone involved, including FTX’s current CEO John Ray and US government officials.

FTX: On Gag Orders & Level Playing Fields

Meanwhile, the US government has accused SBF of publicly trying to defame Ellison, his former business partner and a witness in the case, prompting the request for a broader gag order.

The defense claims that its client is in a “toxic media environment” because of the collapse of the exchange, and they place the blame on FTX’s current CEO, Ray, for making baseless allegations against SBF.

Bitcoin falls back to the $29K level. Chart: TradingView.com

The defense has brought out what they consider as a double standard on the part of the US government in an effort to establish a level playing field and a fair trial.

Multiple negative pieces about SBF’s reputation have apparently been published, tipping the scales in his apparent detriment. The defense hopes that by making everyone involved sign a gag order, the imbalance may be corrected.

SBF has pled not guilty to the allegations of fraud that led to FTX’s financial collapse, and the trial date is rapidly approaching despite his continued insistence on his innocence.

Tensions continue to rise as the fate of FTX and its former CEO hangs in the balance pending the outcome of the trial set to begin on October 3.

Featured image from Wired