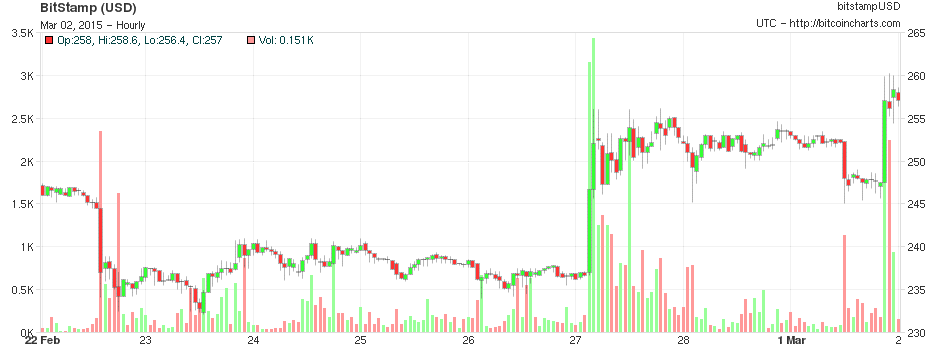

With the end of February just passing, many were saying February the most stable month of Bitcoin so far. With a net change of a $1 per day, Bitcoin users enjoyed a stable price. For a while, it looked that February was going to end with Bitcoin at a price of the mid $230s.

Also Read: Last Weeks Market Wrap Up

Later Sunday, after the price dipped to the upper $240s, we had a similar breakout when we broke through $250. China is leading the way again, but $260 has been surpassed from all the principal Bitcoin exchanges in the USA and China.

While there has been a good amount of “bullish” news released this week, one headline stood out against the rest. Gavin Andresen, a lead developer on Bitcoin Core, announced on the 26th of February some findings regarding the proposed 20MB Blocks:

I was running some benchmarks on 20MB blocks, and was surprised at how long block validation took even when all transactions had already been seen and were in the signature cache.

So I moved caching up from being a low-level signature cache to a high-level “have we already validated this txid.

Extrapolating to full (1MB) blocks, the old code would spend about 600ms CPU time per hop propagating blocks with already-seen transactions, this new code will spend under 10ms.

Memory usage is about 60 times smaller, also:

Old code: (sizeof(scriptSig)+std::set overhead) * number of txins (about 200K for the 365K block)

New code: an extra 4 bytes per transaction in the mempool (about 3K for the 365K block)

On Reddit, the post received over 900 upvotes and over 200 favorites and retweets on Twitter. On top of Gavins news, there has been some positive speculation regarding Mega accepting Bitcoin, which may have helped to kick start the Bitcoin bull run we are experiencing. Mega was recently left with the inability to charge customers as Paypal stopped processing payments for Mega; credit card companies did the same.

Paypal and the credit card companies withdrew from Mega as Mega back in September was accused of being havens of copyright infringement from a report by the US Digital Citizens Alliance.

With Mega possibly considering Bitcoin, and Bitcoin Core getting seriously optimized after the release of v 0.10, has caught people in a bullish mood.

Bitcoin’s price was also holding steady, even with the constant dumping of coins, suggesting that the only way was up. Due to these reasons, Bitcoin has increased a staggering 10.36% in the last seven days.

Darkcoin has also been up a significant amount, up nearly 34% this week as well. With the volume approaching $100,000 as well, Darkcoin is receiving much interest this week. There does not seem to be any news that could have set off the Bull Run, charts and trends show a constant accumulation of Darkcoin.

![]() Darkcoin shows no sign of stopping, and breaking $4 certainly could be doable. Darkcoin has been seen as the next biggest coin after Litecoin, but if the market continues, that may change in the near future.

Darkcoin shows no sign of stopping, and breaking $4 certainly could be doable. Darkcoin has been seen as the next biggest coin after Litecoin, but if the market continues, that may change in the near future.

Photo Sources: Bitcoin Charts, CMC

What do you think? Will you cashing out now or do you think Bitcoin and Darkcoin can rise more? Let us know in the comments below!