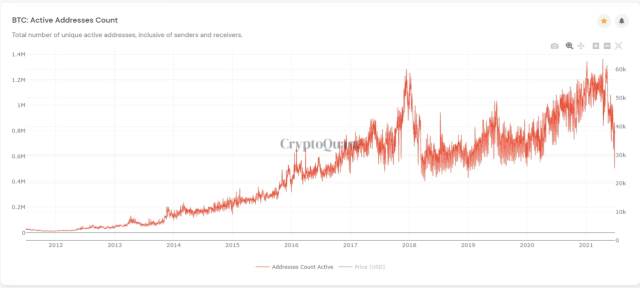

The number of active Bitcoin addresses has tanked. On-chain data currently shows that the number of active Bitcoin addresses has crashed over 50% in the past months. The number of active Bitcoin addresses during the height of the bull market surpasses one million. By the time Bitcoin hit its $64k all-time high, there were almost 1.4 million active addresses.

This number is slightly higher than the previous record. Back in the height of the bull market in 2018, Bitcoin active addresses hit 1.3 million. But that record was broken recently with the tremendous run bitcoin had. A number of reasons could be behind the decline in active Bitcoin addresses.

Number of active addresses nosedive as price of bitcoin falls | Source: BTC: Active Addresses Count on CoinQuant.com

A chart from CryptoQuant shows that the number of active Bitcoin addressed have nosedived. The chart tracks the number of active Bitcoin addresses at different price points. Showing how the number follows the ups and downs of the market.

Price Crash Leads To Fewer Active Addresses?

The price crash in recent months has taken the market by storm. Bitcoin crashed to less than 50% of its $64k high. Leaving blood in its wake. Since then, the coin has been struggling to climb back up. Still trading in the $30k range. But never breaking the $40k price resistance.

Related Reading | Bitcoin Fundamental Tool Produces Worst Reading Since the Bull Run Began

A good reason for the sharp decrease in the number of active addresses could be the price crash. When prices start to decline, investors typically try to get out of the market. People who bought at low prices would want to take profits in case the price crashed any lower. Taking their bitcoin and exchanging it for fiat.

Some people tend to get out of the market entirely during a crash. Investing can be an emotional rollercoaster. And not everybody wants to be on that ride. Selling off coins is usually the easy option for people who cannot keep emotions out of the game. So, with prices fluctuating wildly, some investors would dump coins based solely on emotions alone.

Bitcoin price struggling as active addresses decline | Source: BTCUSD on TradingView.com

Selling off their bitcoins means there are no more bitcoins left in their wallets. Hence, their wallets are now inactive.

Are Investors Consolidating Their Bitcoin?

Another reason for the decrease in active Bitcoin wallets could be consolidation. Investors usually have more than one bitcoin wallet at a time depending on the transactions that they need to carry out.

Others could have a series of small balances in different wallets gotten from various sources. With coin balances and recent transactions, these wallets could be seen as active.

Related Reading | Is It Time To Sell Your Bitcoin? Jim Cramer Says It Is

But then investors and holders might decide to move their Bitcoins to a single wallet. This allows for better keeping track of coins that they own. Others might want to take all of their coins off online wallets and move them offline for better safety.

So, with coins moving from different wallets to a single wallet, the zero balance wallets become inactive.

Featured image from Bitnovo Blog, charts from CryptoQuant and TradingView.com