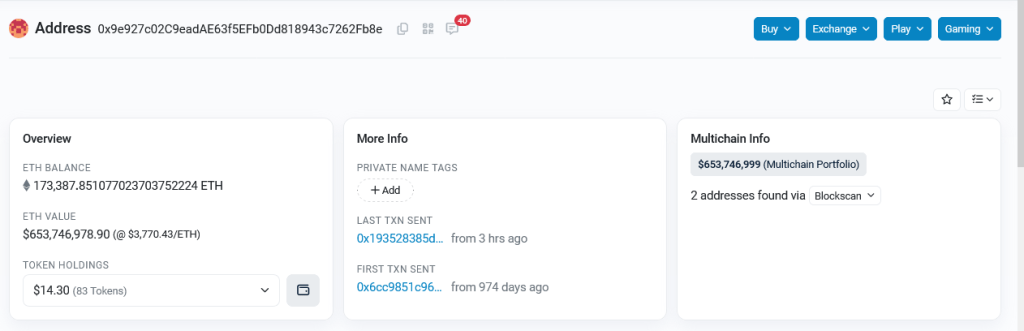

Nansen, a blockchain analytics firm, is strongly convinced that one Ethereum addressing controlling a whopping 173,700 ETH worth over $650 million at spot rates belongs to the DBS Bank, the largest bank in Singapore.

Is The DBS Bank One Of The Largest Ethereum Whales?

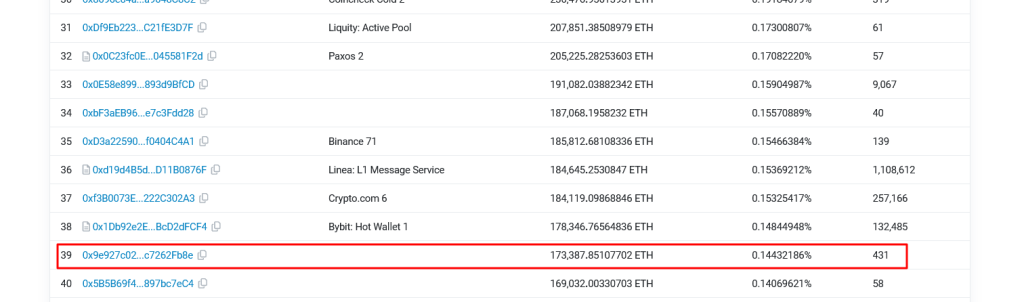

Taking to X, the blockchain analytics platform picked out an address “0x9e927…fb8e” as that belonging to the financial institution, sparking interest and excitement. Looking at Etherscan, the address is one of the largest, placing it among the top 40 largest holders of the world’s second most valuable cryptocurrency.

DBS Bank stands out from the list and is on par with the top crypto exchanges, mainly Binance and Kraken. The fact that the bank is among the top players in crypto is a huge boost and endorsement for the industry, a sphere that is still evolving. Encouragingly, with regulatory clarity, especially from regulators in the United States, more institutions will likely warm up to digital assets.

It is doubtful that the bank is holding ETH as an investment. Last year, the bank launched the DBS Digital Exchange. Through this platform, the bank allowed accredited investors to trade several digital assets, including ETH. Even so, there are limitations. For instance, the DBS Treasuries don’t allow inward or outward transfers of ETH and other coins. They also restrict United States citizens from participating.

Nonetheless, the decision by DBS to launch the exchange, tapping into their broad experience in the capital markets and custody, is bullish. It is a signal that the bank’s hierarchy is comfortable with emerging asset classes like crypto despite their inherent volatility.

For now, DBS Bank has to clarify whether they control the address and whether the ETH held is their investment. At the same time, the bank has to make public if the over $650 million ETH belongs to the exchange. From Etherscan data, the first transaction to the address was made 974 days ago.

Singapore Is A Big Crypto Player In The Asia-Pacific Region

According to Statista, Singapore plays a leading role in promoting crypto in the Asia-Pacific region. In 2023 alone, there were 88 deals helping raise over $625 million for multiple crypto firms. Through favorable government policies and adoption, Singapore wants to strengthen its position as a leading pro-crypto hub amid rising competition from Hong Kong.

In early April, Singapore tightened anti-money laundering measures for crypto firms. The Monetary Authority of Singapore (MAS), the city-state’s regulator, said it was changing financial regulations.

Changes made to the Payment Services Act will now empower the regulator to overlook, among other things, digital asset custody and cross-border payments.