Bitcoin has closed above the $100,000 mark for two consecutive days, reinforcing its strong bullish momentum as it eyes a push toward new all-time highs. This milestone has reignited optimism in the crypto market, with investors anticipating a sustained breakout. BTC’s ability to hold above this key psychological level suggests that further upward momentum could be in store as it approaches its previous peak at $103,600.

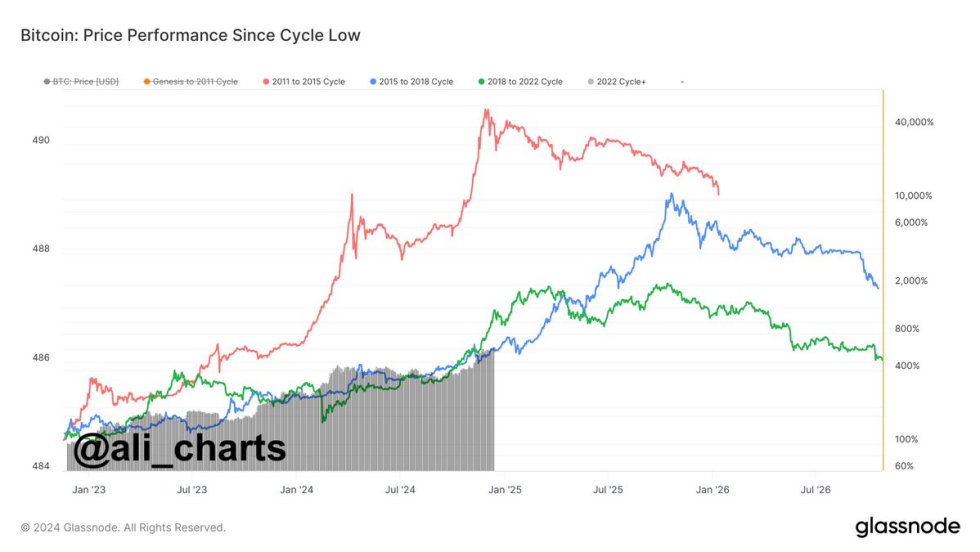

Top analyst Ali Martinez recently shared compelling insights on X, suggesting that BTC may still have significant room to grow before reaching the current bull cycle’s top. Drawing parallels with the 2015 and 2018 market cycles, Martinez predicts that the next major market peak could materialize in October 2025. If history repeats, Bitcoin’s recent performance is just the beginning of a longer bullish phase.

While the short-term outlook for BTC is promising, this perspective places the current rally within the broader context of a multiyear growth trajectory. As BTC continues to capture attention with its resilience and institutional support, market participants are closely watching for confirmation of the next leg up. The coming weeks could be pivotal in determining whether Bitcoin’s next chapter will redefine its all-time high and reaffirm its dominance.

Bitcoin Compared To Past Cycles

Bitcoin has officially entered its bull run phase, with the rally that began on November 5 sparking significant momentum. Since then, the price has surged over 50%, showcasing weeks of positive price action that have consistently set new highs. This remarkable performance has reignited enthusiasm across the crypto market, with many analysts and investors now speculating on when this cycle’s market top might occur.

Top analyst Ali Martinez recently shared compelling insights on X, offering a broader perspective on Bitcoin’s trajectory. According to Martinez, Bitcoin’s price movement could follow one of two key historical patterns.

If it aligns with the 2015 and 2018 cycles, the next major market top could materialize in October 2025. However, if BTC mirrors the shorter, more explosive 2011 cycle, the current high may already represent the bull run’s peak. Martinez backed his analysis with a chart comparing every cycle since Bitcoin’s cycle lows, illustrating how these patterns provide valuable context for predicting outcomes.

While some analysts call for caution, others emphasize Bitcoin’s long-term potential, arguing that the growing institutional adoption and strong fundamentals could extend this bull run further than previous cycles. As Bitcoin’s price continues to climb, market participants remain focused on key resistance levels and long-term trends to confirm the path forward.

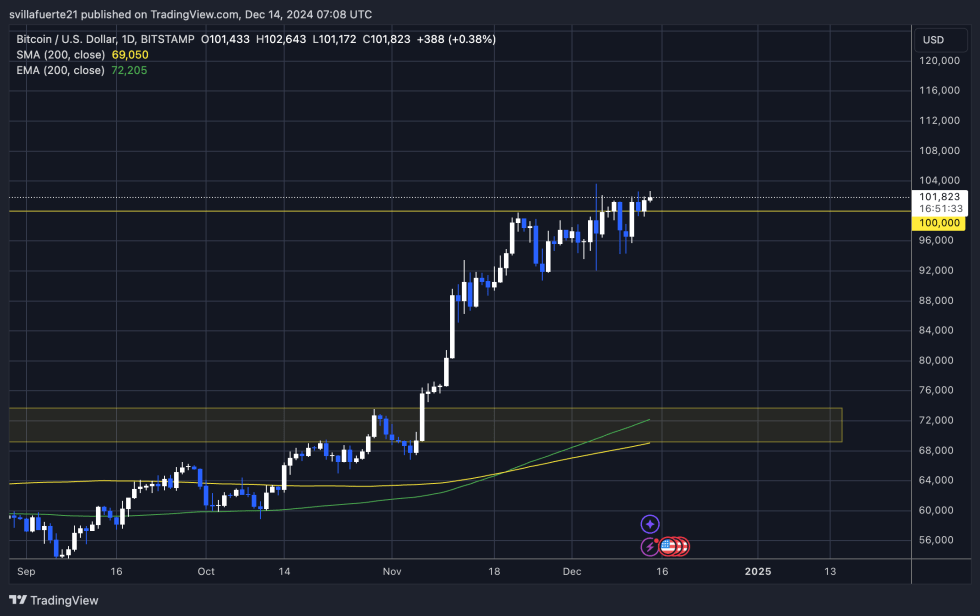

BTC Testing Supply Above $100K

Bitcoin is currently trading at $101,790, holding strong after reclaiming the critical $100,000 mark two days ago. However, the price remains confined within a narrow range between $99,000 and $102,000, reflecting market indecision. Traders and investors are closely watching for a breakout, which could determine Bitcoin’s next major move.

If BTC manages to sustain momentum above $100,000 and push beyond the key resistance level at $103,600, a bullish rally could ensue, potentially setting new all-time highs. This scenario would reinforce the ongoing bullish sentiment in the market and attract further participation from institutional and retail investors alike.

On the flip side, failure to hold the $100,000 level could shift momentum in favor of the bears. A significant breach below this psychological threshold would likely trigger a retracement toward lower demand zones. Analysts point to $92,000 as a key support level, where buyers could step in to stabilize the price.

With BTC’s range-bound movement continuing, the market awaits a decisive signal. Whether the price breaks out to the upside or corrects downward, the next move will likely set the tone for Bitcoin’s trajectory in the weeks ahead. For now, the $100,000 level remains a pivotal battleground.

Featured image from DALL-E, chart from TradingView