The contraction phase of the cryptocurrency market cycle appears to be coming to an end. Led by a recovery in Bitcoin, renewed optimism in the digital asset space is driving a resurgence in a variety of sub-sectors of the crypto industry.

In categories such as DeFi, GameFi, and more, innovation never stopped, possibly making these unique assets especially noteworthy when growth fully resumes. Across DeFi in particular, we’ve seen early signs of a potential repeat of the 2020 DeFi summer, arriving slightly later than expected. In this article, we’ll explore the various indications that the DeFi space is about to heat up once again.

What Is DeFi Summer?

DeFi summer is a term affectionately coined in mid-2020, as the Total Value Locked in DeFi applications began skyrocketing. Cryptocurrency holders flocked to DeFi for lending, borrowing, and liquidity provisioning, now possible through permissionless decentralized technology.

This trend began in June, resulting in several ultra-hot months of growth in DeFi asset valuations and TVL. While this summer in 2023 thus far hasn’t been quite as scorching as back then, we are starting to see some sizzle in decentralized finance.

The Technical Case For Renewed Growth

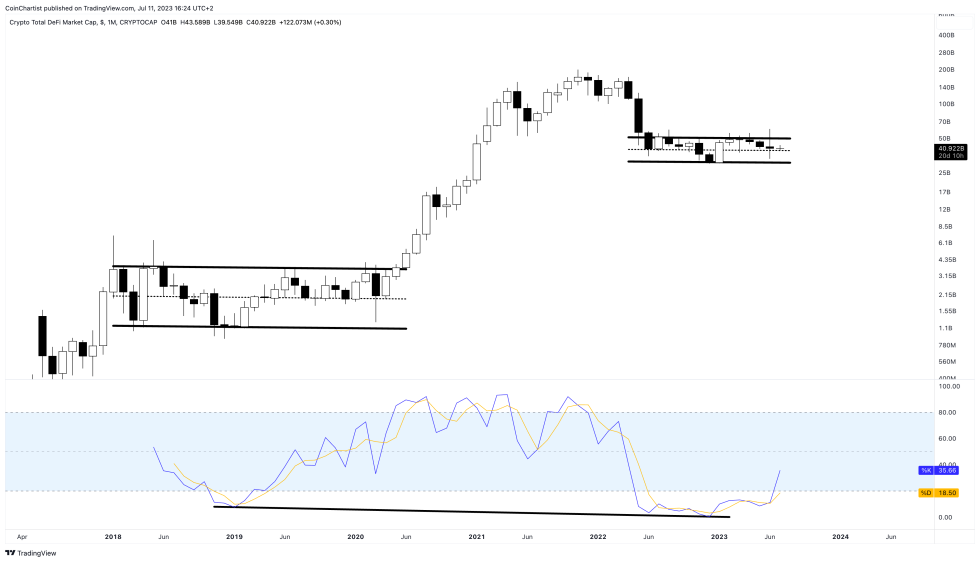

The technical environment is ripe for a more substantial recovery across DeFi, as can be seen in the Total Crypto DeFi Market Cap chart by TradingView. The Index aggregates top DeFi assets such as Compound, Aave, and more.

Could the trend be changing? | Source: Total DeFi on TradingView.com

According to the monthly Stochastic, the DeFi market is leaving oversold conditions for the first time since 2019. In the months following, the first DeFi summer sprouted its wings and began to take off – will we witness similar behavior again?

Furthermore, the DeFi Market Cap monthly candlestick has held above a range median, much as it did the last time Stoch left oversold levels. The shorter, tighter trading range is a hallmark of reaccumulation but could need to reach overbought levels to return to the full strength and growth seen in the last DeFi summer.

Meanwhile, individual assets within the DeFi basket are soaring. The aforementioned Aave is up more than 70% in the last few weeks, while Compound has rallied by more than 200%. As more individual assets participate, the breadth could carry the sub-section of the crypto market much higher.

Fundamental Strength Keeps Innovation Active In DeFi

Early strength in individual assets is capped off by unusual surges in volume as TVL begins to recover. Volume spikes in the early months of 2023 could represent more prominent market participants getting positioned. However, it isn’t abundantly clear what caused the increase in volume, only that the volume was the highest ever recorded according to data aggregator DeFiLama.

Volume spiked to the highest ever, but why? | Source: DeFiLama

For added perspectives, we gathered insights from within the DeFi industry itself, speaking to co-founder of the Metis network, Elena Sinelnikova.

“Layer2 solutions have made strides in addressing scalability issues, reducing transaction costs, and increasing efficiency for DeFi applications. Furthermore, the tokenization of assets like art and commodities has revolutionized individual accessibility, enabling fractional ownership and trading on decentralized platforms, bringing unprecedented liquidity to traditionally illiquid assets,” said Elena Sinelnikova, Metis co-founder.

“The surge in marketing and business development budgets of new platforms has amplified the DeFi APY, especially observable in liquidity mining where increased rewards are offered to those who bring liquidity. Also, the constant innovation in DeFi protocols, encompassing facets like lending, borrowing, decentralized exchanges, derivatives, insurance, and synthetic assets, has considerably expanded DeFi capabilities, thereby attracting new liquidity,” Sinelnikova continued.

Recent developments also suggest an increase in interest in specific DeFi projects. For example, Aave, the second-largest application in DeFi, has raised the supply caps for its popular pools on the Metis network, laying the foundation for increased TVL, liquidity, and participation in the ecosystem.

Conclusion

While the future trajectory of the DeFi market remains uncertain, the combination of technical indicators, fundamental strength, and ongoing innovation suggests that a DeFi summer could be on the horizon.

Investors and enthusiasts should closely monitor the evolving landscape and seize opportunities in this dynamic and rapidly expanding sector.