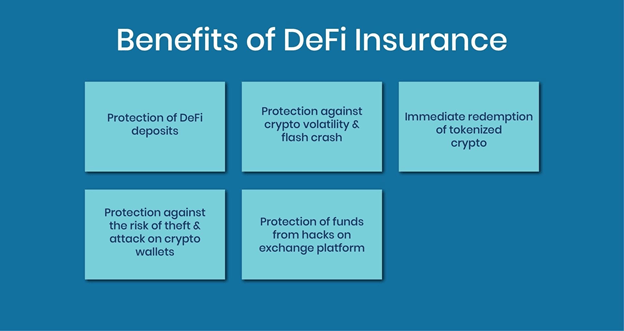

Traditional assets have been commonly protected through the use of insurance, which would soften the blow should something happen to that individual’s investment. There are now multiple options for insurance, specific to the DeFi ecosystem and projects contained in that ecosystem. Currently, only 2% of DeFi holdings are insured, which is a dangerously low amount considering the prevalence of scams, hacks, and technical failures. There is now a range of DeFi insurance projects.

(Source)

It is likely that as more people enter the DeFi market and become exposed to the benefits of having DeFi insurance, we will see more people coming towards these products as a means of protecting their investment.

InsurAce.io

InsurAce.io is the frontrunner of the current Defi insurance projects. The main reason behind this is that in the previous two months, InsurAce.io has deployed on both Ethereum and Binance Smart Chain, require no KYC, and have partnered with some of the leading DeFi protocols. They have also received professional backing from a range of institutions including Defiance Capital, Huobi Labs and several more. This has allowed InsurAce.io to provide protection for a range of other DeFi projects, including but not limited to AAVE, Compound and Anchor.

InsurAce.io is able to offer prices much lower than other insurance protocols, sometimes as much as 60% cheaper. This is due to their portfolio-based insurance which lets the user insure their combined assets together. Their offering gives investors peace of mind when operating in DeFi. As of now they actively offer covers for Centralized Exchange Risks, IDO Event Risks and Smart Contract Vulnerability. There are also plans to include dPeg and wallet insurance in the future, as well as an upcoming API that will allow for 0-click insurance integration with DeFi protocols.

Bridge Mutual

Bridge Mutual has a versatile offering of insurance products related to the crypto market. Furthermore, users do not have to worry about unscrupulous insurance companies and unfair denial of a claim. This is because claims go through a two-stage verification and voting process to ensure they are worthy.

This also protects the insurance funds, making sure they aren’t spent needlessly. The project currently has plans to explore other blockchains, which remain to be seen. People are also able to stake on the platform, which will earn them a variety of rewards.

Cover

Cover is a DeFi project that is attempting to make insurance a more community-focused and serving venture. The insurance marketplace on this platform follows a peer-to-peer model, which causes prices to be impacted by supply and demand. This creates a flexible market. Users of this project are also able to use these services without actually giving up their identity to Cover. This can be an attractive option for those that are anxious about handing over personal information on the internet.

Decisions on the outcome of insurance claims from Cover are made by a community board, which is made up of prominent figures in that particular ecosystem.

Nsure

Nsure is the project name behind a DeFi protocol that operates an open insurance platform that is not exclusive to the crypto market. This marketplace allows individuals to trade for the values of certain risks. What you find in a system where rights to these risks are tradable, the powers of the market and supply/demand calculations will have a massive impact on the final pricing of coverage.

By putting money or assets into the project, people are able to get NSURE tokens, which are the native tokens used on the platform. Buying insurance plans with Nsure is also another way to accrue these tokens. This rewards the user for not only buying into the project but also for using its primary function.

Nexus

Smart contract failures and exchange hacks are two of the most common causes for loss within the DeFi sector, which is why Nexus provides cover for these eventualities. The project is run through and on the behalf of its community. Decisions for the project are recorded on the blockchain and they are then put into practice by the use of smart contract technology.

Nexus has attracted a decent amount of exposure in the DeFi insurance market and they have plans to branch into other lines of insurance products too. This can be crypto wallet insurance or even your standard, non-crypto insurance products like earthquake insurance.

Image by Gerhard G. from Pixabay