On-chain data suggests the Bitcoin HODLers have remained stalwart recently, not selling despite the rally beyond the $44,000 level.

Bitcoin Long-Term Holders Have Ignored The Latest Rally

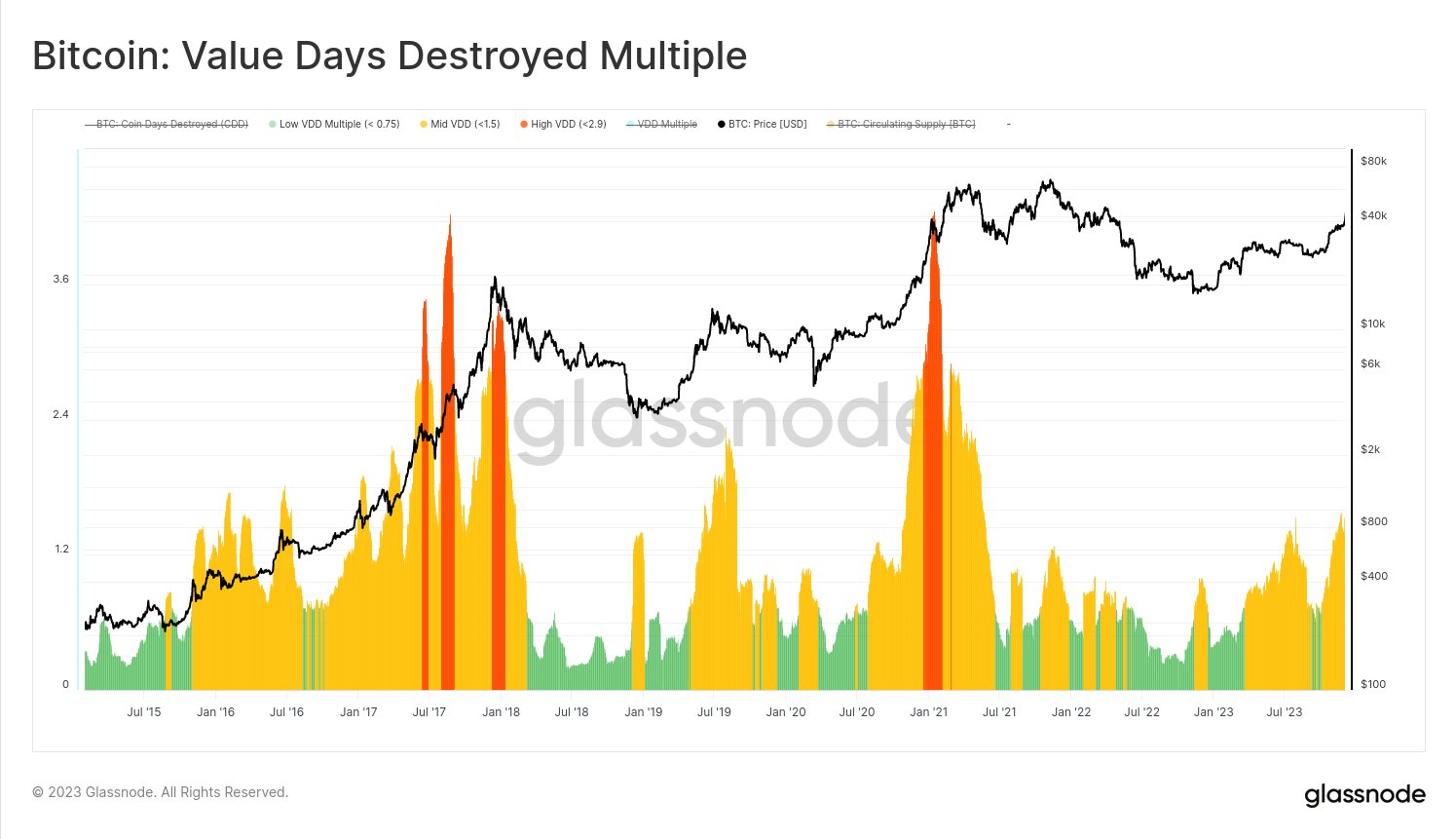

As Glassnode lead on-chain analyst Checkmate explained in a post on X, the old BTC hands aren’t even selling at levels similar to 2019 yet. The relevant indicator here is the “Value Days Destroyed Multiple,” which is based on another metric called the “Coin Days Destroyed” (CDD).

In on-chain analysis, a coin day represents the amount that 1 BTC accumulates after sitting still on the blockchain for 1 day. When a coin that has been dormant for a while finally moves, its coin days counter would naturally reset back to zero, and the coin days it had been carrying earlier would be “destroyed.”

The CDD measures the destruction of coin days that are taking place across the blockchain. Thus, when this metric spikes, many dormant coins have just been moved to the network.

Since the HODLers carry many coin days, the indicator observing a spike usually indicates that these resolute hands have decided to move their coins, potentially for selling.

Another form of the indicator is called the “Value Days Destroyed” (VDD), which is calculated by multiplying the CDD by the current spot price of the cryptocurrency.

The Bitcoin long-term holders generally don’t sell even in times of significant profit-taking opportunities, so it can be worrying when these investors do take to selling. The chart below shows these diamond hands’ reaction to the current price rally.

Looks like the value of the metric isn't too high at the moment | Source: @_Checkmatey_ on X

In the graph, the “VDD Multiple” data is displayed, a metric that compares the 30-day and 365-day moving averages of the Bitcoin VDD. The chart shows that the multiple has observed some growth recently and has hit yellow values, representing a mildly heated market.

This would suggest that the BTC HODLers have been spending more than usual recently, which isn’t surprising considering the sharp surge in the asset’s price.

The indicator’s value is still far from what was the norm during previous bull runs, however, as the metric spiked towards the red overheated zone during them. The metric has, in fact, not even hit the same values as during the recovery rally that kicked off in April 2019, as is visible in the graph.

Interestingly, the largest spike in the VDD Multiple during the 2021 bull run coincided with Bitcoin breaking the $44,000 level, the same mark the asset has just reclaimed with its latest rise. “HODLers are not relinquishing their coins. They demand higher prices,” notes the Glassnode lead.

BTC Price

Bitcoin has registered an increase of over 14% during the past week, as the asset is now floating around the $44,100 level.

The price of the coin appears to have shot up during the last few days | Source: BTCUSD on TradingView