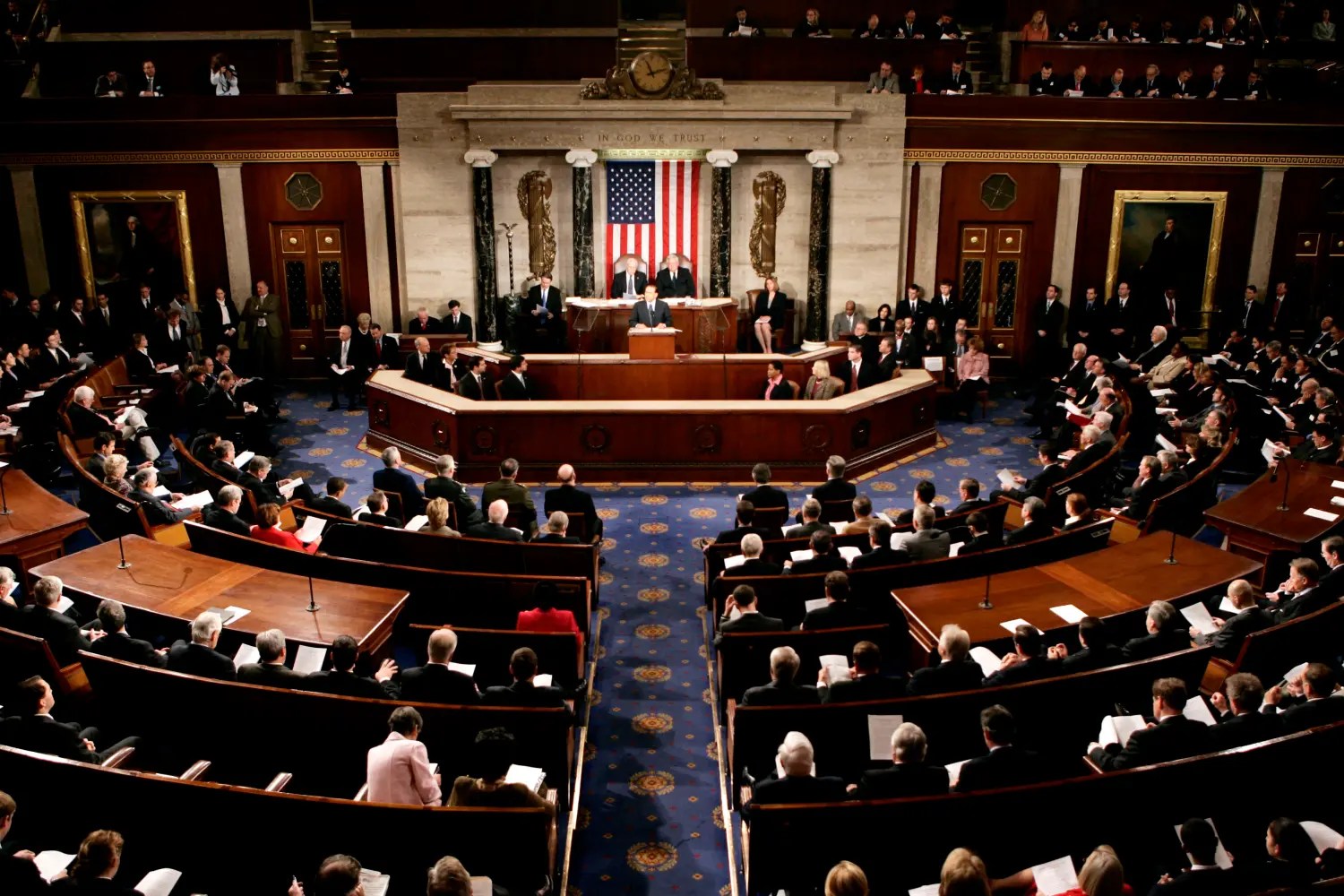

On September 11, 2024, the world’s first-ever Congressional hearing dedicated solely to DeFi, entitled “Decoding DeFi: Breaking Down the Future of Decentralized Finance”, was called by Congressman French Hill, R-AR.

The hearing was intended to understand the evolving world of DeFi and how it may affect the financial ecosystem.

DeFi: Overview Of Hearing

Those advocating for support of DeFi called on the commission to keep away from overregulation that could hamper innovation in the nascent digital assets space.

Two of the key DeFi proponents — Amanda Tuminelli of the DeFi Education Fund and Peter Van Valkenburgh of Coin Center — urged for a robust regulatory framework intended to enable, rather than completely suppress, innovation.

Against claims that DeFi is going to enable tax evasion and other criminal enterprises, Van Valkenburgh argued that blockchain technology is so transparent that people can’t use it for a lot of ill-getting activities.

Tomorrow is the first ever Congressional hearing on DeFi and it’s going to be 🔥

DeFi is the future of finance and it’s about time for Congress to start formally educating itself on how this tech will change the world.

Watch here tomorrow at 10 am ET:https://t.co/0WEI75baD4

— Jake Chervinsky (@jchervinsky) September 9, 2024

The hearing even exposed deep partisan divides among the lawmakers of both Republicans and Democrats. Whereas the Republicans were largely supportive of lighter regulations, Democrats, through luminaries like Rep. Bill Foster, did raise apprehensions regarding the possible use of DeFi for criminal acts.

Among others, Foster suggested that builders of DeFi projects should be culpable when these technologies are exploited for nefarious means, while in contrast, tighter AML controls are required.

Mixed Signals From The Biden Administration

The hearing came amid mixed signals from the Biden administration over its views on DeFi. While some actions — including Treasury Secretary Janet Yellen’s pullback of a controversial rule on self-hosted wallets — suggested the administration was warming up to the industry, as other regulatory moves indicated a lack of coordinated policy.

For instance, the recent settlement that had been reached by the Commodity Futures Trading Commission against Uniswap Labs was pointed out by several commissioners to be excessive and inconsistent with any certain regulatory strategy.

BTCUSD trading at $56,211 on the daily chart: TradingView.com

Congressman Hill attacked the Biden administration for “playing catch-up” on DeFi and “reactively legislating instead of actively.” He said DeFi had the potential to make things better in financial freedom, and make the financial system “better, faster, stronger, and cheaper.” However, he complained that the present regulatory environment might stifle innovation.

Image: Kiplinger

Wider Implications For Crypto Industry

The hearing marked a watershed moment in the maturation of the DeFi industry, reflecting a wider acknowledgment by lawmakers of the space’s role within the wider financial system.

As the industry gains momentum, the biggest financial institutions–including BlackRock–have begun to take notice, political headwinds apparently shifting to favor crypto.

Meanwhile, with the 2024 presidential election in sight, candidates like former President Donald Trump have fashioned themselves as pro-crypto, promising to protect the industry, against a Democratic platform that is decidedly less fleshed out. This political landscape will more than likely guide the future trajectory of DeFi regulation over the next few years.

Featured image from Brookings Institution, chart from TradingView