The planned $1 billion sale of Voyager Digital to Binance.US has hit a speed bump as a federal judge granted the United States government’s request for an emergency stay.

The move comes after the Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance’s global entity for allegedly allowing U.S. customers to trade cryptocurrency derivatives products illegally on its platform.

While Binance.US maintains independence from its parent company, both are feeling the impact of the CFTC’s legal action.

Bad News For Voyager Digital Creditors

After filing for Chapter 11 bankruptcy on July 5, Voyager Digital has taken a proactive approach in organizing a plan to redistribute funds.

As part of the approved Binance.US acquisition by Judge Wiles earlier this month, bankruptcy tokens were to be issued to Voyager Digital customers affected by the bankruptcy.

Image: CoinWire

However, with the recent emergency stay granted by Judge Jennifer Rearden of the U.S. District Court in New York, the potential deal between Voyager and Binance.US is now on hold until a ruling is made on the Department of Justice’s appeal regarding the bankruptcy plan.

An emergency stay is a legal order issued by a judge that puts a hold on a previously granted decision, effectively pausing any actions related to it.

This kind of order is usually granted in urgent situations where immediate action is necessary to prevent further harm or damage.

CFTC Accuses Binance Of Market Manipulation

According to the complaint filed by the CFTC, Binance is accused of engaging in trading activities on its platform through 300 “house accounts” without disclosing this information to its customers in its Terms of Use.

The regulatory agency also alleges that Binance deliberately kept this information hidden from the public and failed to respond to subpoenas requesting information about its trading practices.

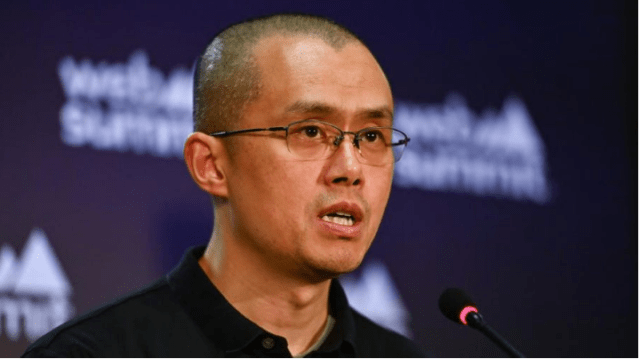

Binance CEO Changpeng "CZ" Zhao. Photo: Getty Images

Binance CEO Changpeng Zhao has fired back against the CFTC’s allegations, stating that the crypto exchange does not engage in market manipulation or trade for profit.

In a blog post on March 28, Zhao addressed the CFTC’s lawsuit against Binance and himself, claiming that the accusations are an incomplete representation of the facts.

Crypto total market cap remains in the $1 trillion level on the daily chart at TradingView.com

CZ clarified that Binance does engage in trading activities, but primarily for the purpose of covering expenses in fiat or other cryptocurrencies.

He expressed disappointment in the CFTC’s unexpected legal action, as the company has been working collaboratively with the regulator for more than two years.

Binance has stated that it will vigorously defend itself against the allegations, and CZ has vowed to continue working with regulators to ensure compliance.

As the case unfolds, it remains to be seen how it will impact Binance and the wider crypto market.

-Featured image from sa-so.com