The U.S. Securities and Exchange Commission (SEC) recently sued Coinbase, a leading crypto exchange. This lawsuit has sent a ripple of worry, with investors pondering on what it could mean for Ethereum (ETH) and Avorak AI (AVRK).

What is Ethereum?

Ethereum is an L1 (Layer-1) blockchain platform that was introduced in 2015 by Vitalik Buterin. It is designed to enable the creation and execution of smart contracts. Ethereum’s blockchain technology also allows developers to build and deploy decentralized applications (DApps). Ether (ETH) is used as a means of exchange, facilitating transactions, and incentivizing participants within the Ethereum network. Ethereum’s flexibility and programmability have made it a popular platform for developers seeking to build decentralized applications involving finance, gaming, and more. The platform has a vibrant community and continues to evolve with updates and improvements, such as the transition to Ethereum 2.0, which aims to enhance scalability and energy efficiency.

Could Ethereum Be Labeled a Security?

In the lawsuit against Coinbase, The SEC alleged that at least 13 crypto assets available to Coinbase customers were considered securities. These assets include Cardano (ADA), Solana (SOL), Polygon (MATIC), and Filecoin (FIL). However, Ethereum (ETH) wasn’t mentioned among the 13. Additionally, in a recent appearance before a House Oversight Committee, SEC Chair Gensler refrained from providing a clear opinion on whether Ethereum should be classified as a security. Therefore, while many members of the crypto community consider Ethereum a commodity, whether it could be labeled a security remains uncertain and will be determined over time, as there are ongoing regulatory discussions surrounding cryptocurrencies and their classification in the U.S.

What is Avorak AI?

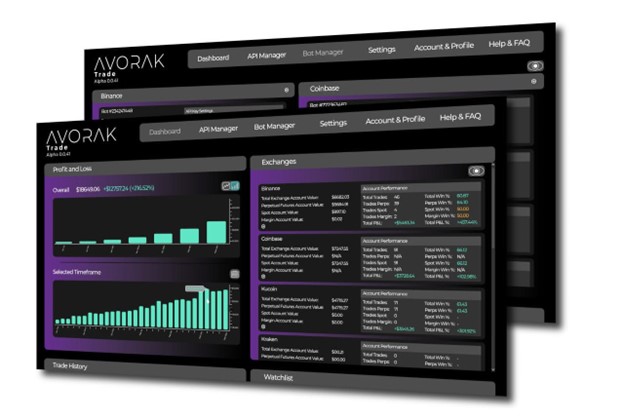

Avorak AI is an innovative project that brings artificial intelligence (AI) to the blockchain. It offers a comprehensive and interactive AI platform that utilizes both text and voice-to-text inputs. Avorak AI provides various solutions, including chatbots, digital assistants, image creators, blueprint drafting tools, automated video editors, and text generators, among others. One of its flagship products is the Avorak Trade bot, a unique AI trading bot capable of automating trades on multiple exchanges and assets. The bot uses a non-code-based command-line input and provides price predictions and significant indicators. The security of users’ API keys is ensured by Avorak’s integration of blockchain and AI technologies.

AVRK is the native token of the Avorak ecosystem, granting access to its services and serving several other utility functions. AVRK holders are entitled to 49% of the revenue generated by Avorak AI services through the project’s revenue feedback system. The hold of the AVRK token can be increased through Avorak’s staking pools. AVRK is also tradable on crypto exchanges like Coinsbit.

AVRK is selling at $0.255 in the second-last phase of Avorak’s initial coin offering (ICO), where investors get a 4% token bonus, priority access to closed beta products, and several other benefits. Avorak and its ICO have received positive reviews from crypto enthusiasts, many indicating its growth potential, commitment to safeguarding investor assets, and compliance with applicable regulations.

For more information on Avorak AI:

Website: https://avorak.ai

Buy AVRK: https://invest.avorak.ai/register

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of Bitcoinist. Bitcoinist does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.