At the moment, most of the decentralized finance services run over the Ethereum network. In Bitcoin land, DeFi is almost non-existent. However, there’s a case to be made for it. And Atomic.Finance started the conversation with an article about how and why they pivoted from building over Ethereum to the arguably biggest challenge of building over Bitcoin. Since this is not a common case, we have to explore it.

Related Reading | Anonymous Buyer Submits 5 ETH Opening Bid for First Ever Community-Minted NFT

DeFi has a blind spot. Ethereum is admittedly fairly centralized at the nodes level, and creator Vitalik Buterin seems to be at the center of the project. So, can everything built on top of it really be considered decentralized? And take into account that Ethereum is the most decentralized of the Smart Contract chains. If we, for example, look at the Binance Smart Chain the centralization becomes evident and undeniable.

So, is that the reason Atomic.Finance left Ethereum? Or is there more to this story? Let’s explore what they have to say

Do We Really Need DeFi On Bitcoin?

The article we’re analyzing is not new. Atomic.Finance published it “in the fall of 2020 when we first decided to make our pivot from ETH DeFi to Bitcoin-native finance.” Their vision is that “sound money deserves sound financial infrastructure,” and maybe it does deserve it. But, does it need it? Isn’t Bitcoin alright just the way it is? Not if the aim is for “Bitcoin holders to be their own banks.”

The reality is, nearly all financial tools and infrastructure for Bitcoin today do not share the same assurances as Bitcoin.

Atomic.Finance makes a great point there. If the market demands financial infrastructure and advanced financial tools, they should be on par with the rest of the Bitcoin ecosystem. Furthermore:

If this trend doesn’t change, then we stand at risk of a future for Bitcoin that is dominated by large centralized institutions, and crypto banks. A future where nearly every Bitcoin transaction or financial activity is done on a custodial banking layer – again, without any of the assurances that define Bitcoin.

Why Did Atomic.Finance Abandon Ethereum?

At first, the company was developing cross-chain financial tools. That was leading them on a path that wasn’t aligned with their vision. Here’s where they savagely criticize Ethereum and most of the current DeFi projects:

It was doing the opposite — taking sound money and slapping unsound financial infrastructure on top, bringing it into the Jenga tower that is ETH DeFi. Continuing to build in the ETH DeFi space would’ve likely forced us to launch our own token in order to compete — and there’s nothing that screams unsound money and unsound financial infrastructure than the rampant printing of money.

For the Ethereum die-hards, this will be hard to admit, but they make a good point. Are all of those tokens really necessary? Or are they a way to maximize profit? Or, better yet, are those tokens necessary to compete but not for the project per se? Then, Atomic.Finance doubles down and throws another rock:

The Jenga tower nature of ETH DeFi – attributed to not just a lack of care from developers but also the inherent security risks of developing with Solidity itself — that did not align with our standards for security.

Is Solidity, the programing language Ethereum developed for smart contracts, a problem in itself? Or, worse yet, a security risk?

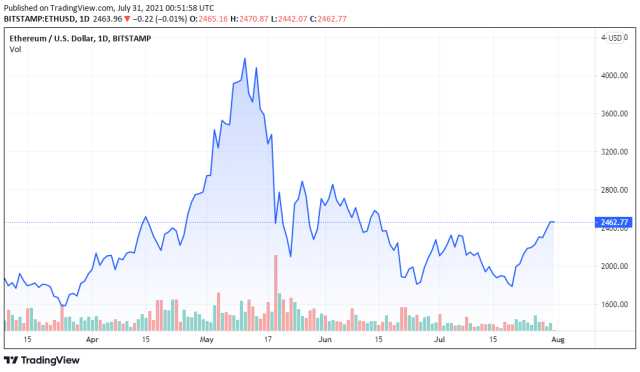

ETH price chart on Bitstamp | Source: ETH/USD on TradingView.com

Building DeFi Over Bitcoin

So, the company abandoned Ethereum and started an exploration of “the tools being built on Bitcoin. Would there be a way to build sound financial infrastructure natively on the soundest money known to mankind?” Since the belief in Altcoin land is that Bitcoin is old tech that isn’t being developed, they thought they weren’t going to find much. They were mistaken. They found:

Clear developer excitement for building on Bitcoin. In particular, for Bitcoin-Native and Lightning financial tools (LiFi). What was also clear was that while there are plenty of infrastructure builders in Bitcoin, user-friendly financial products that the average Bitcoiner could actually use were far and few between, outside of centralized and custodial products.

Related Reading | Bitcoin Is Holding a Pivotal Macro Level, But Don’t Be Bullish Yet

That last phrase right there at the end, that’s what you call a business opportunity. Make of it what you will.

Featured Image by Our Life in Pixels on Unsplash - Charts by TradingView