Data suggests the wrapped Bitcoin (WBTC) supply on Ethereum has dropped by around 35% since the LUNA/UST collapse last year.

101,550 BTC Has Exited Wrapped Bitcoin Supply Since All-Time High

According to data from the on-chain analytics firm Glassnode, about 285,000 BTC was locked into the WBTC supply at an all-time high (ATH) last year. WBTC is a tokenized version of Bitcoin on the Ethereum blockchain that is backed 1:1 with actual BTC, and thus always trades at the same price as the crypto.

But what’s the point of holding it? Well, ETH as a crypto network is very rich in its offerings, as its smart contracts mechanism means that it can easily host a wide variety of constructs on its blockchain. Since WBTC is an ERC-20 token, its holders can gain exposure to BTC while leveraging the Ethereum blockchain.

Investors may also choose WBTC over BTC when fast transactions are required (as the Bitcoin network is generally slower than the Ethereum blockchain in processing transactions).

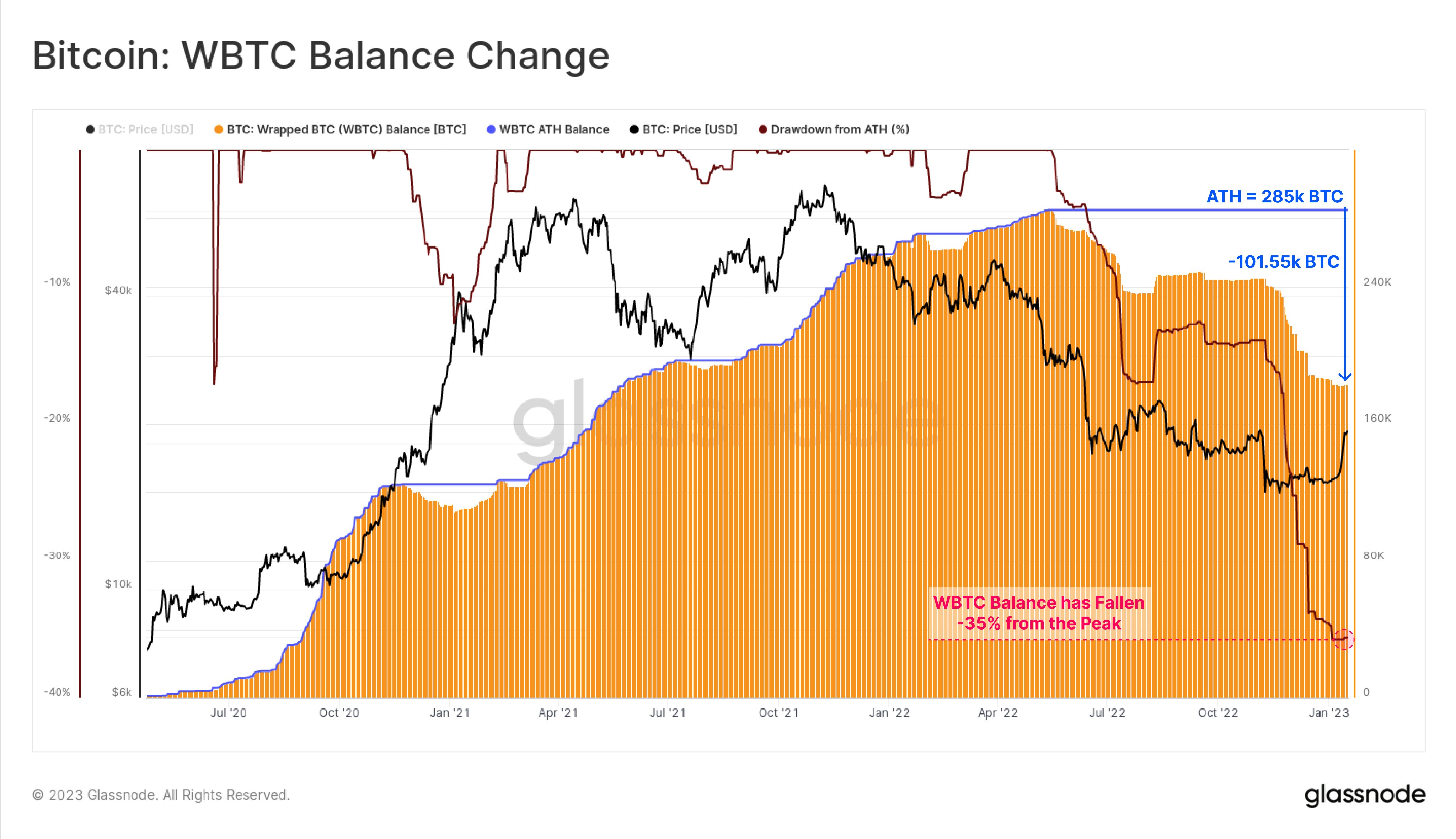

Now, here is a chart that shows how the WBTC supply on the ETH network has changed during the last few years:

The value of the metric seems to have plunged in recent weeks | Source: Glassnode on Twitter

As displayed in the above graph, the Bitcoin supply wrapped on Ethereum saw sharp growth throughout 2020 and 2021 as the bull market raged on. The metric slowed down in the first half of 2022 and peaked at 285,000 BTC.

Since the LUNA/UST collapse back in May of last year, the indicator has been rapidly going down instead and has declined by around 35% so far. This means that WBTC has seen an exit of 101,550 BTC from the contract in this period.

This would suggest that the demand for Bitcoin wrapped on Ethereum is significantly lesser now than last year. One apparent reason behind this trend is the prolonged bear market, which has led to capital exiting multiple sectors.

One of the things investors like to use WBTC for is the Decentralized Finance (DeFi) apps on the Ethereum blockchain. Still, the DeFi sector on ETH has seen a significant decline in the past year, as DeFi total value locked (TVL) on ETH has fallen by 76% over the past year, showing that a massive amount of capital has flown out of these apps.

BTC Price

At the time of writing, Bitcoin is trading around $21,200, up 23% in the last week.

Looks like the value of the crypto has been moving sideways since arriving at the $21,000 level | Source: BTCUSD on TradingView