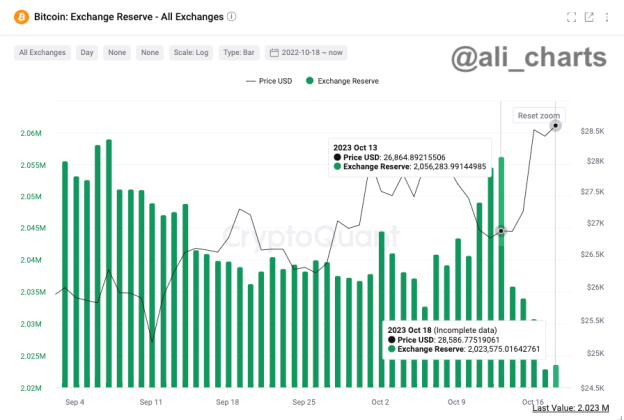

The recent surge in the Bitcoin price was preceded by a significant amount of BTC leaving centralized exchanges. Over the past week, investors took to exchanges to remove their BTC holdings, supposedly for safekeeping in private wallets.

30,000 BTC Leaves Exchanges

On October 18, crypto analyst Ali Charts revealed that more than 30,000 BTC had left exchanges. The data encompassed a period of five days which showed massive withdrawals from crypto investors from these centralized exchanges.

The chart shared by the analyst shows the accumulation had started earlier in the week and continued until the rally began. This accumulation eventually saw a total of 33,000 BTC worth approximately $925 million move to private wallets.

BTC leaving exchanges | Source: X

Usually, when Bitcoin moves away from exchanges, it is bullish for the coin because it means that these investors are not looking to sell their tokens right now. The fewer the number of investors looking to dump their BTC, the lower the selling pressure on the coin.

This reduced selling pressure allows demand to mount over time and the result is often a price explosion. This was likely the case on Thursday as the price of Bitcoin began to rise, briefly hitting $30,000 before correcting back downward.

Bitcoin Open Interest Swells

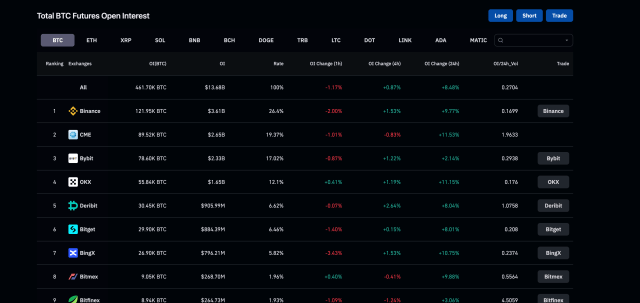

As the price of Bitcoin has risen, the open interest in the asset has also grown. Data from Coinglass shows that in the last 24 hours, the total Bitcoin open interest has grown by almost 8.5%. This translates to over $1.3 billion in open interest added by investors over the last day.

This rapid rise in open interest suggests that there is an increased willingness among investors to participate in the market. Additionally, the majority of the open interest has flowed toward short contracts, which means that investors are expecting that the price of BTC will fall.

Open interest rises 8% | Source: Coinglass

However, this could lead to what is called a short squeeze where the price of Bitcoin rises once more and shakes out the shooters in the market. This could see millions of dollars in shorts liquidated, leading to massive losses for those who bet on the Bitcoin price to fall. If the shorters do prevail, then Bitcoin could fall back toward the $28,000 level.

For now, Bitcoin is struggling to hold support at $29,500. A fall below this support would put the bears in charge, leaving the next significant support for Bitcoin at $29,000.

BTC sitting above $29,600 | Source: BTCUSD on Tradingview.com