The bitcoin price has stayed at the same level all week. However, the market has been building a technical trigger and adding bullish consensus, which has sustained all factors that back the next rally from $650 to $820.

Also read: Bitcoin Price Volatility Exciting Bulls, Rally Still Expected

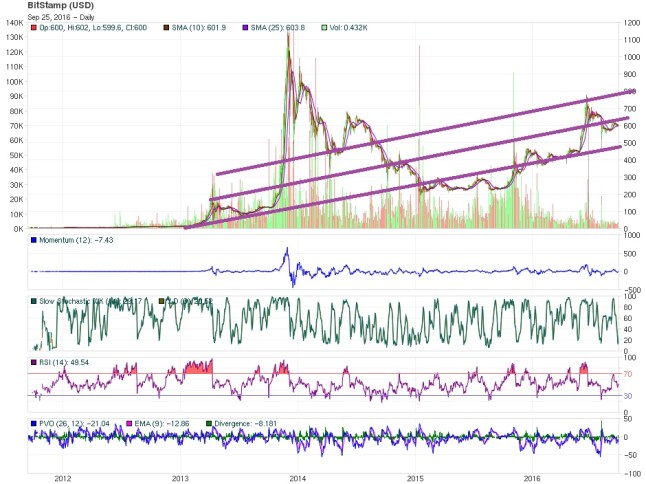

Technical Analysis: Cycle Synchronization to Spark Rally to $820

Long-Term Analysis

Fundamentals and political factors promote the next rally, which is expected to increase the bitcoin price $650 to $820. From the current support level determined in the $580 $600 range, bullish consensus allows a sustained, upward movement that will probably ignore every intermediate resistance from the present technical zone to $820.

A new cycle has begun, with the original upward-sloping trendline from 2013 still driving action to trigger prices among $600 and $650 from where the rally is calculated.

Mid-Term Analysis

In the current cycle, price quotes near the technical axis attracts action to a smooth rising line that sometimes causes technical corrections to the up side. A similar movement happened in late May 2016.

These days, a longer than expected lateral sideways movement has driven the figures away from that line. We can expect the next synchronization to work as a technical trigger, which would send the bitcoin price $650, and then higher to the $820 stage.

Short-Term Analysis

Mathematical indicators are turning upwards again. Japanese Candlestick Analysis reflects that even with some bearish activity, a theoretical technical trigger could be expected in the $620 $650 area.

Traders should consider some options with bull-spread strategies, considering that every intermediate resistance currently looks like a vertical rolling opportunity, giving many small traders the chance to resize their positions.

What do you think will happen to the bitcoin price? Let us know in the comments below.

Cover image courtesy of The Art of Chart.

This technical analysis is meant for informational purposes only. Bitcoinist is not responsible for any gains or losses incurred while trading bitcoin.