The Bitcoin Coinbase Premium Gap has continued to be at a notable green level recently, a sign that institutional traders are buying the asset.

Coinbase Premium Gap Is Positive Right Now

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the Bitcoin Coinbase Premium Gap. This indicator measures the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The former cryptocurrency exchange is the primary hub for US-based investors, particularly large institutional entities, while the latter is utilized by traders worldwide. As such, the Coinbase Premium Gap essentially represents the difference in behavior between American whales and global ones.

When the value of the metric is positive, it means the price of the asset listed on Coinbase is higher than that on Binance. Such a trend implies users of the former are applying a higher buying pressure (or lower selling pressure) than those of the latter.

On the other hand, the indicator being under the zero mark implies Binance users are the ones participating in a higher amount of accumulation, as they have pushed the asset to a higher price on the platform.

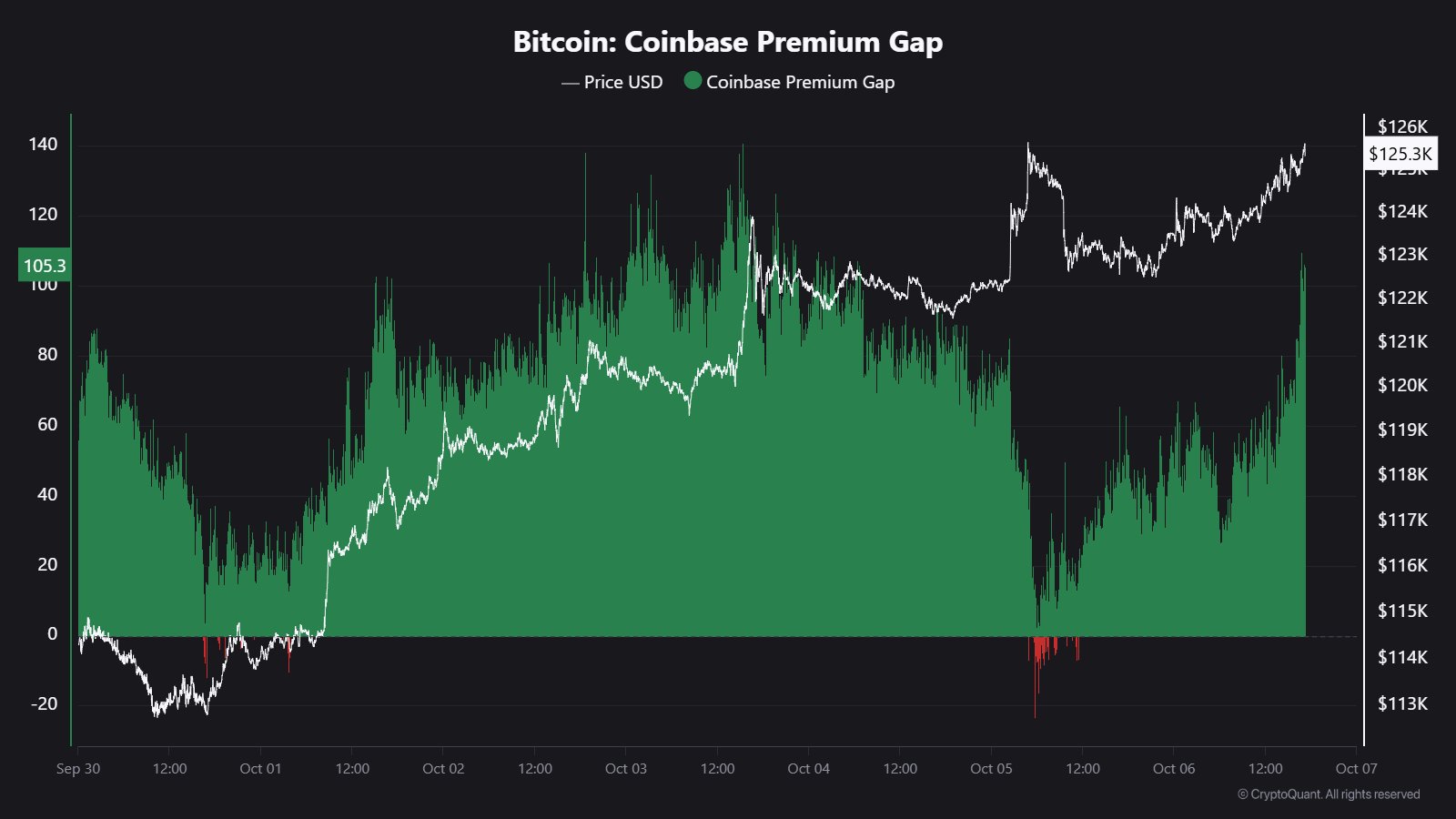

Now, here is the chart shared by Maartunn that shows the trend in the Bitcoin Coinbase Premium Gap over the past week:

Looks like the value of the metric has just witnessed a large green spike | Source: @JA_Maartun on X

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has remained at mostly positive levels for the past few days, suggesting that buyers on Coinbase have been more aggressive at buying the cryptocurrency than Binance users during this rally.

The metric reached its high on October 3rd, when BTC traded at a premium of $140 on Coinbase. During the weekend, the indicator saw some cooldown, with it even briefly turning red during the all-time high (ATH) break on Saturday, but it has surged again in the new week and recovered to a notable positive level of $105.

Thus, it seems that despite Bitcoin now entering ATH exploration mode, US-based institutions are only continuing to accumulate more of the cryptocurrency. These investors have been one of the main drivers in the market since last year, so if the Coinbase Premium Gap continues to remain green, the rally could potentially sustain for longer.

Speaking of institutional demand, another metric that can correspond to buying/selling from the cohort is the netflow for the spot exchange-traded funds (ETFs). These investment vehicles saw massive net inflows during the past week, providing further evidence of institutional accumulation.

The ETF netflow compared to the supply issuance | Source: @therationalroot

As the above chart shared by cycle analyst Root shows, the latest week of spot ETF inflows was 8.8 times the new Bitcoin supply that miners minted in the period.

BTC Price

Bitcoin breached above $126,000 on Monday to set another new ATH, but it has since cooled off a bit, with its price coming back to $124,300.

The trend in the price of the coin over the last five days | Source: BTCUSDT on TradingView