At the start of May, Bitcoin experienced its latest block reward halving. This event saw the number of BTC issued per block cut in half from 12.5 coins to 6.25, meaning that there is less supply to satisfy demand.

Fortunately for buyers, demand is rapidly increasing, suggesting Bitcoin should continue to rise.

Institutions Are Scooping Up Bitcoin

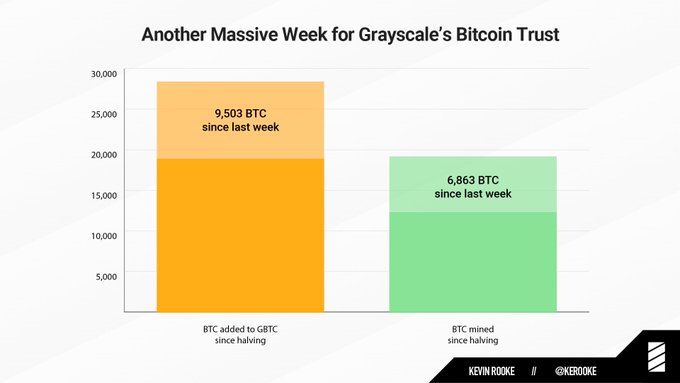

According to technology data analyst Kevin Rooke, Grayscale Investments has seen an influx of Bitcoin investment activity over the past few weeks.

His analysis found that in the past week alone, the American firm added 9,503 BTC to their Trust holdings while miners produced 6,863 coins over that same time frame. Grayscale bought these coins in response to client demand for shares of the Trust, which trade under the “GBTC” ticker.

Analysts see this as bullish because the clients of a single Bitcoin firm are absorbing more coins than are minted each week.

As a pertinent aside, there’s been a similar trend transporting with Grayscale’s other flagship product: the Grayscale Ethereum Trust (ETHE).

A top industry analyst shared on June 4th that the Trust traded at $239.50 a share, more than 1,000% higher than the value of the Ethereum backing the asset. This suggests strong retail and institutional accumulation.

Following the Footsteps of Paul Tudor Jones

The surge in Bitcoin accumulation by Grayscale’s clients seems to be related to one of two things: 1) the block reward halving, or 2) Paul Tudor Jones.

While the firm was already seeing mass inflows before, things have really started to pick up in the past month, after the halving and after Paul Tudor Jones promoted BTC. It isn’t 100% clear which one caused the boost. But in reality, the two events are closely connected.

In early May, the billionaire hedge fund manager came out with a research note titled “The Great Monetary Inflation.”

The note saw the Wall Street veteran explain why there is likely to be the debasement of fiat monies in the ongoing recession caused by the global illness.

Bitcoin, to him, is a way to hedge his portfolio amid these trying times. He explained that the asset’s scarcity, which is enforced by halvings like the one we saw in May, makes it the “fastest horse” in the asset race at the moment.

“The Great Monetary Inflation” was shared widely in mainstream media, leaving some to suggest that it has drawn institutional players into the Bitcoin space.

A Big Catalyst for Bitcoin

The entrance of institutions into the cryptocurrency space is expected to be a large boost for this nascent market.

Bloomberg senior commodities strategist Mike McGlone made the following comment on institutions in Bitcoin in a June cryptocurrency report:

“Despite the lack of a U.S. exchange traded fund, Bitcoin on-exchange instruments indicate greater buy-andhold interest, supporting prices. The Grayscale Bitcoin Trust (GBTC), the largest, is taking an increasing amount of supply off the market, yet its premium continues to decline.”

McGlone added that the accumulation shows institutions are “dip buyers,” suggesting they see long-term potential in the cryptocurrency. Goldman Sachs, though, would beg to differ.

Featured Image from Shutterstock Price Tags: btcusd, xbtusd, btcusdt Data Analyst: There Continues to Be Mass Bitcoin Accumulation By Institutional Players