The aftermath of FTX’s collapse sent ripples across the crypto industry, and the fallout is still being felt almost a year after the exchange’s failure. FTX co-founder and former CEO Sam Bankman-Fried has recently been found guilty and is awaiting sentencing.

Meanwhile, according to Bitcoin author Vijay Boyapati, a much larger and more complex fraud took place in 2022 but has largely been overlooked by mainstream media. Boyapati recently took to social media platform X (formerly Twitter) to explain in a lengthy thread the details of this alleged fraud committed by DCG and its CEO, Barry Gilbert.

Genesis Fraud Exposed: The Truth About Barry Silbert’s DCG Empire

Boyapati describes in his exposé how Digital Currency Group and its affiliates falsely represented to creditors that Genesis, a cryptocurrency brokerage, was solvent months before it filed for bankruptcy amid the FTX debacle.

After the fall of FTX in November 2022, many cryptocurrency companies, including Genesis, announced that they would be filing for bankruptcy. However, Boyapati alleges that the corporation had been insolvent since the middle of June 2022 after the collapse of the Terra Luna ecosystem but Genesis’ senior executives employed an elaborate scheme to paper over the losses on the company’s balance sheet.

1/ There was a much more important fraud than SBF’s embezzlement that took place in 2022. It was a fraud (allegedly) perpetrated by one of the oldest companies in the space, @DCGco and its CEO, @BarrySilbert.

Time for a thread 👇

— Vijay Boyapati (@real_vijay) November 6, 2023

Genesis was one of the top Bitcoin lenders for crypto hedge fund Three Arrows Capital (3AC) and lending platform BlockFi, who both farmed Grayscale Bitcoin Trust’s (GBTC) premium for profit in its early days. However, as the GBTC lost its premium over the net asset value of Bitcoin, these hedge funds were forced to move to other profitable trading, including TerraUSD.

Unfortunately, the Terra Luna ecosystem would collapse in May 2022, leaving gaping holes in Three Arrows Capital’s finances and rendering it insolvent. As a result of this insolvency, the hedge fund was unable to pay up its $2.3 billion loan from its lenders, including Genesis. Consequently, this caused a $1.2 billion deficiency in Genesis’ balance sheet.

Boyapati claims that this was the point at which Genesis went bankrupt since the company would not have been able to pay back its own Bitcoin lenders in the event that they requested a withdrawal.

At this time, reports came out of DCG assuming the entire $1.2 billion claim with a ‘promissory note’ to clear Genesis of any outstanding liabilities to 3AC. However, the promissory note turned out to be a sham as it was all a plot to convince Genesis’ clients that it was solvent.

Why Go Through This Elaborate Scheme?

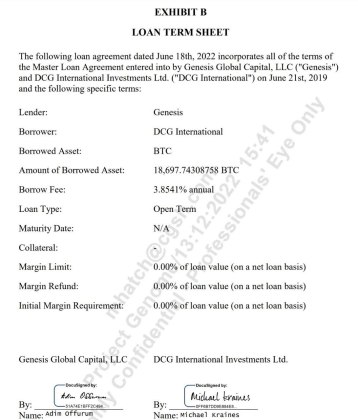

It would seem DCG was particularly incentivized to carry on with the facade for months, as the company had a massive loan of 18,697 BTC from Genesis. If Genesis were to declare bankruptcy at that point, DCG would also be forced to pay up this loan.

Source: X

The New York Attorney General has since filed a $1 billion civil complaint against Genesis, DCG, and executives Barry Silbert and Michael Moro.

Boyapati argues that the fraud surrounding DCG and its subsidiaries is comparable to the recent FTX scandal. However, the mainstream media has largely ignored it. If these claims are substantiated, this complaint could eventually lead to a criminal case.

Total market cap drops to $1.3 trillion | Source: Crypto Total Market Cap on Tradingview.com