On-chain data shows the number of Bitcoin addresses is declining, a sign that the investors may be making the switch towards the new spot ETFs.

Bitcoin Holders Have Declined By 40,000 Since The Start Of 2024

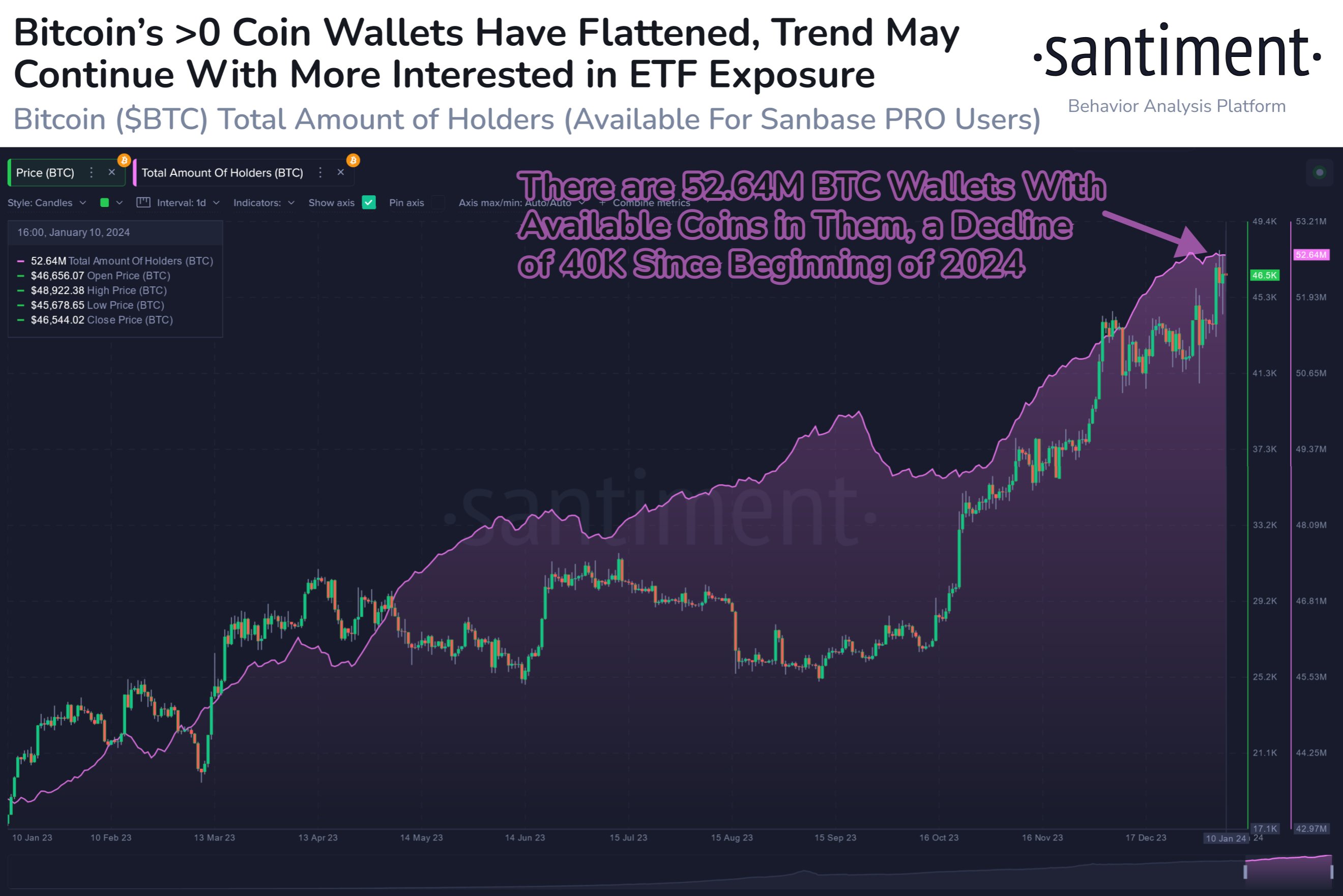

According to data from the on-chain analytics firm Santiment, the BTC total amount of holders metric has gone through a shift of trend recently. The “total amount of holders” keeps track of the total number of addresses on the Bitcoin blockchain that are carrying some non-zero balance.

When this indicator’s value drops, it can mean that some of the holders of the cryptocurrency have decided to exit the market, as they are cleaning out their wallets. Such a trend may also arise out of investors consolidating their wallets, although this isn’t likely to happen on any significant scale.

On the other hand, the metric’s value increase can imply that the adoption of the asset is picking up as fresh investors are opening up new addresses and buying the coin.

Some holders also prefer to open new addresses whenever they receive fresh transactions, as it provides better privacy. Naturally, these traders would also contribute towards a rise in the total amount of holders.

Now, here is a chart that shows the trend in the Bitcoin total amount of holders over the past year:

The value of the metric appears to have slowed down in recent days | Source: Santiment on X

As displayed in the above graph, the total number of Bitcoin holders had been rising at a notable pace during the final couple of months of 2023, suggesting that adoption of the cryptocurrency was likely taking place.

Since the start of 2024, though, the indicator has switched its trend to that of mostly flat movement, with its value even registering a slight net decline of 40,000 during this period.

The explanation behind this trend shift may lie in the Bitcoin spot exchange-traded funds (ETFs). ETFs refer to financial instruments that help allow investors to gain exposure to an asset without having to actually own said asset directly.

ETFs trade on traditional exchanges, so investors unfamiliar with cryptocurrencies (which require knowledge of how wallets and transactions work) might find the ETFs to be an easier way to gain exposure to BTC’s price movements.

The spot ETFs for the digital asset were finally approved by the US SEC on January 10th, but the majority of the market had been anticipating this decision since a while ago.

Thus, it’s possible that the decline in the amount of BTC holders may have been because of investors ditching the asset so that they could go with the ETFs once they were approved.

Santiment notes that Bitcoin could continue to see this decline in addresses, as more investors make this switch. The analytics firm notes, though, that this is likely to not have any impact on the asset’s price.

BTC Price

Despite the ETF approval, Bitcoin is yet to see any net uplift, as the asset’s price continues to trade sideways around the $45,900 level.

BTC has gone stale in the last few days | Source: BTCUSD on TradingView