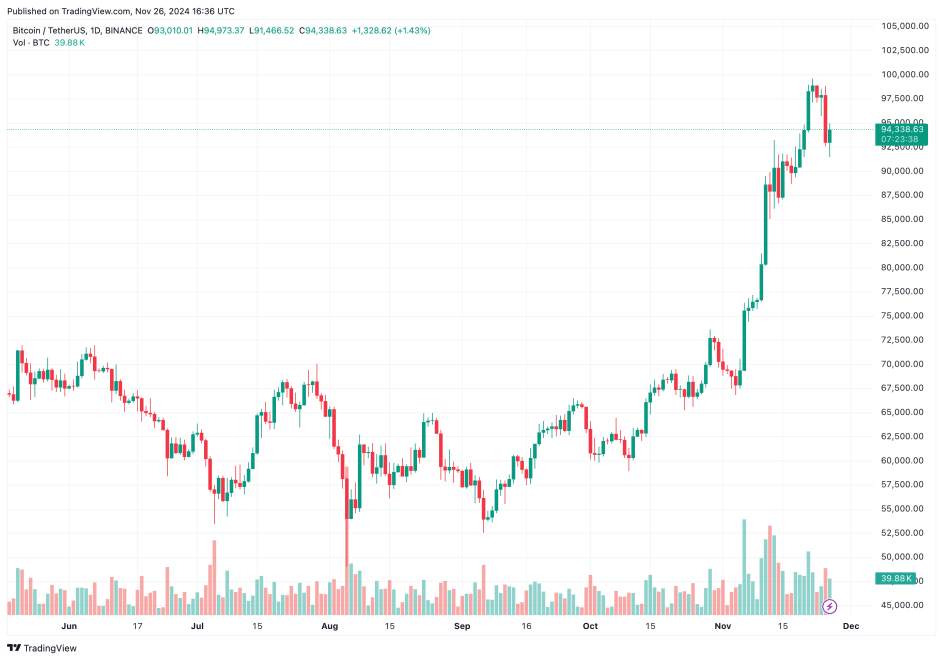

Bitcoin (BTC) has lost some of its recent gains, falling from $99,645 on November 22 to $91,830 during the early hours of November 26. However, crypto analyst Ali Martinez suggests a price rebound may be on the horizon for the leading cryptocurrency.

Bitcoin Technical Indicators Flip Bullish

The largest cryptocurrency by market cap experienced a sharp 5% decline starting late on November 25 and continuing into the early hours of November 26. Over the past 24 hours, the crypto market saw liquidations totaling $571 million.

Of these liquidations, 82% were long positions, amounting to $469 million, while 18% were short positions worth $102 million. This skew toward long liquidations indicates that bullish traders were caught off guard, expecting a smooth rally to the $100,000 milestone.

Still, Martinez provided some optimism for BTC bulls in a recent analysis. According to him, the TD Sequential – a technical analysis indicator – has issued a buy signal on the BTC hourly chart.

For those unfamiliar with the TD Sequential, it identifies potential trend reversals or exhaustion points in an asset’s price movement. The bullish signal suggests that sell pressure on BTC may be easing, potentially paving the way for recovery.

Additionally, Bitcoin’s relative strength index (RSI) has formed a bullish divergence, which could drive the asset to retest the $96,000 price. In this context, a bullish RSI divergence indicates that Bitcoin’s price is lowering lows while the RSI makes higher lows, signaling potential upward momentum despite bearish price action.

BTC To Consolidate Before The Next Leg Up?

Despite these bullish signals, some analysts remain cautious about Bitcoin’s recent price drop. A co-founder of Material Indicators, Keith Alan noted in an X post that “nothing about the chart resembles a validated support test for BTC.”

Alan explained that Bitcoin must first consolidate and convert previous resistance levels into support to restore confidence. Until this occurs, he warns that the current recovery may be a short-term bounce designed to trap overconfident long traders.

Meanwhile, Bitcoin whales appear unfazed by the pullback. In just 96 hours, whales have recently accumulated approximately $3.96 billion worth of BTC, signaling their confidence in the asset’s long-term potential.

Although Bitcoin’s journey toward the highly anticipated $100,000 mark has temporarily paused, institutions remain optimistic. VanEck and other firms have expressed confidence that Bitcoin will soon reach and sustain a six-figure price.

In related news, Bitwise CIO recently remarked that Bitcoin remains an “early trade” until it surpasses $500,000. BTC trades at $94,338 at press time, down 1.9% in the past 24 hours.