The Bitcoin block rewards are becoming lesser and lesser with each halving. Will transaction fees eventually be able to fill up this void?

Bitcoin Transaction Fees Has Been Trending Up With Each Cycle

One of the most innovative features of the Bitcoin blockchain is that approximately every four years, the block subsidy (that miners receive for solving blocks on the network) is slashed in half. Such events are called the “halving.”

Halvings naturally mean that the miners’ revenues also take a heavy hit, primarily made up of the block rewards. Why does the concept of halving even exist? Well, consider the scenario if there was no halving.

The block rewards serve as the only way to mint new tokens so that they can be equated to the new production of the asset. Without halvings, miners would continue to produce the coin at the same rate, and the supply would grow constantly.

Due to supply-demand dynamics, this growth might decrease the asset’s value as more asset tokens are introduced into circulation.

To control this inflation, Satoshi worked the halving into the cryptocurrency’s code, thus ensuring that, while the supply would continue to grow (until the supply upper limit is hit, of course), its growth would become lesser and lesser with each halving, thus adding a factor of scarcity to the asset.

As mentioned earlier, however, the halvings mean that the miners’ revenues take a big hit with each one. In the future, when block rewards would have substantially shrunken down, miners would be making very little from these rewards.

What will happen to the miners then has been the topic of debate in the Bitcoin community for as long as it has existed. One solution often discussed is that the other component of the miners’ revenues, the transaction fees, could replace the block rewards.

The transfer fees, however, have historically been much lesser than the block rewards, so the miners often rely solely on the latter to pay off their running costs.

In a post on X, the CryptoQuant Head of Research, Julio Moreno, has noted that it’s indeed difficult to know whether the fees can take up the place of the block subsidy, but signs aren’t looking so bad right now, as the long-term trend of the transaction fees would suggest.

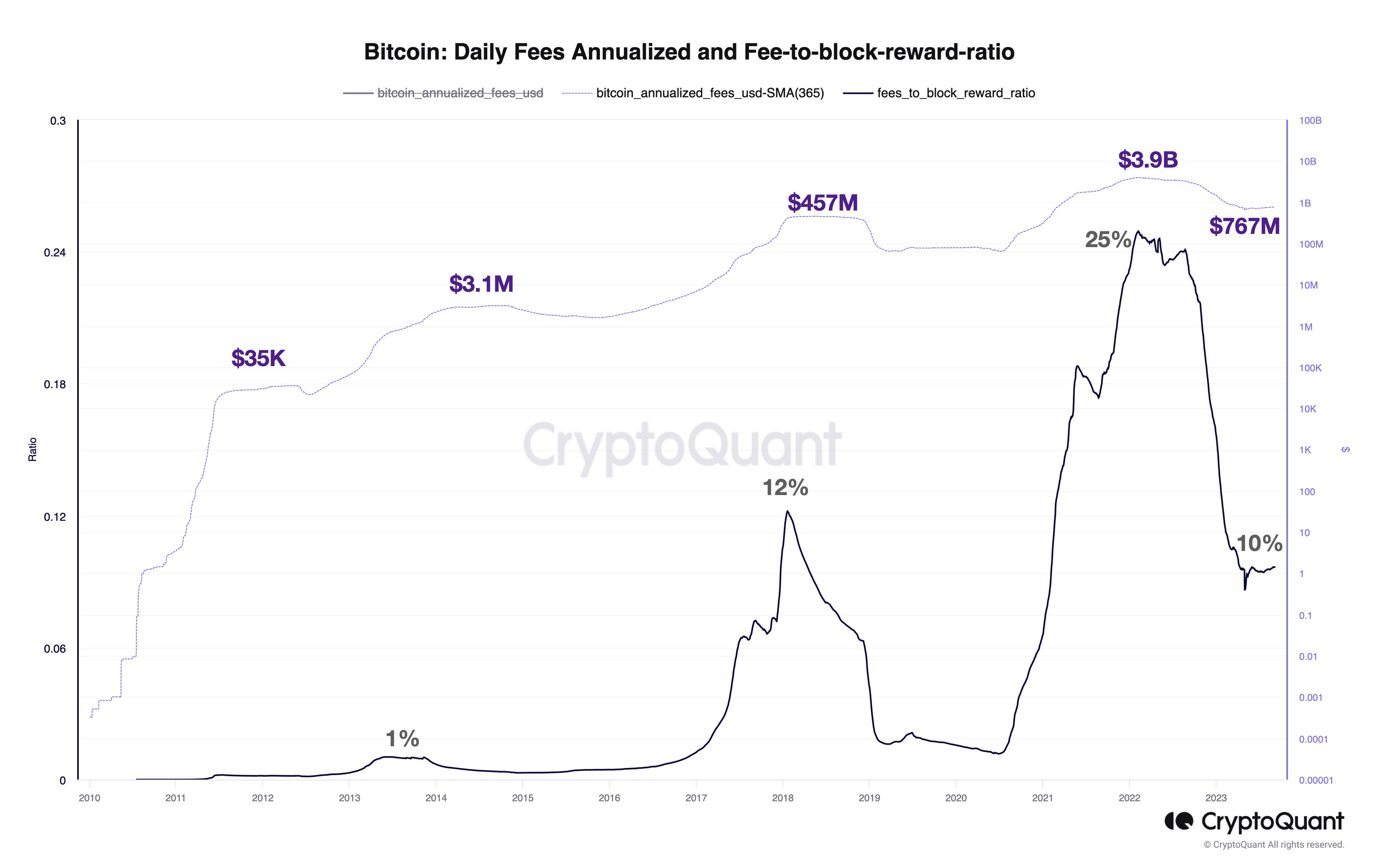

The value of the metric seems to have been going up through the years | Source: Julio Moreno on X

The chart shows that the USD value of the transaction fees has risen with each Bitcoin cycle. But not just that, the percentage share that the fees occupy in the miners’ total revenues has also increased.

On average, miners receive 10% of revenues from the fees. This is still not substantial enough to replace the rewards, but miners can only hope that this trend of fee increase will continue throughout the upcoming cycles so that one day, it may be able to match up the block rewards.

BTC Price

Bitcoin continues to show stale price action as its value is still stuck around the $25,700 mark.

BTC appears to be unable to break the sideways trend | Source: BTCUSD on TradingView