Fund manager Viridi Funds has launched the first focused Bitcoin crypto mining investment product. Called the Viridi Cleaner Energy Crypto Mining & Semiconductor ETF (RIGZ), the product will be traded on the New York Stock Exchange (NYSE).

Launched as an actively managed ETF, Viridi will invest in crypto mining companies and mining infrastructure industries, according to a press release.

The firm launched this ETF to meet the high demand of investors looking for Bitcoin exposure within regulated markets. In addition, the ETF allows such investors to support and “commit” to environmental sustainability.

Bitcoin mining is a sector that is particularly well suited to such an investment product as, according to recent figures, over 50% of North American bitcoin mining is done using renewable energy sources, which is a trend that Viridi hopes to encourage through products like RIGZ.

Amongst companies to be target by the ETF are producers of semiconductors and specialized computer chips, necessary tools for Bitcoin mining, manufacturers of crypto mining hardware, mining companies with “long-term energy offtake” agreements.

The fund will not directly invest in cryptocurrencies, according to the release. The CEO of Viridi Funds Wes Fulford believes that Bitcoin is seeing new institutional interest and support. He added:

We launched RIGZ to provide investors with an ETF that attempts to align purpose and profit by investing in the infrastructure that underpins the entire ecosystem with sustainability in mind. Miners provide an essential service to cryptocurrency networks, and leading operators are able to generate Bitcoin and other cryptocurrencies at a fraction of prevailing market prices.

Institutions Can Leverage More Options To Gain Bitcoin Exposure

The Viridi Crypto Mining ETF has received financial backing from some of the most important companies and groups in the crypto industry, such as Alameda Ventures, Luxor Technology, Fundamental Labs, Mechanism Capital, and CoinShares. The later company led the funding round for the investment product.

Meltem Demirors, CoinShares CSO, claimed that the fund will provide investors with more opportunities to gain active exposure to the Bitcoin value chain. In that sense, investors can “realize more upside” for holding a share in a key part of the infrastructure alongside the underlying asset, BTC.

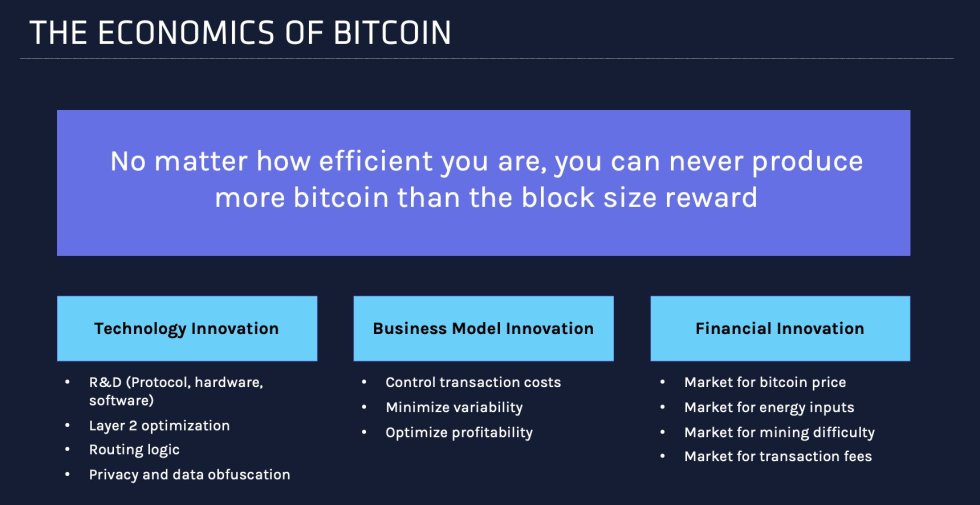

Due to Bitcoin’s design, a miner can never produce more BTC than the block size rewards. Therefore, Demiros believes there is real competition to lower the cost of producing the cryptocurrency, reducing the capex drag of hardware, and use low-cost energy sources.

In consequence, the BTC mining sector has been inclined towards renewable energy sources, contrary to the narrative spread by some mainstream media. Data shared by Demiros indicates that 50% of BTC miners in North America alone use renewable energy.

Thus, BTC is “one of the greenest industries” in the U.S. Demiros added:

(…) as one of the world’s largest digital asset managers, CoinShares is proud to be Viridi’s lead investor, and to continue to expand the universe of crypto investment products with innovative partners like Viridi Funds, 3iQ Digital Asset Management, and Invesco EMEA.

At the time of writing, BTC trades at $31,684 with a 5.6% profit in the daily chart.