The CEO of the on-chain analytics firm CryptoQuant has suggested that Grayscale’s recent Bitcoin selling may not be behind the latest downtrend.

Bitcoin Has Been Derivatives-Driven Recently, Not Spot

In a new post on X, CryptoQuant CEO and founder Ki Young Ju discusses how the derivatives market has been the driving force behind recent price action in BTC.

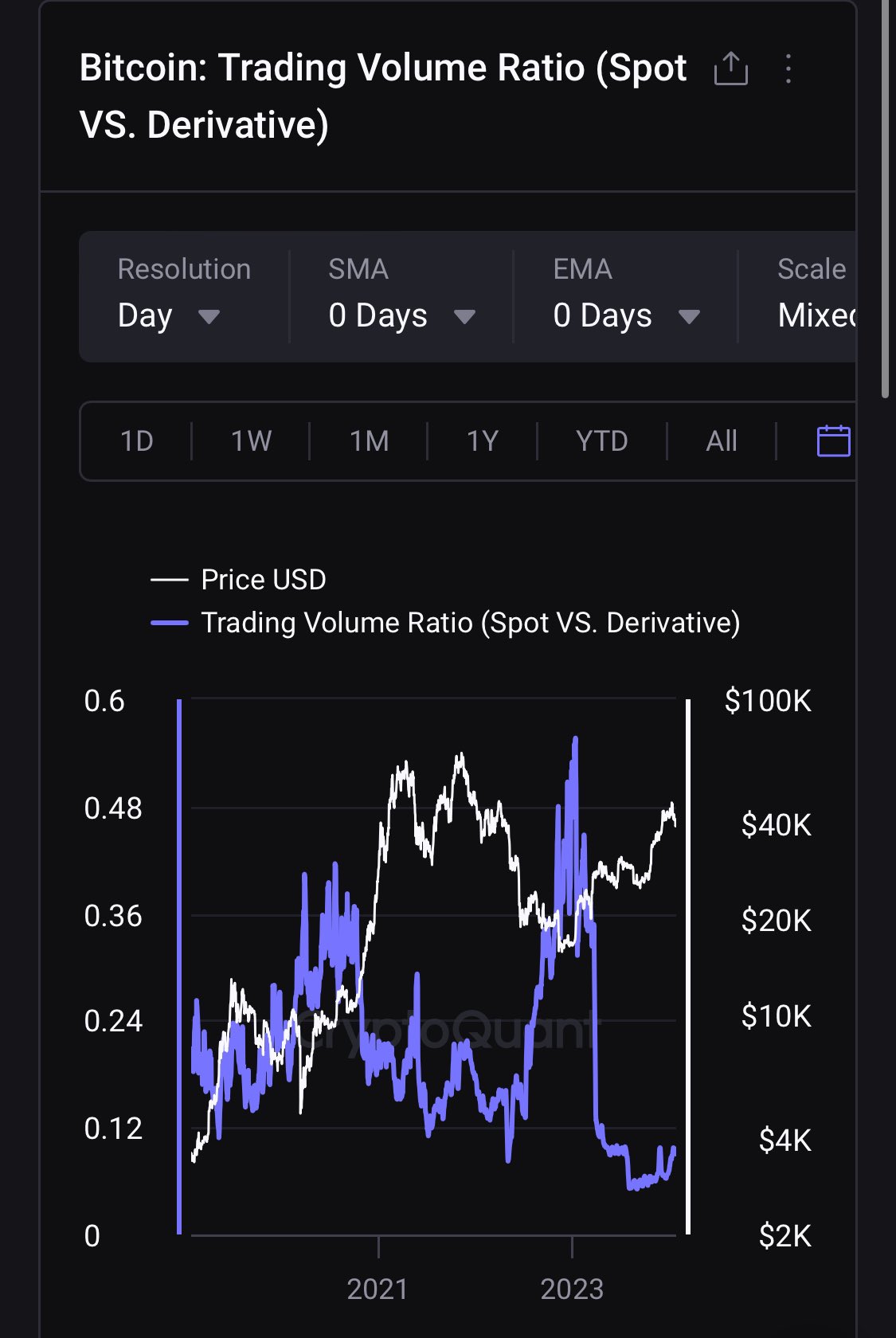

The analyst has cited the “spot vs derivatives trading volume ratio” indicator to showcase this. The “trading volume” refers to a metric that keeps the total amount of Bitcoin involved in some kind of trading activity daily on a given exchange or group of exchanges.

When the value of this metric is high, it suggests that the platform in question is currently observing a high amount of trading activity. Such a trend implies that the exchange’s users are highly interested in making trades right now.

The spot vs derivatives trading volume ratio, the main metric of interest here, compares the combined trading volumes on all spot and derivative platforms.

The ratio’s value is higher than one, suggesting the spot exchanges are currently receiving a higher volume while being under the market, implying that derivative-based platforms are the dominant force in the sector.

Now, here is a chart that shows the trend in the Bitcoin trading volume ratio for these two groups of exchanges over the last few years:

Looks like the metric's value has been quite low in recent days | Source: @ki_young_ju on X

The spot exchanges naturally serve as a means for investors to make spot buying and selling moves, while the derivative platforms enable users to open positions on the futures market. As such, the ratio’s value tells us about which of the two modes of trading have higher interest at the moment.

The above graph shows that the Bitcoin sector has been dominated by the derivative platforms for a while now, as the ratio’s value has been less than one.

The metric’s value has recently been particularly low, suggesting that investors’ interest in derivative products has been especially high. This may indicate that the recent price discovery has had the futures market play a larger role than spot trading.

Since the Bitcoin spot ETFs gained approval earlier in the month, the asset’s price has been struggling, registering a significant drawdown toward the $40,000 level.

Grayscale Bitcoin Trust (GBTC) has been making notable outflows in this same period, making some think that this selling pressure from the fund might be behind the asset’s drawdown. The CryptoQuant CEO explains, however, “Bitcoin is in a futures-driven market, less affected by spot selling from $GBTC issues.”

BTC Price

Bitcoin had slipped under the $39,000 mark just earlier, but it would appear the asset has seen a bit of a rebound as it’s now trading around $40,000 again.

BTC is slowly making recovery from its plunge | Source: BTCUSD on TradingView