On-chain data shows around 199,000 Litecoin addresses have sold off their entire holdings during the past 10 days alone.

Litecoin Addresses Carrying Some Balance Have Noted A Sharp Drop Recently

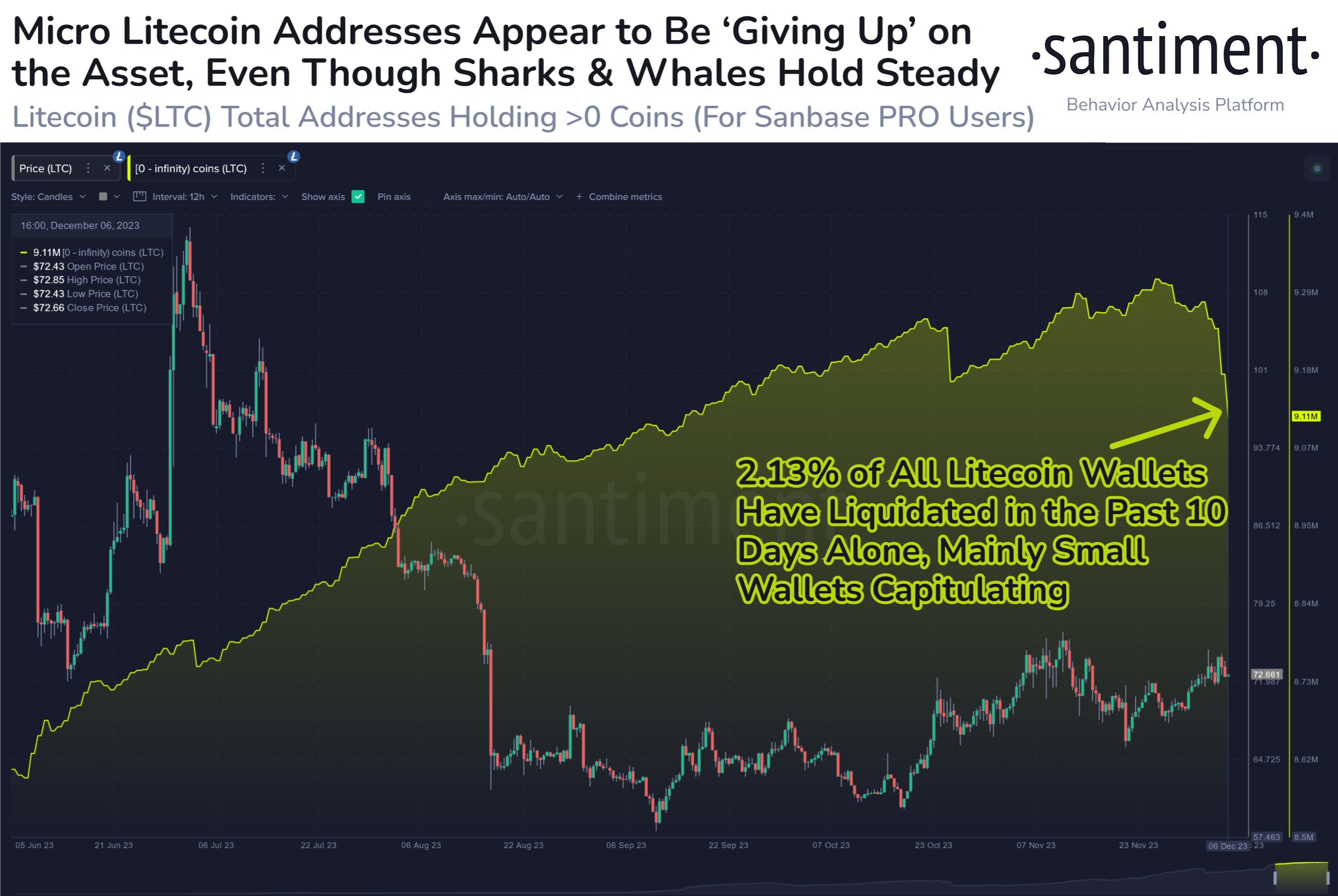

According to data from the on-chain analytics firm Santiment, the small LTC addresses have appeared to have been giving up recently as they have been emptying out their balances.

The metric of interest here is the total number of addresses on the Litecoin blockchain that are carrying a non-zero amount of the cryptocurrency. When the value of this indicator goes up, it means that the asset is observing more adoption as new investors are joining the network.

On the other hand, a decline suggests the holders are exiting the cryptocurrency as they are completely liquidating their wallets. Adoption is generally positive in the long term, while an exit like this could have more complex implications on the market.

Now, here is a chart that shows the trend in the number of Litecoin addresses over the past few months:

Looks like the value of the metric has registered a large decrease over the last few days | Source: Santiment on X

As displayed in the above graph, the Litecoin addresses carrying some amount of LTC have seen a large drawdown of about 199,000 during the past 10 days or so.

“This is the biggest drop in wallets since October 2022,” notes Santiment. Back in October 2022, the cryptocurrency sector was inside a bear market and interest in the market as a whole was on the down, so it’s not surprising that Litecoin had seen a large drop in its investors.

The recent drop is different, however, as many of the coins in the sector have been enjoying rallies recently and fresh interest is brewing among the investors. Yet, Litecoin has seen holders liquidating, perhaps because the asset has been unable to see any uplift comparable to its peers.

One positive in this selloff could be the fact that the wallets exiting here are mainly the small ones, while the larger entities like the sharks and whales are continuing to hold steady.

Naturally, the larger the supply held by an investor, the more influence that they carry in the market. Thus, the sharks and whales continuing to believe in Litecoin could be an optimistic sign for its future, regardless of what the micro-wallets are doing.

“LTC‘s market value vs. BTC has dropped -55% in 5 months, but FUD & small wallets dropping could turn this around,” explains the analytics firm. Back in October of this year, a similar trend was also seen, where the shrimps sold off their holdings. What followed then was a notable price rise for the cryptocurrency.

The scale of the capitulation is even greater this time, so with the sharks and whales picking up the coins of these loss holders, a surge might happen for the asset again in the near future.

LTC Price

Litecoin has been stuck inside a range recently as its price has been bouncing back and forth between $70 and $75.

The price of the coin appears to have been going through consolidation recently | Source: LTCUSD on TradingView