McKinsey & Company, the leading consulting firm, says blockchain technology is failing to transition past its pioneering stage. The company notes, however, that payments may not be the best use-case for a complex technology like blockchain.

Houston, We Don’t Have Lift Off

Major consulting company McKinsey & Company has published an article on the current issues faced by blockchain technology as a whole.

The firm argues that all through 2017 and 2018 the industry has seen an influx of investments from both venture capital companies and major corporations.

Indeed, blockchain-based projects have raised upwards of $21 billion in 2018 according to data from CoinSchedule.

However, according to McKinsey, little progress has been made given the publicity and money poured into it:

The bottom line is that despite billions of dollars of investment, and nearly as many headlines, evidence for a practical scalable use for blockchain is thin on the ground.

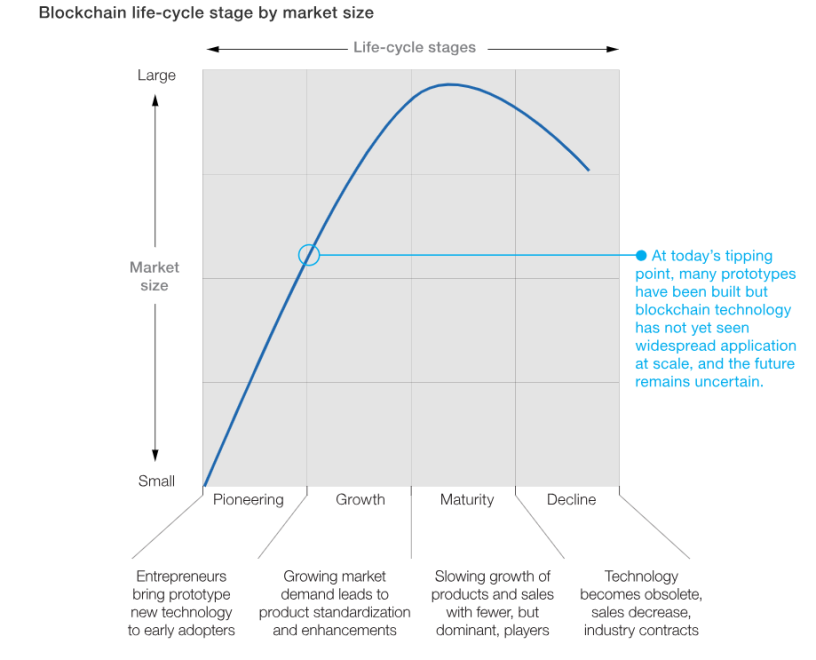

The consulting firm holds that as an infant technology, blockchain is still relatively complex, expensive, unstable, and unregulated. It opines that the industry is currently in stage 1 of its development when investment is supposed to bear fruit in the form of a product being brought to market.

However, McKinsey notes that the industry is failing to emerge past that pioneering stage into further market expansion and adoption.

One of the reasons for this, especially for “blockchain players in the payments segment” is that the technology is not really needed as it’s not the simplest solution.

Occam’s razor is the problem-solving principle that the simplest solution tends to be the best. On that basis blockchain’s payments use cases may be the wrong answer

It’s worth noting that this doesn’t seem to be the position of MIT. Bitcoinist reported on a recent article by MIT Technology Review, which expects 2019 to be the year when blockchain projects will start to bear fruit and become ‘boring.’

Niche Applications

Meanwhile, McKinsey & Company, considers blockchain technology to have practical value in other areas.

Examples are found in insurance, supply chains, and capital markets, in which distributed ledgers can tackle pain points including inefficiency, process opacity, and fraud.

Additionally, the company believes that the technology appeals to certain industries, which are oriented to modernization.

In addition, blockchain holds reputational value or perhaps PR value (at least for the time being) as it signals to shareholders that a company is striving to innovate.

What do you think of McKinsey & Company’s take on blockchain technology? Don’t hesitate to let us know in the comments below!

Images courtesy of Shutterstock