Data shows PEPE has observed many future liquidations in the last 24 hours as the memecoin’s price has taken a 24% hit.

PEPE Has Registered Total Futures Liquidations Of More Than $13 Million

The “liquidation” of a futures market contract happens when a derivative exchange has to forcibly close said contract because the holder has accumulated losses equal to a specific percentage of the margin or the initial collateral (this percentage can differ from platform to platform).

A couple of things can significantly raise the risk of a contract being liquidated. The first one is the volatility of the asset the contract is for. Cryptocurrencies generally have quite volatile prices, and memecoins like PEPE are especially known to display some wild volatility, so the risk of getting liquidated can be quite significant.

The other factor is leverage. The “leverage” here refers to a loan amount that any contract holder may choose to take against the margin. This leverage is often the initial position itself, and the benefit of it is that any profits accumulated become more by the same magnitude as the leverage.

This also means that any losses incurred are also multitudes more in this case. In the digital asset sector, some platforms offer easy access to leverage as high as even 100x.

Extreme amounts of leverage combined with high volatility can result in a disaster, so that uninformed futures trading can be quite risky for cryptocurrencies.

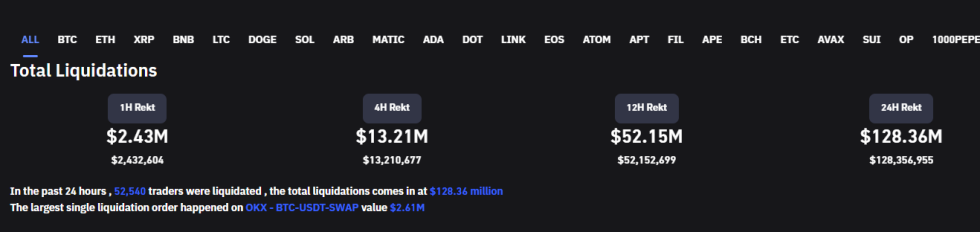

Due to this reason, mass liquidation events, where a large number of contracts are liquidated at once, aren’t an uncommon sight in the sector. The data below shows that such an event has also occurred in the last 24 hours.

Looks like a huge amount of liquidations have occurred in the market today | Source: CoinGlass

As you can see, there have been liquidations of more than $128 million worth of cryptocurrency futures market contracts over the past day. There were around 52,540 traders involved in this leverage flush, and about 76% were long holders. This would align with the volatility observed today, as most of these liquidations would have been triggered by a price plunge.

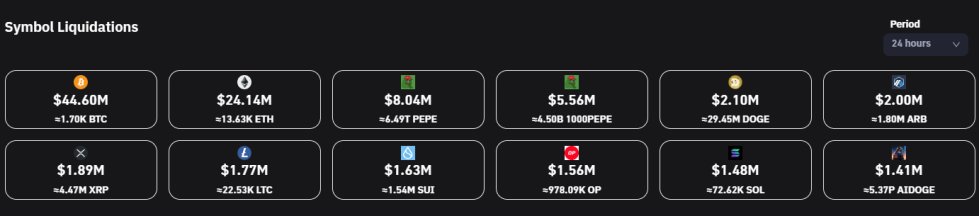

While the data above is for the entire market combined, here is a table that shows which futures contract symbols contributed how much to these total liquidations:

PEPE was the third largest symbol in terms of liquidations during the past day | Source: CoinGlass

Unsurprisingly, the two largest cryptocurrencies by market cap top this list: Bitcoin and Ethereum. Together, they made up for about $68 million of the total market liquidations.

What is interesting, though, is that PEPE is third here. The combined liquidations of PEPE and 1000PEPE (a contract using 1000 tokens of the asset as its base unit) stand at more than $13 million for the last 24 hours.

The reason behind these sharp liquidations is the high volatility that the memecoin has experienced in the past day, which has seen the price not only plunge hard but also observe a rebound.

Dogecoin, a fellow memecoin, has also seen a relatively large amount of liquidations during this period. It currently sits fifth (fourth if 1000PEPE and PEPE are consolidated into one) with a little over $2 million contracts flushed.

PEPE Price

At the time of writing, PEPE is trading around $0.000001309, down 71% in the last week.

The memecoin has sharply gone down in recent days | Source: PEPEUSD on TradingView