Bitcoin and Ethereum might be capturing the most mainstream media attention as the two largest cryptocurrency networks by market cap. But unfortunately, their market size can get in the way of investors discovering a world of innovation around in the rest of the blockchain space.

Here’s why PIVX is a coin you might have heard about before but will soon be hearing a lot more as its value proposition is brought to the forefront of finance in the future ahead.

The Backwards Battle Of Blockchain Intelligence

Blockchain is being heralded as the most disruptive technology of the modern age, following the internet itself. In addition to the network of data, the value lies in the transparency and immutability of the underlying distributed ledger technology.

Cryptography, more so related to the assets that transact across these ledgers, adds a layer of pseudo-anonymity to cryptocurrencies but falls short of providing complete privacy for the end-user.

Through blockchain intelligence and on-chain analysis, governments have begun to utilize the data to trace Bitcoin and other cryptocurrency wallets back to individuals through bank accounts, KYC, and more. If governments possess this ability, then cybercriminals can also do so, ten times more efficiently.

As blockchain adoption goes mainstream, the need for financial privacy and to conceal user data related to transactions will become a crucial fight.

Governments have demonized privacy coins in the past for their illicit uses. However, their application for specific industries, especially finance or anything related to personal privacy, will become critically important in the all-digital future.

For instance, banks keep personal data private so that criminals don’t target the wealthy. Another example involves cybercriminals following a blockchain-based shipment waiting to intercept a rare luxury item that utilizes a blockchain-based RFID tag for supply chain transparency. Or imagine if blockchain is used for voting – an ideal application for the technology – yet every vote was made public. Removing all aspects of privacy from blockchain would destroy its potential in most situations.

PIVX And The Unrealized Value Of Privacy

Protecting innocent users in the all-digital world will become so critical, governments will have no choice but to rethink the benefits of privacy coins and potentially adopt aspects of privacy protocols for the proposed central bank cryptos like the digital dollar and euro. One of the benefits of using cold hard cash is that no one knows what you did with it after.

Just as there was once a time when no one could imagine Bitcoin or other cryptocurrencies as money or a worthy investment, they are now the talk of the financial world. However, another cryptocurrency with a deep-rooted history in the blockchain space with an introduction in 2015, PIVX, is even more revolutionary.

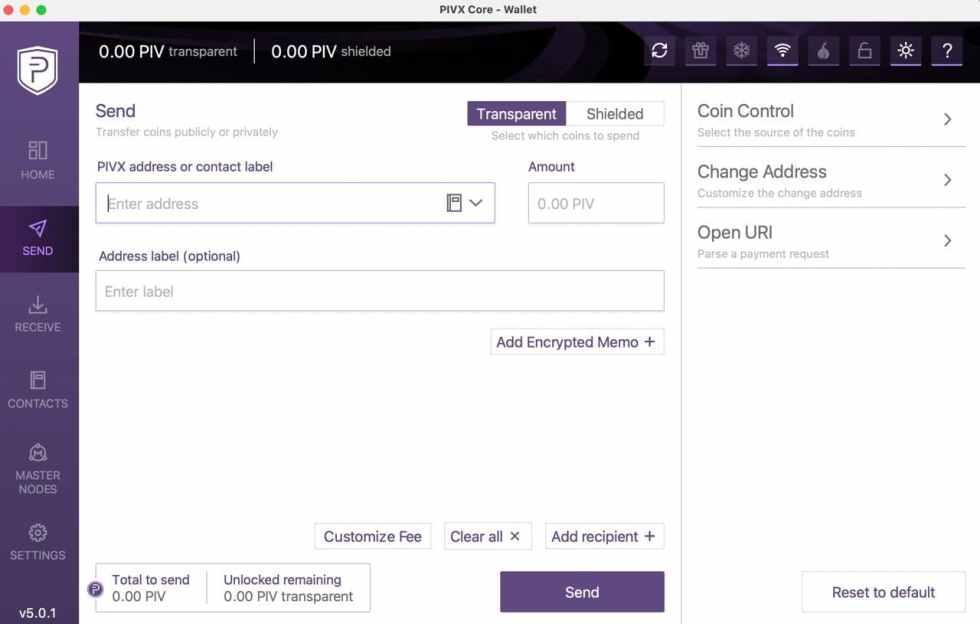

PIVX solves the issues with current privacy coins by letting the user and use case dictate if the transaction data should remain obfuscated or not. The groundbreaking technology powering PIVX retains all the initial value of blockchain and DLT transparency while preserving privacy for any and all parties that desire it.

Solving Cryptocurrency’s Notorious Volatility Problem

Another reason for Bitcoin’s recent emergence has been the claim that the cryptocurrency is a hedge against dollar inflation due to its limited supply. Pundits argue some inflation is necessary for economic expansion, while others look to deflationary assets to preserve wealth.

What is really broken in terms of the current monetary system is that although quantitative easing was a necessary evil to save the economy, there’s never been any plan to remove excess money from circulation for balance. And while Bitcoin does bring some balance to how inflationary the dollar has become, it is too volatile ever to be used as a currency.

Here’s yet another way that PIVX raises the bar for crypto projects. PIVX solves the volatility issue with a dynamic coin supply. When trading volumes are high, coins are burned to encourage saving. When volumes are low, coins are minted at a higher rate, and transaction fees are burned to encourage spending instead. This constant cycling toward equilibrium enables steady growth in the PIVX price, rather than volatile and unpredictable price action.

Even Ethereum 2.0 Tries To Catch Up With PIVX Protocol

We now know how PIVX solves the Bitcoin volatility problem and tears down the barriers surrounding privacy coins, but even Ethereum cannot keep up with PIVX and is now trying to catch up. Features that are native to PIVX are now slated for the Ethereum 2.0 upgrade. PIVX operates on the SHIELD protocol, a customized zk-SNARKs sapling deployment compatible with PoS.

By relying on PoS while retaining the most essential aspects of privacy coins, PIVX achieves efficient scaling and prevents critical issues such as 51% attacks. Ethereum 2.0 will implement this solution, and the altcoin’s founder Vitalik Buterin has shared his positive thoughts about the technology with the development community.

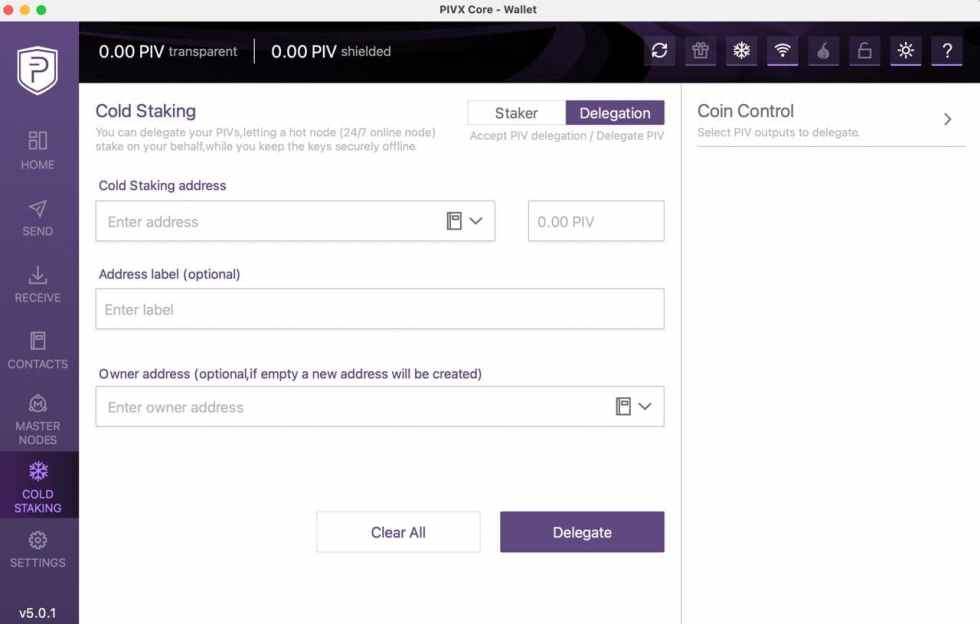

PIVX also features a comparable staking system to what Ethereum is planning, providing masternode operators with as high as 9% annually in rewards as well as one vote per masternode. PIVX puts governance in the hands of masternode operators who can shape the future of the treasury, upgrades, and much more.

PIVX, like many other coins that debuted years prior, are now bearing the fruits of the labor of the development teams and supporters. Technical issues are now solved, and soon PIVX will bring to light the value of privacy as it pertains to blockchain data and transform the face of financial data for the future.

To learn more about PIVX, check out the official website.

Disclaimer: The information presented here does not constitute investment advice or an offer to invest. The statements, views, and opinions expressed in this article are solely those of the author/company and do not represent those of Bitcoinist. We strongly advise our readers to DYOR before investing in any cryptocurrency, blockchain project, or ICO, particularly those that guarantee profits. Furthermore, Bitcoinist does not guarantee or imply that the cryptocurrencies or projects published are legal in any specific reader’s location. It is the reader’s responsibility to know the laws regarding cryptocurrencies and ICOs in his or her country.