Data shows that the largest of the Shiba Inu and Ethereum exchange wallets have seen recent withdrawals, a sign that could be bullish for their prices.

Shiba Inu, Ethereum, & Chainlink Are Among Coins Seeing Exchange Outflows

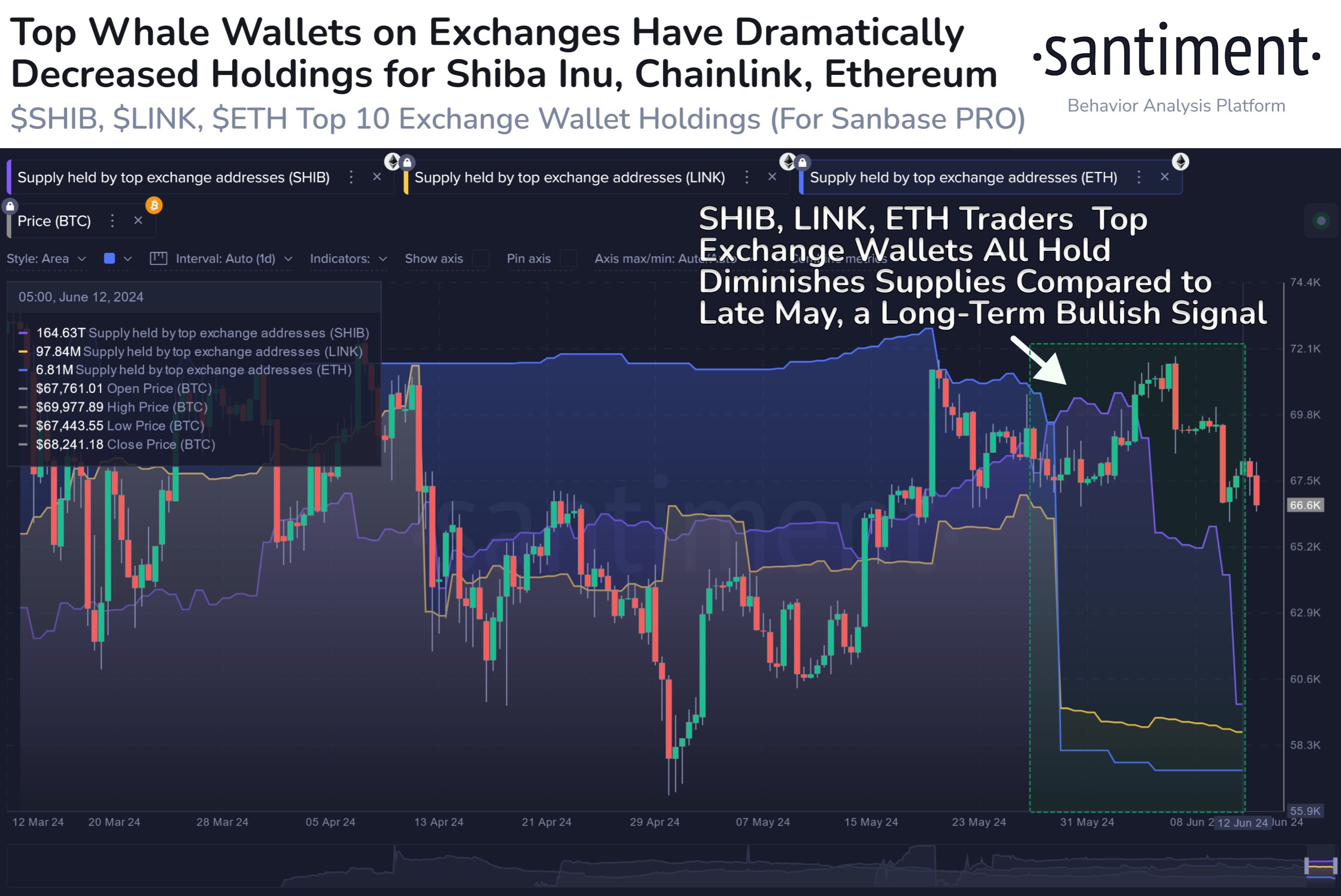

As explained by the on-chain analytics firm Santiment in a new post on X, the top 10 exchange wallets on the SHIB, ETH, and LINK networks have recently seen their supplies go down.

The “top 10 exchange wallets” refer to the ten largest wallets currently attached to centralized exchanges. Naturally, such large wallets would belong to the largest investors in the market, humongous even among the whales.

Generally, any address’ influence on the network rises as its holdings go up, so the top 10 exchange wallets would be among the most influential investors in the market. As such, the trend in their combined supply can be worth keeping an eye on for any cryptocurrency.

Below is a chart that shows the data for this metric for three of the top assets in the sector: Shiba Inu (SHIB), Ethereum (ETH), and Chainlink (LINK).

Looks like the value of the metric has been going down for each of these coins recently | Source: Santiment on X

As is visible in the above graph, the size of the top 10 exchange whales has recently decreased for all three cryptocurrencies. More particularly, since late May, Shiba Inu has seen this metric decline by 2.4%, Chainlink by 2.9%, and Ethereum by 8.6%.

Usually, buying from the whales is a bullish sign for any asset, but here, the size of the wallets goes down instead. In this case, however, the addresses in question are those attached to exchanges rather than self-custodial wallets.

Investors usually keep their coins on exchanges whenever they plan to trade them shortly, so the coins sitting in the supply of these platforms can represent the available sell supply of the asset.

As such, the exchange supply recently heading down for SHIB, LINK, and ETH implies that a potential reduction in selling pressure has occurred for these markets.

As the wallets being considered here are the ten largest associated with these platforms, the withdrawals may provide a particularly bullish signal, as it suggests mega whales are possibly interested in holding their coins in the long term.

From the chart, it’s visible that Chainlink and Ethereum saw rapid withdrawals from these large holders at once around the end of May, and since then, the metric has been moving sideways for them.

On the other hand, Shiba Inu saw a rise instead at first and then a couple of waves of outflows, the latest of which occurred during just the past week. Thus, it’s possible that while LINK and ETH whales seem to be finished with their withdrawals, SHIB’s outflows could still be underway.

SHIB Price

At the time of writing, Shiba Inu is trading around $0.0000216, down more than 13% over the last seven days.

The price of the memecoin seems to have been going down over the past few days | Source: SHIBUSD on TradingView